September 2023: Rate Decision & Economy

The Reserve Bank of Australia (RBA) has today announced no change to the official cash rate, leaving it at 4.10%.

The world economy had a chance (in part at least) to breathe and markets readjusted to expectations of a softer economic outlook.

Economic Results & Sentiment

Locally, Australian Bureau of Statistics’ (ABS) data showed the annual inflation rate fall to 4.9% in July, from 5.4% in June, which was lower than expectation. Price pressures for many goods such as food, petrol and consumables fell.

The RBA will be noting prices that are rising significantly are largely beyond consumer discretion (rents, insurance, electricity for example). This will have a hand in their softened tone below.

Jobs data is very strong with unemployment at a near low of 3.7%. While this is naturally a positive, for the RBA it is a challenge as rising services costs, driven by labour demand, have an upward impact on inflation.

Consumer Sentiment Subdued

This month we note a switch to consumer insights, where confidence is below average. Though the ANZ-Roy Morgan Consumer Confidence was up slightly to 78.1 this week, this index has now spent six months below the mark of 80.

A big part of subdued confidence is mortgage stress. Roy Morgan shows a 1.5 million (29.2%) mortgage holders were ‘At Risk’ of ‘mortgage stress’ in the last quarter. Some of the concern is coming through in higher arrears rates on mortgages, though this is not widespread as yet.

RBA Stance

With the hold at August's meeting, the RBA commentary is still robust on inflation with a hint of softening.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks. In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market. The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

The minutes also outlined a “credible path” back to the RBA’s target range of 2% - 3%, potentially without further rate rises. In other words, they are prepared to be patient. A lot softer.

Shares & Markets

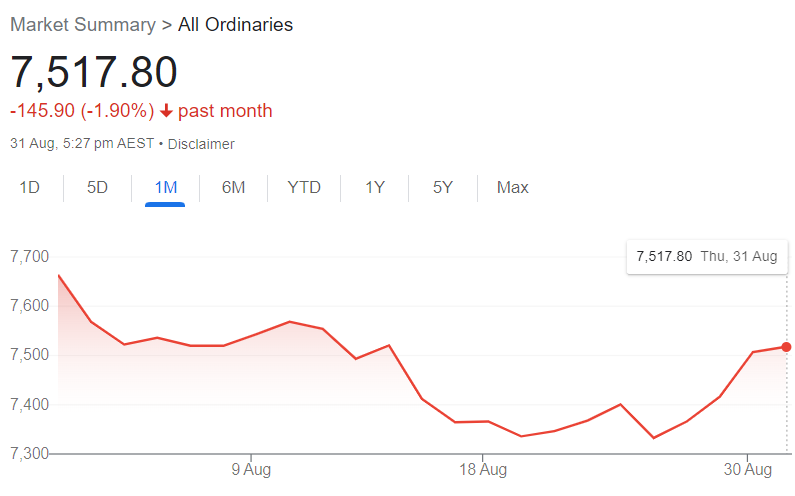

Overall, the market ended August with a fall in the All Ordinaries, reversing July's momentum.

The broader poor sentiment hurt markets early in the month, though the better than expected inflationary data drove a late rally - especially across interest rate sensitive real estate stocks for example.

Listed companies also defied expectations delivering strong results during earnings season, raising expectations that most of the economy may not be hard hit by dampened demand.

Direction for Local Interest Rates?

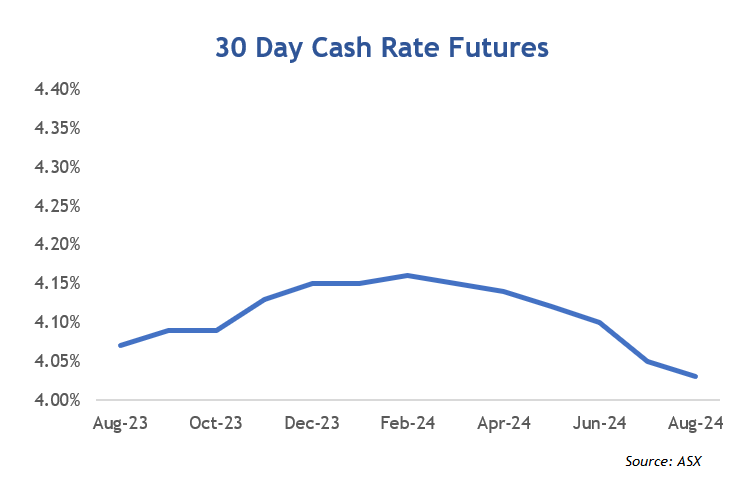

Markets expectations were reflected by money markets where rates fell across the board.

Movement in the ASX Cash Rate Futures offers some insight. This month, the shape of the curve changed, with a 20 point decrease in expectations. The market is seeing rates at the peak of the tightening cycle.

This is indicated by the ASX Cash Rate Futures as below.

Financial markets are now implying that the cash rate will trend flat to falling slightly over the next 12 months and off a smaller peak. Not all Economists agree but less think there is more tightening of monetary policy ahead.

Another good argument though is that we may see a "new normal" in monetary policy settings. Basically, if unemployment remains low, why drop rates and provide stimulus for the economy?

Update for Interest Rates Worldwide

As a broad statement, Australia is clearly more patient than the rest of the world in allowing inflation to take longer to come back to target range. Most countries aren't so prepared to wait it out.

New Zealand's central bank left the cash rate unchanged at 5.50%. Their commentary stressed the need for maintaining these settings for longer to meet its inflation targets, not ruling out another increase either.

In the UK, the Bank of England made their 14th successive increase since December 2021 to 5.25%. Despite slowing inflation, most are expecting more tightening to come.

The U.S. are absorbing the 5.50% rate after another 0.25% last time. US Federal Reserve chairman Jerome Powell make it clear that the inflation fight was not over, putting markets on notice that they could raise rates in the future.

Canada, after surprising last month with another 25 points to 5.00%, is expected to hold at this month's meeting, with inflation moving toward the range set by the central bank.

Central Bank Cash Rates

Before posting any changes today we compare central bank cash rates and their longer term 10-year bond yields.

There are signs that markets are settling, with very little movement at both ends of the curve this month. Perhaps a sign that things could start to normalise. The spread in most countries remains inverted as we have discussed.

|

Country |

Cash Rate | 10 Year Bond | Spread |

|

Australia

|

4.10% | 4.02% | -0.08% |

|

Canada

|

5.00% | 3.60% | -1.40% |

|

China

|

3.45% | 2.62% | -0.83% |

| Germany | 4.25% | 2.54% | -1.71% |

| India | 6.50% | 7.18% | 0.68% |

| Japan | 0.00% | 0.62% | 0.62% |

| New Zealand | 5.50% | 4.89% | -0.61% |

| Singapore | 3.71% | 3.15% | -0.56% |

| United Kingdom | 5.25% | 4.40% | -0.85% |

| United States | 5.50% | 4.18% | -1.32% |

The fascination will be to watch the direction of all these spreads. If it heads towards a more normal it will compare to other similar economies (Canada, UK, USA, NZ) where they are all at a significant premium.

Local Money Markets

Australian money markets were active and yields fell across all terms. The short end of the curve fell as the expectations of rate rises dissipated. The 10-year rate had a yo-yo during the month but settled to be relatively unchanged.

| Month | Cash Rate | 180 Day | 10 Year |

|

Sep 22

|

2.35% |

3.04% |

3.65% |

|

Oct 22

|

2.60% |

3.55% |

3.90% |

|

Nov 22

|

2.85% |

3.61% |

3.74% |

|

Dec 22

|

3.10% |

3.48% |

3.48% |

|

Feb 23

|

3.35% |

3.67% |

3.50% |

|

Mar 23

|

3.60% |

3.94% |

3.85% |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

|

May 23

|

3.85% |

3.82% |

3.34% |

|

June 23

|

4.10% |

4.21% |

3.65% |

|

July 23

|

4.10% |

4.67% |

4.03% |

|

Aug 23

|

4.10% |

4.70% |

4.06% |

|

Sep 23

|

4.10% |

4.37% |

4.02% |

Residential Property

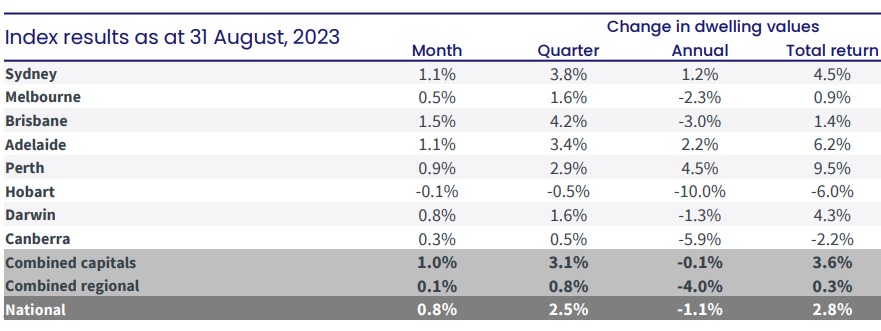

The latest residential monthly property results from CoreLogic showed a slightly higher pace of growth.

The increase is a sixth consecutive monthly rise and partly on the back of a lower level of listings. There is naturally a lot of diversity in the results. For example, parts of Regional Victoria and Tasmania in particular are well off their peaks as affordability bites.

Other Property Markets

There is still a mismatch of sorts between what buyers and sellers are willing to pay, so a lot of weakness in commercial property not actually crystallising. This said, "Cap" rates are on the rise and listed entities in particular are suffering paper losses at least in terms of revaluations.

According to the Property Council of Australia’s biannual CBD office markets update, office vacancy rates in the CBD nationally are approaching 13%, which is the highest level since 1996. This is part weakening demand and an increase in supply.

At the lower end of the scale, assets are on market for longer but at this stage valuations are holding up.

Currency

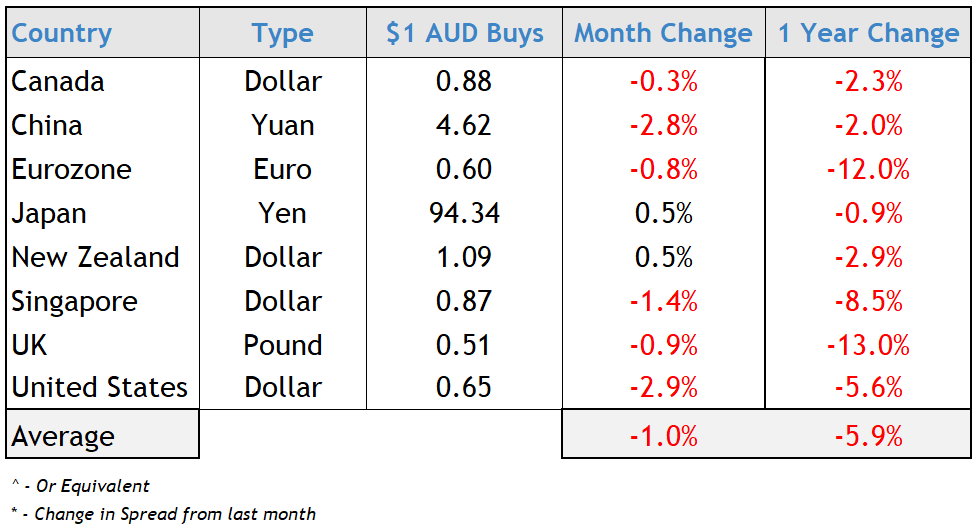

The Australian dollar lost ground again against the majority of other currencies and is one of the poorer performers out of established currencies over the last year.

A slowing Chinese economy, interest rate differentials and the strength of the US economy means the AUD has been sold off. This said, the counter argument is the relative strength of commodity prices, traditionally having a strong nexus to currency performance.

Our weaker currency is resulting in foreign imported goods landing at a higher cost, leading to the potential of imported inflation.

We wish you a prosperous month ahead. May your NRL/AFL finals team fight as hard as the economy!