2019 & The Economy

Official interest rates have remain unchanged at 1.50% for over 2 years.

The softening economic mood continues, with Australia’s economy slowing sharply through the second half of 2018 accordingly to GDP data. Consumer confidence is also relatively weak, despite a slight rebound in recent weeks.

At a local level, the Geelong & Region market is fairly robust and there are some alignments in economic performance compared to the rest of Victoria.

The Property story (see below) is a very good one. More broadly, ABS data confirms that for the Geelong region:

- The Unemployment Rate remains above the state average; the gap has widened out to almost 2%.

- Population Growth exceeds the state average (since 2015) which is a driver for property growth and those seeking employment.

- Economic Growth (GDP measured) has exceeded state average but Geelong has levelled off and the gap has closed (potental lag indicator for property)

- Building Approval Data is mixed. Geelong (not surprisingly) well above average for residential building approvals, but well below for non-residential.

On the last point, Geelong & region accounted for nearly 6% of total residential approvals in Victoria in FY18. For non-residential it was only 4% for the same period. Employment has been in a transition away from Manufacturing and into services such as Education and Health.

This data highlights some opportunities and threats for the local economy in the medium term. The employment weakness and a potential cooling in residential property may start to erode confidence and spending. This will be reflected in weaker GDP data.

This said, many also see opportunity in office and industrial property in the Geelong area as the transition of the city continues. There are many varying projects set to go ahead over the coming period as community leaders see blue sky for the region.

Property

Aligned to the low credit growth above, Property continues to be weak. In fact, there have been 17 consecutive months of falls on a consolidated basis.

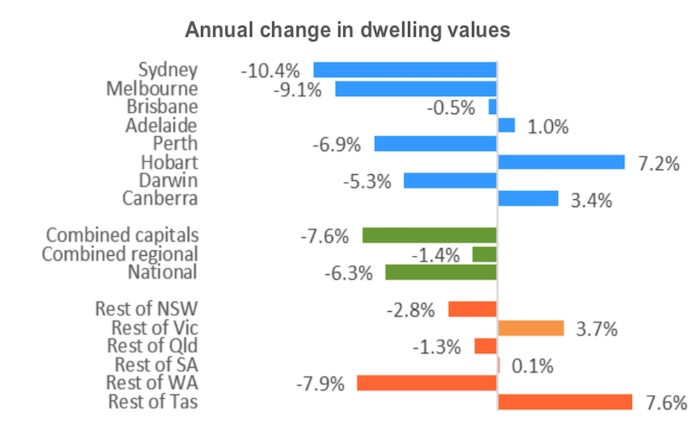

CoreLogic data below shows most categories continue to decline, though at a slower rate.

Results are very divergent across different markets as the table above shows. Against trend, Regional Victoria has been a growing market, where Geelong & Region leads the country along with Tasmania for residential property price growth.

During 2018, median values in the Geelong Region increased by 9.1 per cent (Houses) and 7.6 per cent for (Units). Rental Yields have also increased in the Region by almost 5% against a national average of only 0.4%.

In terms of trends, commonly regional dwelling values do go up after the end of capital city growth cycles so the results should be considered in that context.

Money Markets

On the money markets, short term and long term rates are both weaker. The "spread" between the 180 Day and 10 Year rate remains at around 20 points which essentially means that the outlook for economic conditions are soft.

As sentiment remains weak, the direction of interest rates remains uncertain though the market is pricing in a possible cut in interest rates this year.

Credit growth has been at its lowest levels since the early 1980's. This data is being lagged by the difficulty in refinancing, and the number of interest only loans transitioning over to a principal & interest basis of repayment.