Do you operate a Legal Practice and its internal finances? Credit providers have become increasingly focused on customising their lending policies accordingly.

There are now a number of established policy guidelines across traditional service industries such as Financial Planning, Real Estate Agencies, Finance Broking, Insurance, Legal & Accounting.

If you are involved in these industries, funding can be a necessary step for growth (acquisitions etc.) or to help in building succession planning.

In Focus - Legal Practices

SME's in the Legal industry are the second most demanded of all professional service providers.

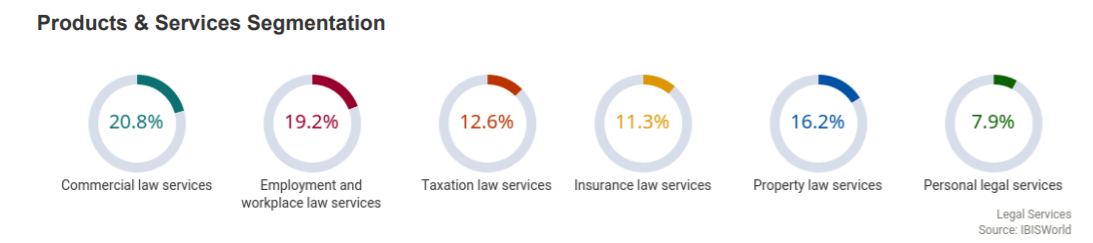

Accordingly to IBIS World data, there are around 18,000 SME businesses in the industry with combined Revenue over $13.1 Billion and over 45,000 staff. Over 50% of SME firms are operated by sole practitioners across a relatively wide areas of practice.

At the "corporate" end of the scale, there are several larger firms, the average profits of larger firms is around 5 times greater than SME firms.

This is not surprising given the access to corporate paying customers, as opposed to SME firms that deal with consumers or smaller business owners directly. In fact, the larger law firms have performed better than expected during Covid, with higher fees against a pre-planned lower cost base.

IBIS World expects Industry revenue is forecast to expand at an annualised 2.3% over the five years through 2025-26, to total $14.7 billion. Demand for property law services, as an example, is likely to grow as the number of housing transfers increases. However, offsetting this is greater competition, technology threats and other costs which threaten to shrink profit margins.

Lawyers & Numbers

Lawyers have many skills, though sometimes managing money isn't a strong one. As a result, many operators in the Legal industry haven't been able to achieve optimal financial performance.

Like an accounting firm, a lot of the current assets are not immediately convertible to cash. Work in Progress (WIP) is generally a very material part of the working capital cycle as an example. Of course, it still has to be completed, billed and collected. So this needs to be monitored with good internal processes.

Lender Appetite - Legal

Traditional firms are all about the individual, ownership is centred across a group of partners who generate personal exertion income based on their specific expertise.

In banking terms, this means a relative lack of leverage with the actual firm; if the person goes, so does part of the firm's future revenue to service debt.

This has meant lower lending thresholds compared to other professional services segments.

This said, many innovative law firms are changing, with the efforts to de-leverage using technology, using para or non-legal staff for a lot of work. It has also been a focus of some firms to build a brand in the eyes of the customer.

To remove any concentration risk, the business generally needs to have two or more owners/advisers.

In terms of participants, ANZ Bank, NAB, Bendigo Bank, Macquarie Bank, Judo Bank, Westpac have policies in the category.

Debt Strategies

Legal firms as a very sweeping comment have a lower appetite for risk, especially in comparison with say the financial planning industry. Though with a weaker reputation for money management, success in managing money and debt typically embraces the following strategies.

- Understand your Working Capital Cycle or Days

Working Capital cycles are a killer for many firms. It can take over 120 days to create, bill and collect invoices. Measure this and do what can be done to shorten the cycle.

This will also avoid jumping into the cycle of using short term debt providers that treat the symptom of the problem without addressing the cause.

- Consider the Security profile and its link to Credit terms.

One of the positive things about borrowing in Professional Services, is the ability to borrow without tangible security such as property or varying levels of guarantees etc. However, make sure the nature of the security provided fits the resultant impact on price and/or terms.

Lender philosophy is advancing in assessing professional services firm, including Legal.

So what are these Worth?

In short, and for SME's at least, not generally as much as many other service firms (Ignoring a few crazy recent examples at the corporate end of town).

Legal businesses were traditionally valued as a multiple to the recurring income (or cents in the dollar) which could be as low as 0.5 to say 1.5 times average revenue. More crudely another methodology is just the firm's net asset position (ignoring the cash/revenue position). The latter was especially relevant where WIP was material and brought to account on the balance sheet.

More common these days is a multiple to Earnings before Interest, Taxes, Depreciation & Amortisation (EBITDA), which allows a comparison of earnings to comparable firms, without the influence of differing capital structures.

Traditionally, multiples at the SME end tend to be in a lower range (e.g. 2.0 - 3.0 times) compared with other professional services.

Regardless of methodology, the key thing for law firms is to focus on the quality and sustainability of their revenue.

How much can I borrow?

When it comes to talking with the bank, it is important to determine what the actual income is to use for loan servicing. Yes, most of us are familiar with EBITDA, but what about adjusting for a market salary for the owners? When putting in a market value of the Owners' contribution this can change this number materially. This is what we call "EBITDAO".

Borrowing limits are less consistent and depend on the underlying customer base and how the terms are structured. As a very generic indication:

1) Maximum loan amount to be less than around 2.0 - 2.50 times EBITDAO.

2) Maximum loan amount to be less than 60% of Recurring Income or subject to lending Cap per Partner.

3) Maximum Loan Term of 10 Years.

Criteria does vary widely and will keep emerging as trends in the industry develop. The recent Government Guarantee Scheme has also extend the ability of many financiers to participate more aggressively in professional services, including Legal firms, in many cases.

More information?

Contact MCP:

E - mcpnews@mcpgroup.com.au

W - www.mcpfinancial.com.au

T - (03) 9620 2001

The team at MCP Financial Services has specialised expertise in advising and managing banking for the Professional Services industry. We support Accounting, Financial Planning, Legal, Insurance, Real Estate, Architecture, Finance Broking and related service industries.