September 2022: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") met today for September, raising the official cash rate by a further 0.50%.

Economic Results

Despite strong employment levels, the unemployment rate is at a 50-year low of 3.4%, the broader economy still looks a little vulnerable and markets are looking for any guidance.

Inflation took a back seat this month, with the major talking point the fall in residential property prices as we outline below.

This housing market correction, along with the increase in interest rates, has not made a material impact on consumer spending as yet but there is the coming reality that it will. To what extent is anyone's guess.

This all said, the economy still expects annual GDP growth to reached around 3.3%.

In the U.S., their Federal Reserve continued their strong theme around controlling rising prices. They warned that investors should not expect any cuts to interest rates until inflation is under control. Some positive signs with some cooling inflation data.

There is some meaningful data to come in the coming months that will give a better guide as to where things are heading.

Shares & Markets

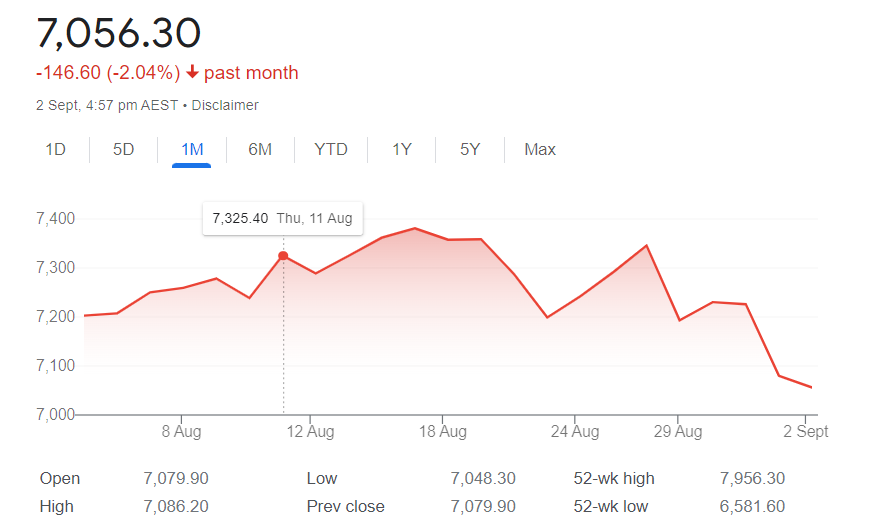

Over the month, the Australian share market was in the negative territory as indicated below:

After last month's equity market rise, our market dipped this month on the backdrop of rising rates and inflationary concerns.

Overseas, the recent U.S. reporting season was broadly in line with expectations, and interestingly a majority of analysts have downgraded their forecasts for 2023.

This was due to the Federal Reserve's comments around monetary policy, with higher rates likely here to stay, rattling their markets which was down over 4% during the month.

Direction for Local Interest Rates?

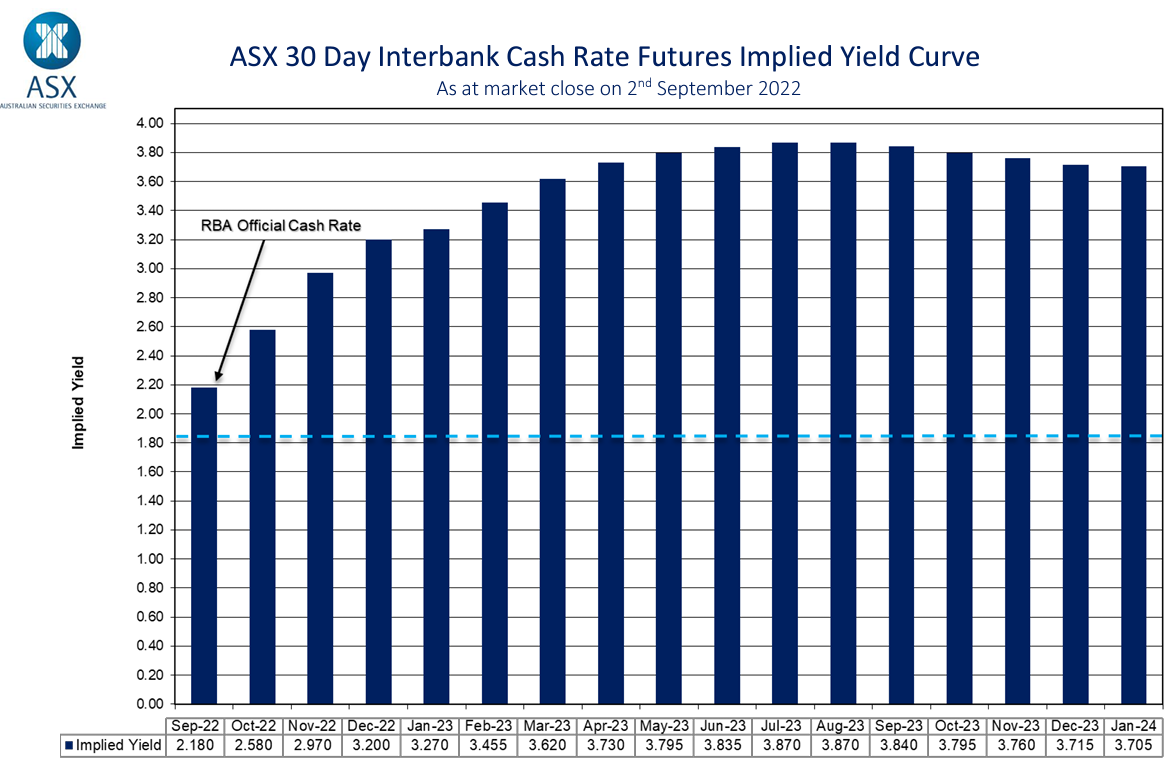

Well, a month is a long time in both money markets and expectations around interest rates.

Last month we said how we expected the RBA will be largely finished with interest rate increases at just above 3%, and then settle at this level for a while.

This month, there is around a 70 basis point (0.70%) increase off this base as indicated by the ASX Cash Rate Futures as below.

This is a material change in the outlook. Whilst inflation remains a priority, if the property prices continue to fall this will test the RBA's resolve materially.

Update for Interest Rates Worldwide

Australia's monetary policy remains in step with central banks across the world.

New Zealand raised interest rates by 0.5% to 3.0% in August. This is the fourth successive time that the RBNZ has now raised rates by 50 basis points in its efforts to fight inflation. Their central bank has a view that inflation levels have peaked, though time is needed to bring it back to the target band.

In the U.S, The Federal Reserve hasn't put a ceiling on rate increases, only that they will do what is required to bring down inflation to its 2% target. This is concerning markets across the world. Their next meeting is later in September with a 50 or 75 basis point rise expected to around 3.25%.

The European Central Bank meets again later this week, where it is expected to raise its central interest rates by another 0.50%, to 1.0%.

Japan's Central Bank, with its policy rate unchanged at minus 0.10%, remains very isolated now in terms of monetary policy.

Money Markets

Money markets all headed north over the month, this movement was very consistent across both short term money and longer term bonds.

This is a material change from the sentiment of last month, where the view was of a short and sharp rate rise, the yo-yo is now back in the focus of keeping inflation well and truly under control.

The market is ultimately following other developed markets around the world, a reminder to us locally of how their fortunes are tied to our own.

| Month | Cash Rate | 180 Day Bill Rate | 10 Year Bond |

|

September 2021

|

0.10% |

0.04% |

1.18% |

|

October 2021

|

0.10% |

0.05% |

1.45% |

|

November 2021

|

0.10% |

0.20% |

2.09% |

|

December 2021

|

0.10% |

0.14% |

1.93% |

|

February 2022

|

0.10% |

0.26% |

1.98% |

|

March 2022

|

0.10% |

0.27% |

2.22% |

|

April 2022

|

0.10% |

0.70% |

2.87% |

|

May 2022

|

0.35% |

1.40% |

3.12% |

|

June 2022

|

0.85% |

1.94% |

3.48% |

|

July 2022

|

1.35% |

2.70% |

3.54% |

|

August 2022

|

1.85% |

2.78% |

2.96% |

|

September 2022

|

2.35% |

3.04% |

3.65% |

The 180 day rate went up and down over the month. The yield curve is now more as the 10 year bond increased more aggressively.

This shows a more "normal" yield curve and the market's recessionary fears are on hold for now.

In the U.S. the story is different. The 2-year US Treasury yield increased to its highest level since pre GFC, and is now sitting 20 points higher than their 10-year rate. The market has a view that the Fed will keep raising rates even if there are clear signs that the US economy is slowing.

All markets are sensitive to data that doesn't change over history. Anecdotally at least, markets seem to be acting increasingly on sentiment and look further ahead that ever before. If this is true, expect greater volatility going forward.

Property

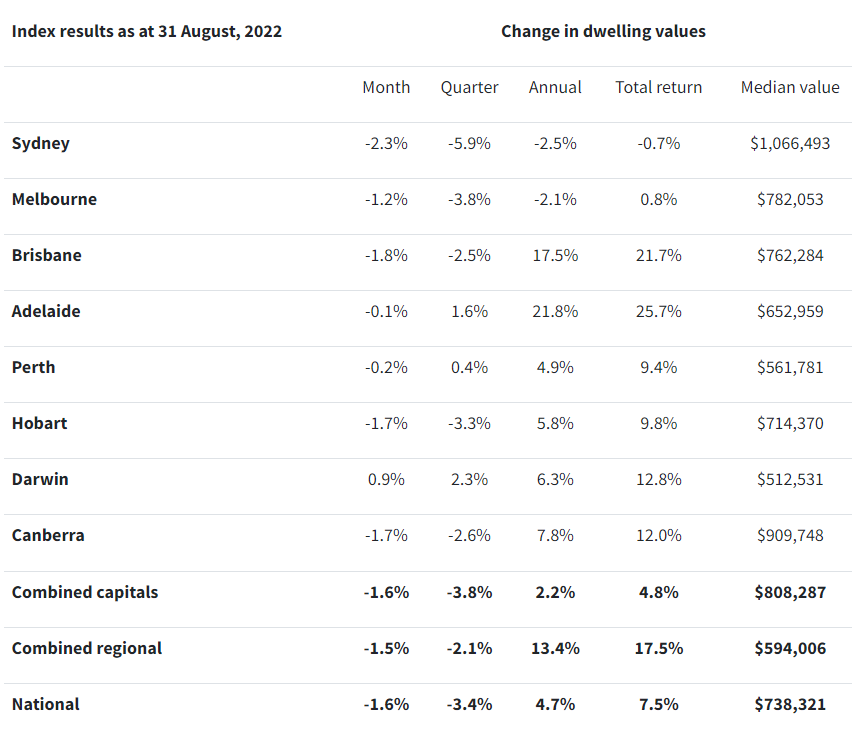

Residential Property continued its downward momentum over the month. If we are searching for the media headline, the national fall of 1.6% over the month is the largest monthly fall recorded since 1983.

CoreLogic data below shows Sydney again had the largest fall and we had the first signs that Brisbane's amazing run is slowing, with a significant fall this month.

Several economists are predicting a total cycle fall of about 15%, so whilst there have been four consecutive monthly falls now, following quarterly trends in our view is a good measure of the impact of market conditions.

Along with the final resting point for interest rates, another material factor for house price performance will be the volume of stock through Spring, testing the depth of the buyer demand.

Apartments

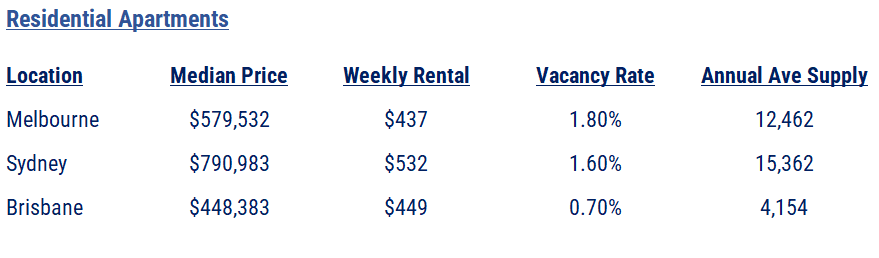

Some great research by property experts Charter Keck Cramer and the apartment markets in capital cities.

It shows how Melbourne for example is transitioning into a "big city" over the last decade. In 2011, 27.2% of Melbournians rented and by 2021 this figure had increased to 30.2%. Furthermore, in 2011, around 3.6% of Melbourne’s total dwelling stock comprised higher density apartments and this increased to 7.7% by 2021. Charter Keck Cramer data shows that this is at similar levels to many cities in the USA and UK, which have more mature apartment markets.

Other parts of the property sector, including commercial in particular, are at an interesting stage. It will take some time for investors to absorb the impact of rising interest rates coupled with the medium and longer term demand by tenants.

Currency

The Australian dollar fell again this month to around US 68¢, offsetting the gains from the previous month.

In part this is based on fears of slowing growth in China, though more a reflection of a stronger USD and a flight worldwide to it as a save haven currency.

Until next time.