Better Working Capital Management for SMEs

Working capital (WC) is known as the lifeblood of a business. So much so that poor working capital management has caused many businesses to stagnate or fail completely, despite having solid business models. An understanding of WC is essential for all business owners.

Key Components of Working Capital

A technical definition of working capital is the amount of capital used by a business in its day-to-day operations, calculated as Current Assets less Current Liabilities. The key components are:

-

Accounts Receivable (Debtors)

-

Inventory (Stock)

-

Accounts Payable (Credit)

How to Review Your Working Capital

Firstly, no amount of efficient WC can be a substitute for a good business model and sufficient Gross Margins. Your business model and profitability tracking are the foundation of your Profit & Loss.

However, working capital management has a greater impact on your Cash position, as a liquidity indicator. Liquidity is a measure of your business's ability to pay all its bills, including loan repayments.

It is important to assess the performance of all key WC classes such as cash on hand, debtors, inventory and creditors. These measures will reveal the overall operational efficiency (or lack of it) of most businesses.

WCM Co - A Client Case Study

Let’s use an case study of a wholesale business, which we will call 'WCM Co'. WCM Co is a growing business, as reflected in increased sales and inventory purchases.

A review of both historical, current and projected performance over three years shows the following working capital position for WCM Co:

|

WC Item |

FY23 |

FY24 |

FY25 |

|

Cash |

$87,369 |

$40,500 |

$17,600 |

|

Debtors |

$284,385 |

$375,943 |

$487,369 |

|

Inventory |

$72,745 |

$118,720 |

$197,225 |

|

Creditors |

$188,366 |

$228,350 |

$347,525 |

|

NET WC |

$168,764 |

$266,313 |

$337,069 |

WCM Co had pursued a growth path, acquired more customers, grown revenue substantially and profits marginally. However, after two years (FY25), the business was short of cash. Accounts Payable terms were also beginning to stretch out (Creditors), and the business was constantly managing supplier requests for payment.

Growing Pains

Typically, businesses that are growing like this reach out for more capital contributions or debt. This is an example of where short-term funders have flourished, often causing more problems than they solve. However, WCM Co, paused to review its progress and make changes to avoid taking on inappropriate debt.

Measuring your Working Capital Cycle

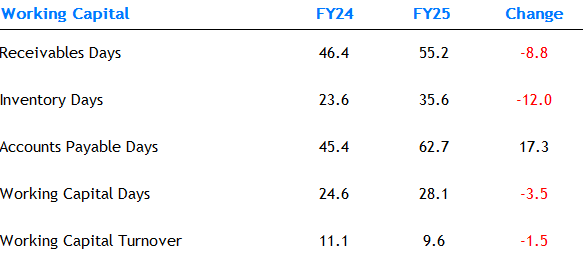

Since Net Working Capital had grown from year to year, the data was examined further, as shown below:

Source: Humbletech Commercial - www.humbletech.com.au

The Review determined that:

-

Accounts Receivable Days had adversely increased by 9 days

-

Inventory Days had adversely increased by 12 days

-

Accounts Payable had pushed out by over 17 days

-

Working Capital Days (Defined as Debtor Days + Inventory Days - Accounts Payable Days) and Working Capital Turnover (Defined as Revenue / Total WC) had also deteriorated.

WCM Co identified that it could make operational changes to improve its working capital management, rather than borrowing to manage working capital gaps.

Working Capital Remediation Strategies

WCM Co committed to implementing the following strategies:

-

Refocused on its customer collections

-

Exited a customer that had 120 average payment days and a lower than average gross margin

-

Reviewed slow performing inventory lines, made write-downs and decided to exit smaller selling products

-

Renegotiated some supplier terms and committed to meeting payments on time

-

Reviewed and updated its sales discounting policy to improve gross margins

Naturally, these actions caused some short-term pain, including no distribution of profits. However, within six months, the business was much stronger.

The WCM Co case study is a timely reminder that a fundamental key to success is to combine good Working Capital Management with a sound business model and a sustained gross margin.

Contact MCP

1300 510 816 or your Finance Partner

enquiry@mcpfinancial.com.au

Follow us on LinkedIn

The team at MCP Financial Services has specialised expertise in structuring complex debt arrangements. We can assist with review and restructuring, refinancing and renegotiating.