September 2021: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") has left the official cash rate unchanged at 0.10%. No more news on this for now (but not forever).

As Melbourne and Sydney continue through hard lockdowns - it is hard not to see the elements of a two-tier economy. The impact on our short-term numbers, and more importantly the number of small business at the forefront, is very real.

At a macro level however, our GDP numbers were surprisingly consolidated in the June quarter, at 0.7% growth. Credit ratings grew firm as S&P Global also upgraded their global economic growth forecast to 5.9% for 2021. This is based on rising vaccination rates, setting an optimistic tone for the following 6 months as Australia seeks to avoid a "recession".

Conversely, the USA's economy stalled in August. This was fuelled by the rapid spread of the coronavirus’s spread across unvaccinated people in particular. This will be an important watch.

The RBA will need to remain very fluid.

Shares & Markets

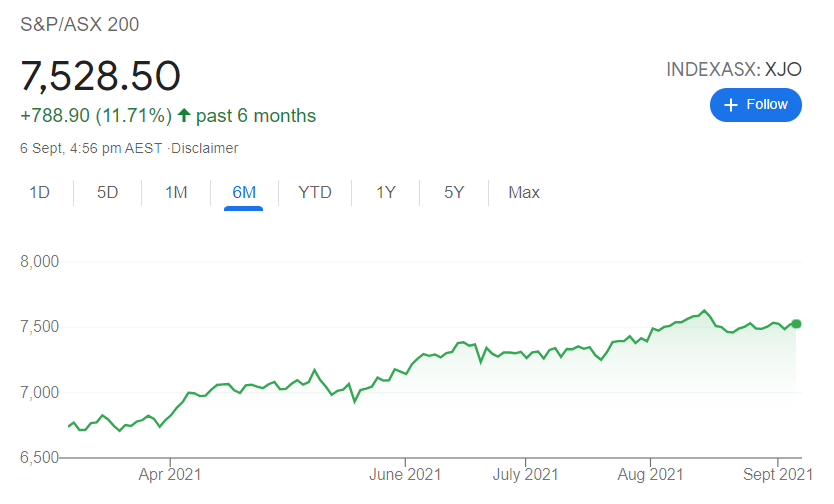

With the very low yields on fixed income, equities remain the beneficiary. With August being all about reporting season in Australia, the benchmark ASX200 delivering another month of gains of almost 2%. As the graph below shows, that makes nearly 12% over the last six months.

In addition to the current dividend season ($40 billion in dividends in this profit reporting), the major banks have announced share buybacks, to return their excess capital holdings. This has the objective of reducing the number of shares on issue. Though more broadly, this delivers a lot more cash in the economy! More two speed economy stuff.

Direction for Local Interest Rates?

The upward momentum for interest rates is on hold, but we can take some cues for neighbouring New Zealand.

Their central bank held interest rates at 0.25% due to their current lockdown conditions, but their central bank was otherwise promoting a likely 25 basis point (0.25%) increase.

In Europe, The Bank of England signalled that its concerns over inflation are strong enough to signal their intent that rates could be heading up. A watch locally for whenever lockdown conditions recede.

Money Markets

A very busy month on money markets, not so much in the numbers below but more across the volume of turnover.

With short term money still having nowhere to go, the 10 year rate has slightly reversed the fall in the yield curve as below.

| Month | Cash Rate | 90 Day Bill Rate | 10 Year Bond |

| September 2020 | 0.25% | 0.12% | 0.84% |

| October 2020 | 0.25% | 0.10% | 0.90% |

| November 2020 | 0.10% | 0.05% | 0.81% |

| December 2020 | 0.10% | 0.05% | 0.90% |

| February 2021 | 0.10% | 0.03% | 1.09% |

| March 2021 | 0.10% | 0.04% | 1.69% |

| April 2021 | 0.10% | 0.05% | 1.74% |

| May 2021 | 0.10% | 0.04% | 1.65% |

| June 2021 | 0.10% | 0.04% | 1.59% |

| July 2021 | 0.10% | 0.07% | 1.48% |

| August 2021 |

0.10% |

0.05% | 1.12% |

|

September 2021 |

0.10% |

0.04% | 1.18% |

The bigger decision for the RBA will be whether or not to reverse its previous intent to reduce bond purchases in the face of a deterioration in the economic outlook.

Property

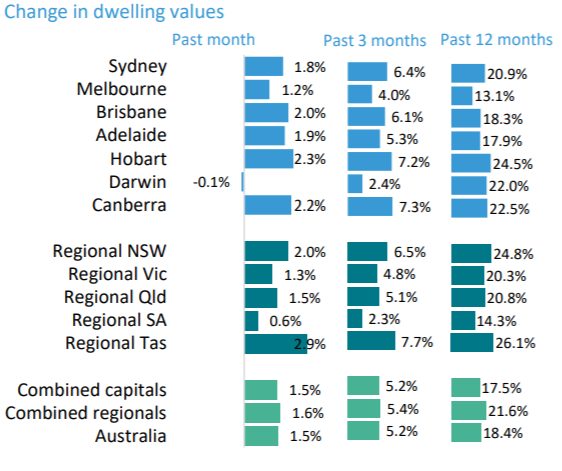

The property market remains positive across the board, despite Melbourne and Sydney lockdowns.

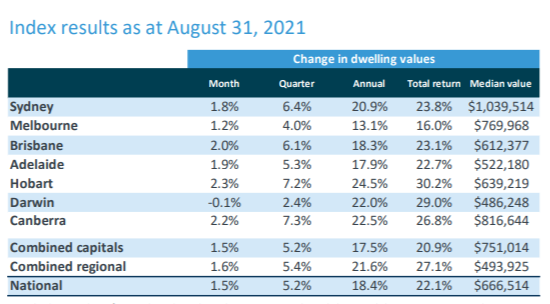

In the residential market, data from CoreLogic listed below, Australian housing values increased a further 1.5% last month, with the latest rise delivering an overall 18% increase for the past twelve months. In comparison, Australian wages increased at an average annual rate of only 1.7%.

Sydney and Melbourne home prices have actually doubled since 2009, prompting regulators to “carefully” monitor lending standards. You would think an increase in interest rates would allow markets to take care of that, though it seems some level of regulation will come first.

Industrial Property

The demand for warehouse space holds strong, across both capital cities and regional areas. In areas like Geelong and Newcastle, developers are actively seeking more land opportunities, and values are increasing significantly as a result. This is also a reflection of the change in how logistics are being coordinated in a post Covid world.

Commercial Property

Australia Post’s decision to move its national headquarters to a new project in Richmond, leads a growing group of major companies pursuing office life outside the CBD. This includes businesses like Seek, Domain, Uber, Reece, Tesla, MYOB and Walt Disney to name a few.

Yields are falling, and anecdotally we are seeing many investors turning to regional areas for some level of income.

Currency

Another busy month with currencies. A sharp fall for the greenback triggered by COVID-19 outbreaks and softer-than-expected jobs growth has sparked a rally in our local currency.

Until next time.