July 2021: Rate Decision & Analysis.

The Reserve Bank of Australia ("RBA") left the official cash rate unchanged at 0.10%

The predominant sentiment globally is one of increasing inflation, strong labour demand and the realisation that interest rate increases are coming. In the U.S for example, their CPI leapt by 3.8% in the past 12 months, the biggest increase since 1992.

Locally, Australia’s unemployment rate peaked at 5.1% (ok, depends of your definition of unemployment)which is a significant number as it is actually below the 12-month average before COVID.

Wage growth has been modest or non-existent for many years, though with the labour market tightening there are signs that we may see future wage growth at a level greater than inflation.

These and other economic factors will be key in interest rate settings (read below).

Whilst the headline economic news is positive - worth sharing some recent data from Canstar which shows the impact of property and mortgage growth. The data shows a material difference in Average Annual Income and the level of Annual Income to avoid mortgage stress.

The results (highlighting Sydney and Melbourne in particular) are not surprising perhaps, but worth bearing in mind in the medium term if rates continue to increase. Certainly plenty in the market are focusing on what happens when this current cycle finishes.

In terms of sentiment, the ANZ-Roy Morgan Consumer Confidence ANZ-Roy Morgan Consumer Confidence was virtually unchanged at 112.2, though more recently Brisbane and Sydney took further dips due to lockdown.

Small signs of Business Investment

Data released from Australian Prudential Regulation Authority shows a mix of activity for business. NAB led the positive growth story, with up its fourth straight month of growth in business loans.

Over the year and by comparison, ANZ’s business loan book shrank by $700M, CBA’s was stagnant and Westpac’s shrank by $300M.

More broadly, Governments and regulated are desperate for businesses to lead and start investing. This will be crucial in making sure that the post Covid recovery is sustainable.

Direction for Local Interest Rates?

The market is catching up the news that the interest rate environment is changing. Australian shares suffered during the month on Monday as traders began to price in the prospect of rising interest rates.

The upward momentum by other central banks is significant now. For example, Norway’s central bank is set to lift rates as early as September, and the market expects Canada and England to raise them later in 2022.

It is therefore possible that this momentum may stop the RBA repeating the $100 billion of asset purchases in the next quarter, when the current program will phase out.

Again, for those calling the bottom for interest rates, the jungle drums are beating loudly.

Money Markets (and Negative Interest Rate Debt)

In a first, the Aust. Government borrowed $1 billion from institutional investors at negative interest rates. This is the first time the total cost of a Treasury debt sale is less than zero.

In a good sign for the Australian Government, the issue was picked by institutional investors including foreign pension funds, insurers and banks.

This means investors will be paid between -0.010% and 0.0% on the $1 billion which falls due in September.

The numbers below show an increase in short term money, but a fall in the 10 year bond flattened the yield curve a little.

| Month | Cash Rate | 90 Day Bill Rate | 10 Year Bond |

| September 2020 | 0.25% | 0.12% | 0.84% |

| October 2020 | 0.25% | 0.10% | 0.90% |

| November 2020 | 0.10% | 0.05% | 0.81% |

| December 2020 | 0.10% | 0.05% | 0.90% |

| February 2021 | 0.10% | 0.03% | 1.09% |

| March 2021 | 0.10% | 0.04% | 1.69% |

| April 2021 | 0.10% | 0.05% | 1.74% |

| May 2021 | 0.10% | 0.04% | 1.65% |

| June 2021 | 0.10% | 0.04% | 1.59% |

| July 2021 | 0.10% | 0.07% | 1.48% |

The spread between short and long term rates will remain a crucial test of the market's view of the economy, including inflation, and the longer term direction of interest rate settings more broadly.

Property

No surprise, but confidence levels in the property sector are close to record levels as confidence in the economy, combined with supply shortages, sends prices north.

The latest quarterly ANZ / Property Council Survey puts confidence at 139 points, the third-highest level since the survey began, with a score of 100 considered neutral.

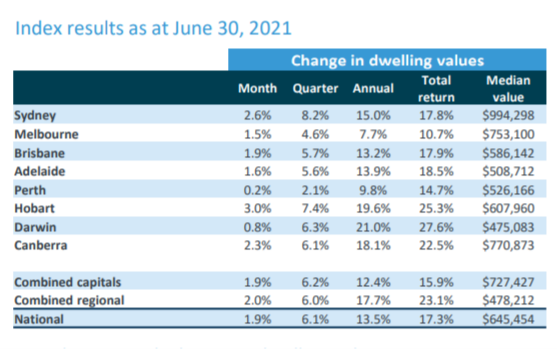

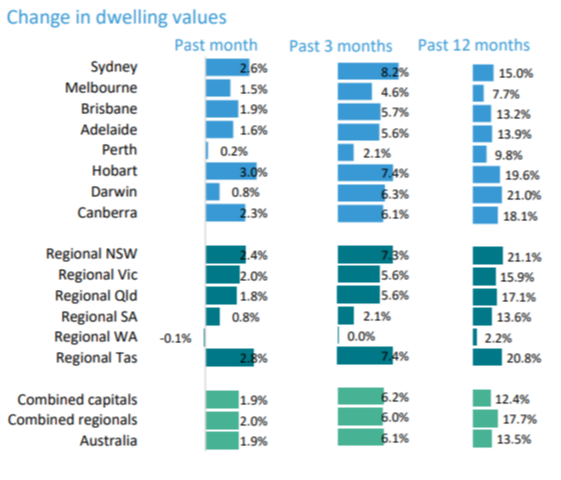

In the residential market, data from CoreLogic listed below, shows continued growth Australia’s housing boom rolls on with national home values lifting another 1.9% in June, which is a little lower rate than the previous month.

Annual returns remain very strong, in fact some of the annual growth numbers are astonishing and the areas of growth are diverse.

Industrial Property leads Surge

Confidence in the industrial sector is very high and reflected in demand. This is largely explained by growing demand for space from the e-commerce industry. The survey also showed rebounding confidence in the tourism and retail sector, which has had a strong run.

Commercial Property

Retail property remains very strong, and whilst office stock still has a lag many properties are not staying on the market very long.

Currency

Our currency remains relatively stable, and by some experts judgement, a little under-priced.

Some of the relative weakness is due to the strength of the US economy, experts expect growth in other non-US economies through the second half of 2021 which could be reflected in stronger currencies in Australia and Europe against the USD.

Until next time.