December 2021: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") has left the official cash rate unchanged at 0.10%.

The main story here and overseas is inflation. Australia had the underlying annual rate up 2.1% in the September quarter. The most for 6 years but admittedly not a crazy mark over a longer period of comparison. In the U.S. however, inflation was up 6.2% from a year earlier and this is at the fastest annual pace since 1990.

On the employment front, data from ANZ showed that job ads rose 7% in November (and over 40% from pre-pandemic levels); ANZ predicts that the unemployment rate could fall below 4% toward 2023.

RBA Governor Lowe is also extremely bullish about Australia's future. "I’m expecting the unemployment rate to get to 4% in 2 years’ time,” he said. “I’m expecting the economy to grow by 5% next year and 2.5% the following year, and I’m expecting inflation to be in the two's and that’s a very good set of economic outcomes.”

Alternative View

Some households and investors are fearful that the economy is vulnerable to the omicron variant, at a time when Government won't be able to provide the same level of financial support. Asset bubbles also build fears for a two-tier economy.

Further worrying markets is that US government is yet to agree upon terms to extend their current debt ceiling deal which is due to expire this week. It seems an impossible event that the US could actually default on its obligations, but it needs to be resolved.

Shares & Markets

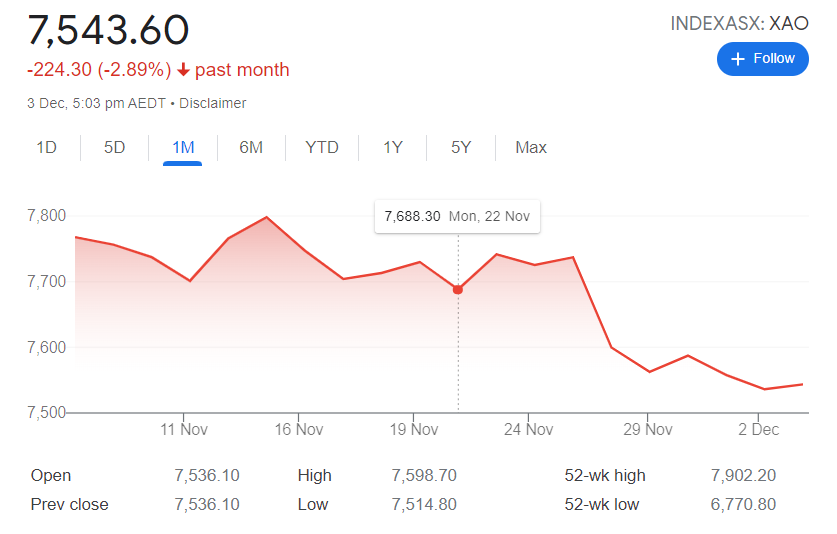

Over the month of November, the Australian share market was all red ink. Not surprising, especially given the latest Covid concerns.

The dip in the equity market might be correction after so many months of sustained growth. This is also not an unusual trend in November, with sentiment often turning positive again in December.

The local market is expected to reverse some of the losses this month.

Direction for Interest Rates?

The Australian bond market is currently predicting around 5-6 increases to the cash rate over the next 18 months. The move north for market interest rates has impacted fixed-rate mortgages accordingly.

The RBA isn't convinced and remains strong on the belief that rates are not moving north materially. Governor Lowe also shut down the belief that they will raise rates in response to Australia’s rising house prices.

“We’re not going to do that,” Lowe said. “So if you think that’s why we’re going to raise interest rates next year, I would encourage you to rethink.”

Instead, they are more concerned about the impact that higher interest rates would have on the employment market.

New Zealand have taken a different approach. The RBNZ raised rates to 0.75%, after concerns about inflation expectations from elevated consumer demand, and rising property prices too.

In the UK, Bank of England governor Andrew Bailey has indicated that the monetary tightening cycle may start soon, but nothing yet.

So the bet locally is that accelerating inflation will put pressure on the RBA to lift rates before 2024.

Money Markets

Another really busy month on money markets, with a high level of turnover.

| Month | Cash Rate | 90 Day Bill Rate | 10 Year Bond |

|

December 2020

|

0.10% | 0.05% | 0.90% |

|

February 2021

|

0.10% | 0.03% | 1.09% |

|

March 2021

|

0.10% | 0.04% | 1.69% |

|

April 2021

|

0.10% | 0.05% | 1.74% |

|

May 2021

|

0.10% | 0.04% | 1.65% |

|

June 2021

|

0.10% | 0.04% | 1.59% |

|

July 2021

|

0.10% | 0.07% | 1.48% |

|

August 2021

|

0.10% |

0.05% | 1.12% |

|

September 2021

|

0.10% |

0.04% | 1.18% |

|

October 2021

|

0.10% |

0.05% | 1.45% |

|

November 2021

|

0.10% |

0.20% | 2.09% |

|

December 2021

|

0.10% |

0.14% | 1.93% |

The sudden increase in all interest rates in October settled down this month, with all indicators down marginally.

Overseas, there has been increases in their respective longer term interest rates, reflecting inflationary pressures that have been more material than expected.

This is now a chance for the market to catch its breath and see what is coming next.

Property

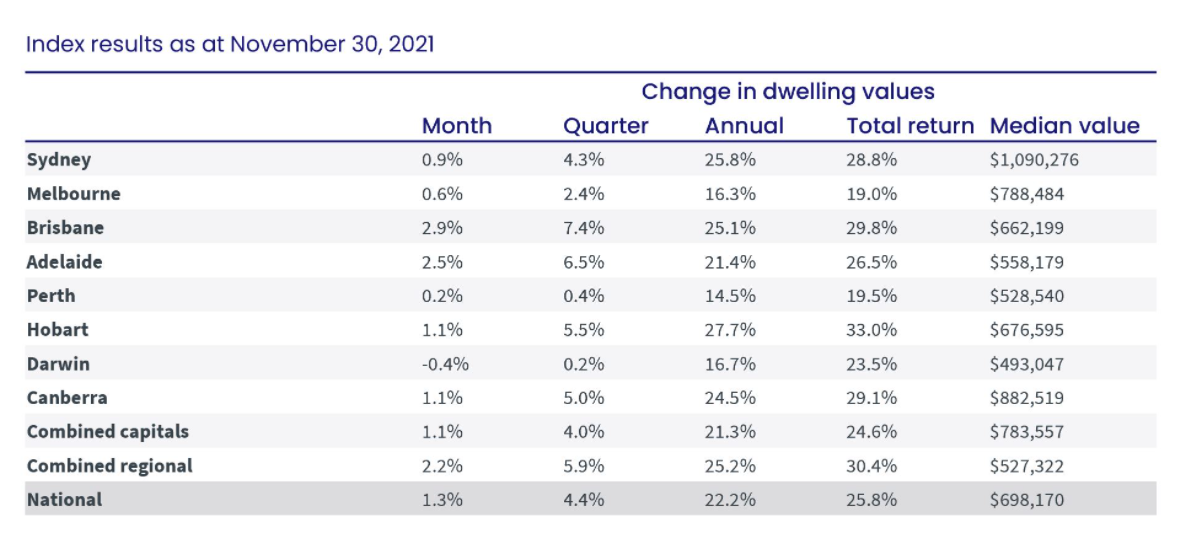

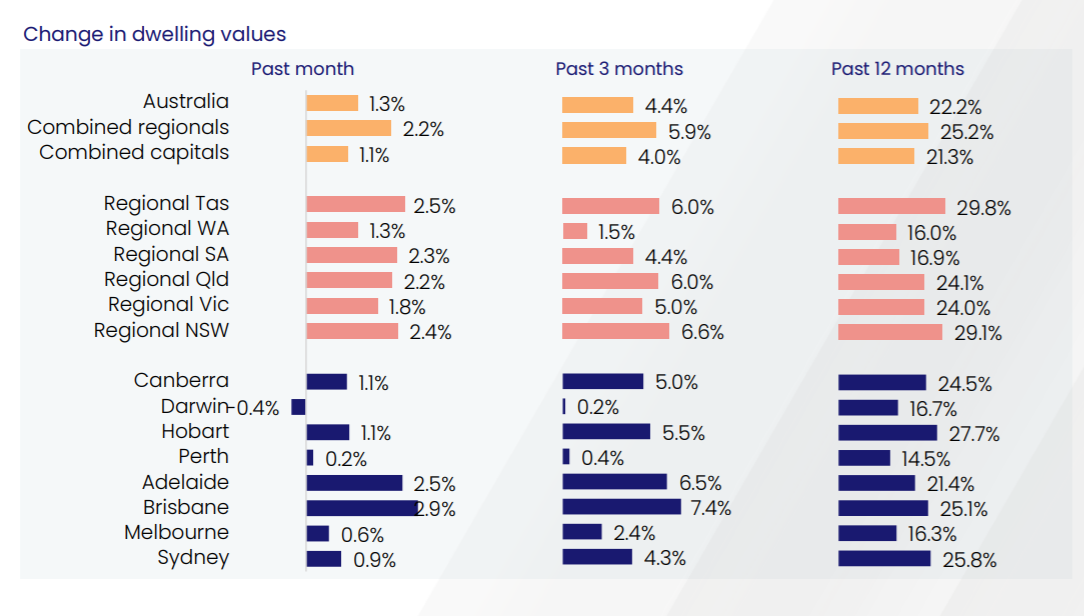

Australian housing values were 1.3% higher in November, as CoreLogic data shows us. Though in most markets, anecdotally at least, momentum is slowing.

Most property experts are calling the end of current conditions. This is based on likely weaker demand due to smaller population growth, tighter credit and an increasing amount of supply.

Adelaide and Brisbane maintain their strong recent growth and are trending ahead of Sydney as major growth locations on a more sustained basis.

Industrial Property

With very strong growth in e-commerce industries, vacancy rates in the industrial sector have reached a low of 1.3%. With more demand for leased space to come, rents are expected to rise and values increase too.

Who would have thought say earlier last year?

Commercial Property

Again, more evidence of falling yields with investor interest, primarily from overseas, in office space where there is surprisingly high levels of interest across Australia. There is a rush of investment into Melbourne and Sydney markets in particular, showing confidence in CBD workplace in the long term.

Currency

The Australian dollar got hammered in November, down to a year low after economic output for the September quarter after the GDP fell 1.9% in the July to September period. Whilst given lockdowns this wasn't totally unexpected, it was still the third largest quarterly fall for over 40 years.

The market didn't like it and hence the currency paid a price. Most experts in currency see this as a temporary setting however.

Lastly, be interesting to see if New Zealand's higher local interest rates could see their dollar head to parity against our dollar.

Until next time.