Do you operate a Finance or Mortgage Broking Practice? Credit providers are slowly developing lending policies for the industry.

This adds to established policy guidelines across traditional service industries such as Financial Planning, Real Estate Agencies, Insurance, Legal & Accounting.

If you are involved in these industries, funding can be a necessary step for growth (acquisitions etc.) or to help in building succession planning.

In Focus - Finance Broking Practices

Despite all the negative press, operators in the Finance Broking industry are down the financial ladder compared with other professional service providers.

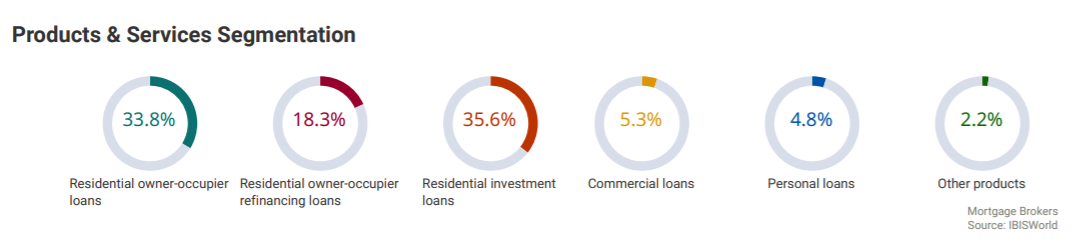

Accordingly to IBIS World data, there are around 7,300 businesses in the industry with combined Revenue over $2.7 Billion and over 18,000 people. Over 50% of firms are operated by sole practitioners across a relatively narrow band of practice as below.

Along with brokers, there are several larger firms that act as aggregation groups.

IBIS World expects industry revenue is projected to increase at an annualised 2.5% over the five years through 2025-26, to total $3.1 billion. Demand for broker services, is likely to grow as the consumer continues to see values in the channel. However, offsetting this is increased competition in upstream lending, leading to tighter profit margins for credit providers and a potential reduction in commission rates.

Along with online mortgage brokers or aggregator platforms, mortgage brokers face competition from several fintech platforms, here and from overseas, seeking to cut out the intermediary and associated fees.

Brokers & Numbers

The industry's financial performance, in a professional services sense, may look a little underwhelming, but this should be considered in the context that the broking industry is still very young.

The early participants led the way, and the industry protocols (along with regulations and associations) were built "as the plane was being flown" in many respects. As a result, the early operators in the Finance Broking industry haven't been able to a follow a playbook for how to build a business of scale.

Unlike an accounting or legal firm, the primary revenue model is based on commission, so no debtors! Work in Progress (WIP) is still a material part of the working capital cycle however, as loans still have to be sourced and settled, and then a wait for commissions to be collected.

As a sector that, perceptually at least, has lower expectations around its professional worth, the risk is that brokers do not command a fair exchange of value for their time committed.

Lender Appetite - Finance Broking

With the perception that knowledge in finance broking is more "portable", the risk of intellectual capital in other industries (say legal for example) is less of a concern. This is despite the industry being centred across individuals that generate personal exertion income, based on their relationships with referral partners or customers.

In banking terms, this means a relative lack of leverage with the actual firm; if the person goes, so does part of the firm's future revenue to service debt.

This, along with the decentralised nature of the industry, has meant less developed lending policy compared to other professional services segments.

This said, the nature of revenue - in particular, trailing commission - provides some ongoing disconnect from the originator and some certainty for the financier.

As a quick litmus test, some banks will look to see if a firm's upfront income exceeds its trailing commission, that will tell whether the business is still growing or otherwise in decline.

In terms of participants, ANZ Bank, AMP, NAB, Judo Bank, Westpac have some appetite in the category.

Debt Strategies

Brokers as a very general comment have a low risk profile. After all, many have spent a lot of time in the banking dealing with risk management. They have a reasonable reputation for money management. In that context, success in managing money and debt typically embraces the following strategies.

- Build your initial Working Capital Cycle

Establishing the initial Working Capital cycle is a challenge for many firms. This applies for start ups or acquisitions alike. It can take over 150 days to create, settle and collect the first commission. This said, plan for this initial bout of capital investment. After that, a rhythm of cash flow should follow your revenue closely. In other words, if you are profitable, the cash flow should mirror profits as in essence it is a pretty simple business model.

Planning will also avoid jumping into the cycle of using short term debt providers and loan book funders, that generally aren't a balanced solution.

- Consider the Loan Term

One of the negative things about finance broking and trailing commission, is that it runs off (despite what every vendor will tell you). So yes, there may be "goodwill" and new opportunity in the books but assume the worst, and amortise the lending over the period for which the trail will provide its best benefit.

So what are these Worth?

For SME's at least, not generally as much as many other service firms. Though again, the industry is still very young especially in the M&A stages, and there has been improvement in recent times. Especially in a post Royal Commission world.

In very simple and generalised terms, Broking businesses are traditionally valued as a multiple to the recurring income which could be as low as 2.30 to say 3.30 times recurring revenue.

A less common approach, though perhaps an aspirational one, is a multiple to Earnings before Interest, Taxes, Depreciation, Amortisation & Owners' adjusted Salary (EBITDAO), which allows a comparison primarily to the first method at least.

How much can I borrow?

Banks are looking for minimum loan sizes in professional services generally, so given there are a lot of smaller businesses in the category, sometimes it might not work and hence why brokers turn to other options.

Borrowing limits are less consistent and depend on the underlying customer base and how the terms are structured. As a very generic indication:

1) Maximum loan amount to be less than around 2.50 - 3.00 times EBITDAO.

2) Maximum loan amount to be less than 1.5 times Recurring Income.

3) Maximum Loan Term of 5 Years. (At times with amortisation based over a longer term)

Criteria does vary widely and will keep emerging as trends in the industry develop. The recent Government Guarantee Scheme has also extended the ability of many financiers to participate more aggressively in professional services, including Finance Broking firms, in many cases.

More information?

Contact MCP:

E - mcpnews@mcpgroup.com.au

W - www.mcpfinancial.com.au

T - 1300 510 816

The team at MCP Financial Services has specialised expertise in advising and managing banking for the Professional Services industry. We support Accounting, Financial Planning, Legal, Insurance, Real Estate, Architecture, Finance Broking and related service industries.