Key Takeaways

- Local Equity Markets weaken with much global volatility.

- The narrative changes on interest rate expectations, and quickly.

- Residential Property growth continues, Melbourne & Sydney returns are a false dawn for now.

December 2025: Rate Decision, Property & Economy

The RBA announced its eighth and final decision for 2025, leaving the official cash rate at 3.60%.

Markets have totally changed their expectations of interest rates, with higher than expected inflation and continued GDP growth.

Bond yields shot up around the world, with Japan announcing a monetary policy shift. This means a mix of the good and bad. Optimism for future growth is layered with worry about inflation.

Inflation & Growth

Australia’s inflation rose sharply to 3.8% in October, above the market expectations of 3.6%, marking the fourth consecutive month of increase. The RBA's "trimmed mean" measure also increased to 3.3%, outside its range.

They sound like small changes, but they rocked markets. On the positive side, the unemployment rate remains historically low, reflecting an economy running closer to capacity, which supported the GDP growth beyond expectation.

Victorian State Government Debt Lingers

Not a news flash, but at a time when regulators are placing limits on bank lending for mortgages, Victorian Government data showed their interest costs are projected to grow to over $10 billion in 2029. Gross debt will reach close to $240 billion by then. Victoria is now among the most indebted state‑level governments in advanced economies.

It is just clinging on to its current AA credit rating, which is up for review soon. Ratings agency S&P estimates Victoria’s debt will reach about 214% of operating revenue by 2027, up from about 70% in 2019. By comparison, this is well above WA's 40% and the world average of about 140%. Granted, there are no mining royalties to lean on.

With the world economy focused on Japan, a comparison of their debt levels shows they are broadly similar. Broadly speaking, Victoria's state debt is a threat to Australia’s AAA credit rating.

RBA Positioning

The message from the Governor last time was pretty clear, and sums up the volatility of economics right now:

“The board is going meeting by meeting and using data to see whether the outlook still looks reasonable, and if it isn’t, they’ll change their mind,” said RBA Chairperson, Governor Michele Bullock. “We don’t have a bias.”

Shares & Markets

The Australian equity market was weaker again over the last month, in the short term, hurt by reduced expectations for interest rate cuts. The drop in the market, other than interest‑rate worries, was driven by weaker financials and technology stocks, and global risk‑off sentiment spilling into Australian equities.

Equity Markets Worldwide

A mixed performance on global affairs. Equities faced bouts of volatility, with investors reacting to shifting expectations for US interest rates and earnings, which fed through to other markets.

|

Country |

Mark |

1 Mth |

6 Mth |

1 Yr |

5 Yr |

|

Australia |

All Ords | -1.9% | 2.1% | 2.7% | 30.0% |

|

Germany |

Dax | 1.2% | -1.1% | 17.9% | 80.7% |

|

Japan |

Nikkei | -0.8% | 33.8% | 29.2% |

88.7% |

|

UK |

FTSE |

-0.7% | 9.4% | 16.3% | 47.6% |

|

USA |

Dow Jones |

2.2% |

12.1% |

7.4% | 58.7% |

|

Average |

0.0% | 11.3% | 14.7% | 61.1% |

Japan has been very volatile, driven mainly by shifting expectations about central bank policy tightening.

The US market continued its growth, based on the opposite scenario of falling interest rates.

Direction for Local Interest Rates?

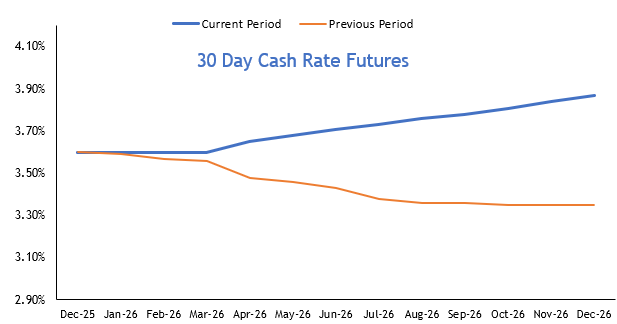

There was a massive change regarding future rate trends, with the market reversing expectations of rate cuts - in fact, taking them the other way.

As a result, the ASX Cash Rate graph spikes up, especially when compared to the previous period.

As a result, government bonds sold off sharply after the higher inflation result - sending the 2 & 3-year yield up over the month.

Interest Rates Worldwide

The story of central banks worldwide remains tilted toward easing, though all eyes will be on a number of announcements this month. This is the harder part of the cycle right here - as some economies "have done all they can" with monetary policy.

New Zealand's central bank cut its Official Cash Rate by 25 pts to 2.25% in November at its final meeting of the year, a widely expected move that brought borrowing costs to their lowest level since mid-2022. The decision reflected significant spare capacity in the economy and easing inflation pressures.

The U.S. Federal Reserve meet this week. Markets are pricing in a further 25 basis point cut in December, though a cut is not guaranteed, with some concern around how quickly things can ease while inflation is still above the 2% goal.

In the UK, The Bank of England is at 4.0%. Markets have all but priced in interest rates falling to 3.75% at the Bank’s next meeting in December after some data showing a continued decline in inflation levels. Inflation at over 3.5% is still above target.

The Bank of Canada sits at 2.25%, and it is likely to hold when it meets this week. Their inflation is easing, and the economy is showing signs of growing, so most experts predict there will be no further easing in this cycle.

Central Bank Cash Rates

Before posting any changes today, we compare central bank cash rates and their longer-term 10-year bond yields.

Relative symmetry across world rates, with nearly every long-term rate falling. Canada, US, NZ also posted reductions to their cash rates. This kept the combined spread at 56 basis points - with China as an outlier now.

Japan is a big story this month, with its 2-year rate above 1% for the first time in 17 years, and the 10-year yield at its highest level since 2008.

The falling yields on the long-term rates generally make it a little easier to make downward adjustments.

|

Country |

Cash Rate | 10 Year | Spread |

|

Australia

|

3.60% | 4.69% | 1.09% |

|

Canada

|

2.25% | 3.42% | 1.17% |

|

China

|

3.00% | 1.86% | -1.14% |

| Germany | 2.15% | 2.80% | 0.65% |

| India | 5.25% | 6.50% | 1.25% |

| Japan | 0.50% | 1.95% | 1.35% |

| New Zealand | 2.25% | 4.48% | 2.23% |

| UK | 4.00% | 4.48% | 0.48% |

| USA | 4.00% | 4.14% | 0.14% |

| Average | 3.00% | 3.81% | 0.81% |

Local Money Markets

Australia’s Money Market had a busy month. Our 2,3,5, and 10-year money rose sharply, nearly 40 basis points, on the back of expectations of rate increases, not cuts.

The rise shows that the yield curve is now normal.

Residential Property Performance

The latest monthly residential property results from Cotality (see table below) rose by 1.0% in November. Just when you thought Perth, Adelaide & Brisbane could not go any higher - the boom continues. The pace of growth is only easing slightly as the Sydney and Melbourne markets lag the mid-sized capital cities and reverse their pace from the previous months.

| Location | Month | Quarter | Annual |

|

Adelaide

|

1.9% |

4.4% |

8.2% |

|

Brisbane

|

1.9% |

5.5% |

12.8% |

|

Melbourne

|

0.3% |

1.6% |

4.2% |

|

Sydney

|

0.5% |

1.8% |

5.1% |

|

Perth

|

2.4% |

7.4% |

13.1% |

|

All Capitals

|

1.0% |

3.1% |

7.1% |

|

All Regionals

|

1.1% |

3.1% |

8.6% |

Property Trends

Supply levels are still a major factor, as we all know. The new APRA restrictions on borrowing are not expected to be a material factor in dampening demand.

Lastly, residential property values hit a new high of $12 trillion.

- Commercial & Industrial

The trends remain the same. Prices in capital cities have been broadly stabilising with small gains in prime industrial and higher-grade CBD office. Retail remains divergent.

Business Conditions

Business conditions across Australia remain mixed and are still tough for small businesses. Sentiment has improved over the past quarter, sitting slightly above their long‑run average on major surveys. Both sentiment and financial outcomes have strengthened in most industries and states.

The ATO is tightening up on collections, and so far, business lending arrears remain relatively contained.

Currency Wrap-Up

The Australian dollar was stronger against all economies! Black ink all around to finish the year. Our higher cash rate is now certainly the main factor.

Helping our dollar was the USD expectations around potential US rate cuts, combined with reduced expectations of near‑term RBA cuts in Australia.

Japan is a watch. The yen has remained weak and volatile, with a slight further depreciation over the past month. Market focus is on a likely move away from the "carry" of borrowing in Japan's low interest rates. Higher rates are normally good for currency, but Japan's economy is not normal.

| Country | Type | $1 AUD Buys | Period Change | Year Change |

| Canada | Dollar | 0.92 | 0.1% | 1.3% |

| China | Yuan | 4.69 | 0.8% | 0.5% |

| Eurozone | Euro | 0.57 | 0.5% | -6.8% |

| Japan | Yen | 103.2 | 2.4% | 6.4% |

| NZ | Dollar | 1.15 | 0.9% | 4.6% |

| UK | Dollar | 0.50 | 0.1% | -1.6% |

| US | Dollar | 0.66 | 1.5% | 3.2% |

See you again in 2026!

This is our last Economy & Property Insights post for 2025. We hope you enjoyed the read. Wishing you and your families a great finish to the year.

2026 looks like being an interesting ride. We will be back in February with more Economy & Property News.

Follow us on Linked in for more insights.