Many financiers have pulled out of the SMSF lending environment in recent years, which has cast a shadow of the validity of this strategy. This has also resulted in "orphaned" loans with increased interest rates, despite in many cases an improvement in the value of the security held by these financiers.

Whilst there are still lenders with an appetite to review and refinance these loans to a more cost effective interest rate; the broader question is whether it still has a role moving forward?

SMSF LENDING

Australia has around 600,000 Self Managed Superannuation Funds (SMSF) in operation, controlling nearly 1 Trillion in assets according to Federal Treasury data. Since it was allowed in 2007, gearing via Superannuation has been popular to accelerate asset acquisition inside this structure.

IS THE SMSF STRUCTURE RIGHT FOR ME?

There is a lot written about the worth of SMSFs, and the first thing is to seek advice from an experienced financial adviser. A SMSF is fundamentally at least, can be a good thing as it allows complete control over your superannuation.

There is the flexibility to invest in things that you generally can't do within a retail super fund, and there is also the capacity to have family included - up to six members can be part of your structure.

On the flip side, there are a number of direct costs, including audit and annual reporting fees.

As a generalisation, a red flag is where people without existing SMSF structures in place, look to create one for the sole purpose of acquiring property and looking to borrow.

HOW DOES BORROWING IN SMSF WORK?

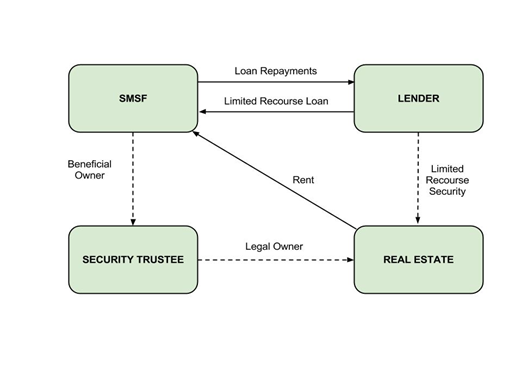

A SMSF can borrow to assist in acquiring Real Property. The arrangement is commonly referred to as Limited Recourse Lending.

The property being purchased is isolated in a Bare Trust or Property Trust which will have a different trustee to the SMSF. This ensures that the assets of the SMSF are protected and there is “No Recourse” at all by the Bank to the assets of the SMSF.

BANK SUPPORT

Traditionally, this product was accessed by existing SMSF holders running established businesses or investment strategies, though it also became a vehicle for individuals seeking the quick fix dream of financial prosperity - usually involving residential property.

As an indirect result, and with the ongoing scrutiny applied to banks - it was a fairly easy lever to turn off.

More recently, most lenders have put some good common sense policies in place to make it harder for new entrants. For example, a specific requirement that the SMSF is to hold some initial liquidity and also hold other assets outside a property being purchased.

Some financiers have supported lending arrangements on the following basis:

- Provide a 1st Registered Mortgage on the Security Property.

- A Guarantee and Indemnity from the Custodial Trustee.

- All Members of SMSF Trustee structures provide unsupported Personal Guarantees, limited to the loan principal, fees and charges.

OPPORTUNITY COST

It is important too to consider the extra cost of borrowing using SMSF. Typically, this would involve an interest rate premium of around 1.00% - 1.50% against borrowing "outside".

Using the example of say a 15 year lending term, this can be a significant interest cost premium. So the benefits (tax etc.) need to offset this cost over the term of the loan.

THE FUTURE

The Association of Superannuation Funds of Australia has not historically been supportive of superannuation borrowing. There is no doubt that the availability of SMSF lending has been a further influence for less experienced investors to speculate into property. So will need to watch this space.

The concept of using gearing via SMSF is still advantageous, in the right circumstances. Especially for business owners looking to own property as a separation from their operating business activities.

FINAL THOUGHTS

In our view, decisions should never be made from the perspective of a taxation advantage or incentive. So before leaping into an investment in SMSF, check in to why you are doing it in the first place. Is it a good decision? If yes, the right structure for it can follow and your SMSF could be a part of that.

Lastly, with company tax rates falling - it is always worth keeping in mind of whether its even better to invest in or outside super.

More Information?

e: mcpnews@mcpgroup.com.au

w: www.mcpfinancial.com.au