What is a Business Review and why it is important?

Overview

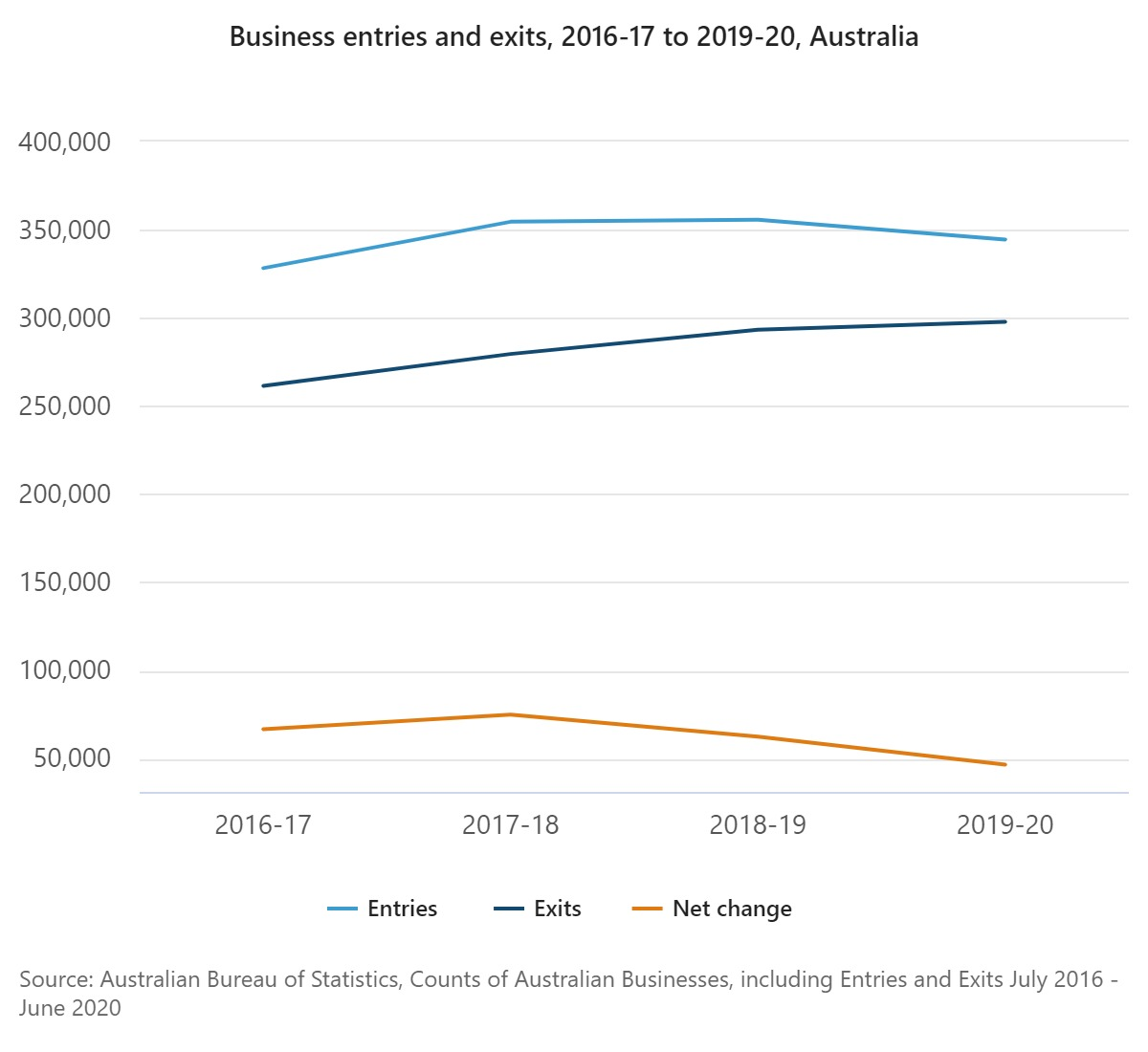

According to ABS data, there are nearly 2.5 million actively trading businesses in the Australian economy. Many thousands are for sale at any time, with around 300,000 new entrants and exits each year too as the ABS data below shows.

So when assessing a business, often with limited data, what are the key things you should look for?

To start with, let's break this across financial data (quantitative) and all other aspects (qualitative).

Qualitative

Whether you are an existing owner (will take some objectivity) or if you are looking at a business for first time, look for:

Understand the Risks

There are countless definitions of risk types, but simply, there are risks that are inherent or beyond direct control (exogenous) (e.g., Economic, Industry specific, Compliance etc.) and others (Reputation, Operational) that are specific to the business. Understand them and how they are managed. If looking at an industry you are not familiar with, find someone who does.

People Dependency

Can the business operate for a sustained period without involvement of key people (typically the owner)? Is there a "brand equity" that can be sustained beyond the key operator/owners.

Leverage

Can the business grow and not be at all solely reliant on the owners? Can it build systems for its growth? Including marketing & sales programs, culture and customer service, that don't rely on individual expertise at an operational level or "black art".

Understand Positioning

Positioning is defined as "shaping how individuals perceive the organisation or its service". Whether deliberately managed or not, the business will have an identity and be positioned in the mind of your target audience and stakeholders, relative to competitors. Make sure this aligned with your own fundamental objectives.

The positioning the business takes in the mind of your target audience is a key means of differentiating its service offering from a competitor.

Scope for Growth

Identify what stage the business is at in its life cycle. Can it grow offering the same services to its existing customers. Or does it need more of one or both?

The End Game

What is the business worth? A buyer will have a range of motivations and objectives in assessing the price they will be willing to pay.

Quantitative

Getting a gauge of the numbers quickly isn't a simple process. There are many moving parts, but a good review of any business should take in to account the underlying trends across profitability, cash flow and key funding measures. Let's look at these:

Profitability

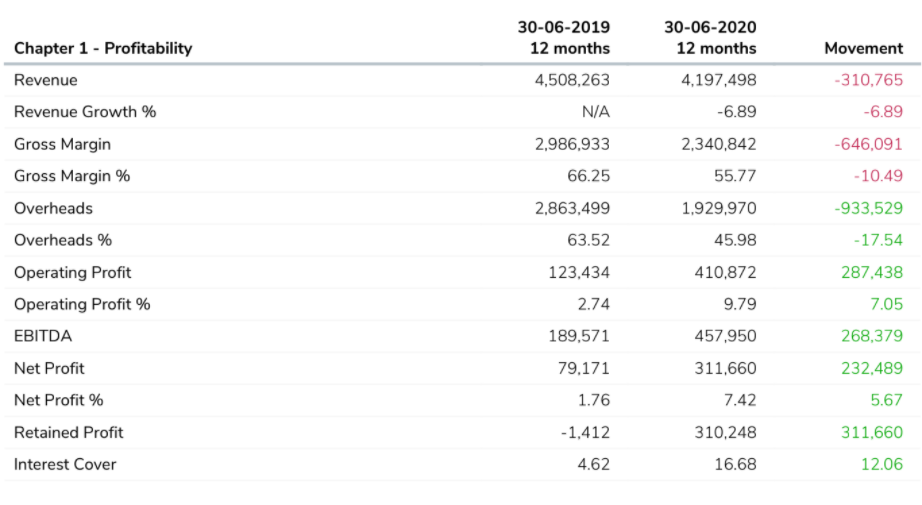

Look for Profitability and the trends over past financial periods. Identify the key trends that provide the context for any material changes.

Look at these numbers above. This business is being offered for sale. The very material movement in Revenue, Gross Margin & Expenses needs review.

Look at these numbers above. This business is being offered for sale. The very material movement in Revenue, Gross Margin & Expenses needs review.

In this example, the business lost some higher margin customers, and employment levels were cut strongly. The business may not be sustainable at the current cost base.

Cashflow

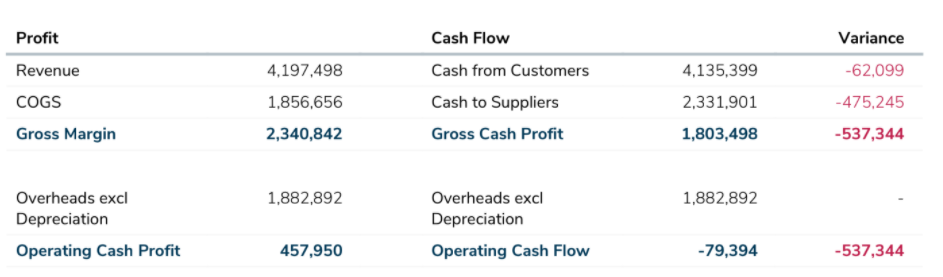

Cash is king. A review of this business above shows a very cashflow compared with its reported profit.

In this example, the business had a very different cash position to its profit, the result of a backlog of overdue payments to its suppliers.

Working Capital Management

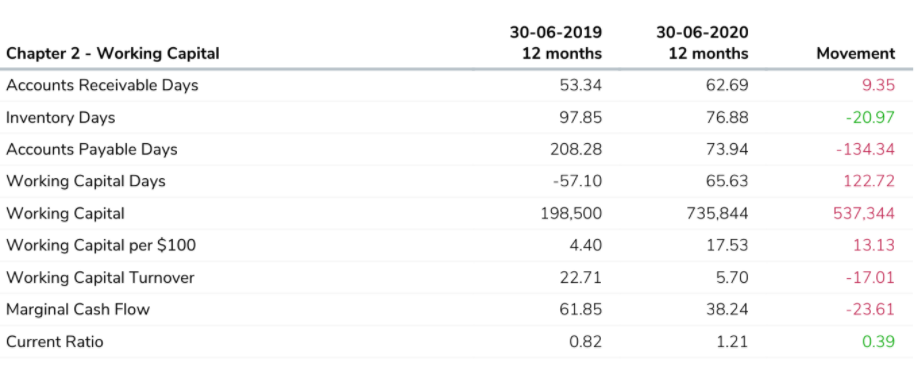

We define this as the capital of a business used in its day-to-day operations, calculated as Current Assets less Current Liabilities.

The Business Review of Working Capital noted:

Accounts Receivable Days had adversely increased by 9 days.

Inventory Days had improved by 12 days.(Turns out business quit inventory at a lower gross margin)

Accounts Payable improved significantly.(Had to be remediated as above).

Funding

It is important to draw a greater understanding of the composition of debt v equity v cash funding of the business operation, and context for movements.

This is where it is critical for business owners to understand the difference between Debt and Equity. that business owners often do, or have, responsibility for a variety of operational and strategic roles in a business.

You may make decisions depending on the different capacity that you find yourself in during business.

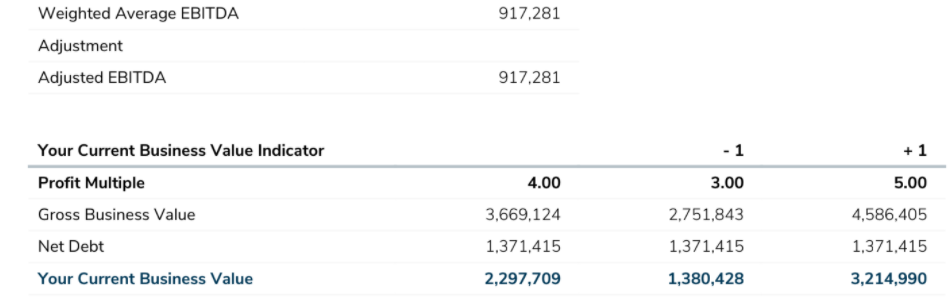

Business Value

All existing and prospective business owners are always interested in business value, net of debt funding arrangements. For more on valuing a business you can see our previous blog on Business Valuations.

Understand your Industry

Lastly, the numbers may not mean as much unless there are benchmarks. Understand the industry the business operates. Average Profit and Gross margins for example. Prospects for the future. Access the data you need to better understand.

More Information?

E - enquiry@mcpgroup.com.au

W - mcpfinancial.com.au