Credit is a critical element of a functioning economy. Whether you are a borrower, finance broker or even a banker dealing with credit approvals, the approach to communicating your story is vital.

Overview

Success in getting the support of “the credit department” is more than just the four or five 'C’s of Credit'.

To be clear, no amount of presentation or sophistication will mitigate a lack of acceptable 'C’s'; however, a credit submission that guides the reader to the key risks and mitigate will ultimately provide the best chance of success.

So, how should applications for business credit be structured?

Solving the “Jigsaw Puzzle”

In the words of a certain senior credit manager - each submission is like a jigsaw puzzle. Often the pieces are all there, but aren't well coordinated, explained, or coherent.

Format

Firstly, there is no set criteria for how long or detailed your submission should be. Submissions should not be a “badge of honour”, nor should they look like a dog’s breakfast.

The key objective is to put yourself in the shoes of the recipient of the submission. Readability is paramount. Communicate the important messages succinctly; bullet points and shorter sentences generally work well for the typical reader.

The supporting detail should be readily accessible, appropriately summarised and relevant to the key points you are communicating.

Understanding the Business & Industry

A critical starting point is to provide a thorough understanding of your customer. The history, the owners' journey, the customers, suppliers, experience, key staff and of course existing banking relationships. This story will be unique to every customer.

From there, look at the industry in which business operates.

What are the inherent risks? How are they relevant to your customer? Barriers to Entry? Where is the business in terms of its own cycle?

Identify these upfront, and explain succinctly the extent which they apply and how they will be mitigated by your customer.

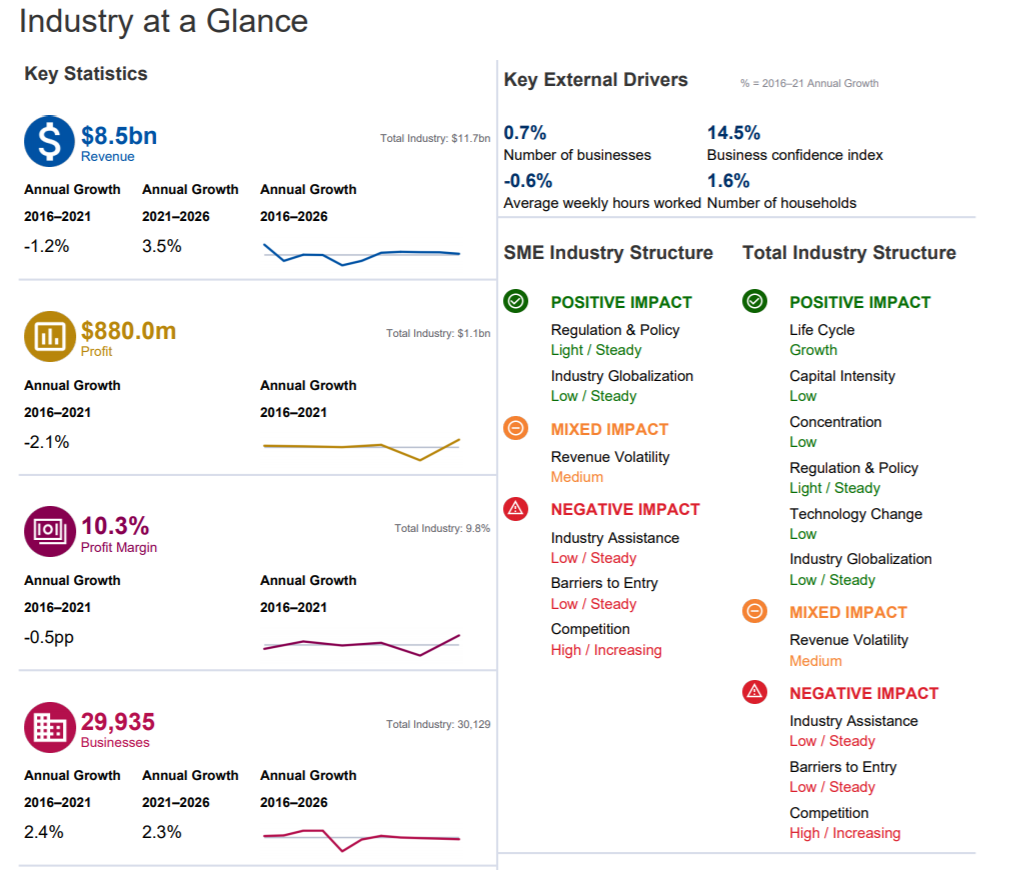

For example, let's say you operate in the Commercial Cleaning Industry. Industry data tools like IBIS World can help build a profile of your industry as per the example below, extracting data on commercial cleaning.

The credit overview should deal with how your business compares with its industry. Put yourself in the eyes of the reader here, and take our cleaning example:

How do you ensure sustainability in an industry where there are typical low barriers to entry and a lot of competition? The trend is for low growth, how will the business be different? How does it relate to forecast results?

The Numbers

The historical financial performance is naturally very important, though last completed financial statements may be many months old. Credit will be more interested in the now and the future. What is happening now and how does it impact performance?

Remember the old saying...Revenue is Vanity, Profit is sanity but Cashflow is reality. Make sure you address the cash position and how it relates to the financial statements.

Working capital, including the profile of customers and suppliers is a critical part of understanding the business. It may not always be the most relevant component, but a good advisor will have great depth here to show a review of the business has been completed.

Lastly, understand and communicate the quality of Management Information Systems (MIS), in a SME this can be very inconsistent in both structure and application.

Capacity is king, Capital is Comfort

The “first way out” for financiers is the cash flow from the assets they are lending against. Demonstrate clearly why you or your customer can do that.

The ability to show this Capacity can be complex. Financiers adopt different approaches and they may not be transparent in how they assess this. Though, as a general rule, you should show capacity to service debt on both a profit and cash flow basis. (See our previous blog on Profit v Cashflow) for more background here.

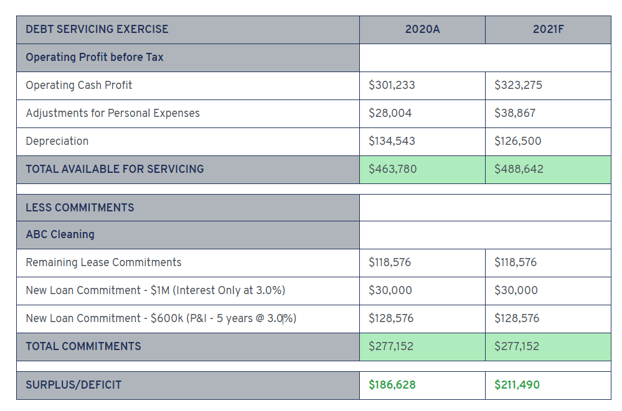

This is relevant to our Commercial Cleaning customer, where the cash commitment on "Leases" for example, has a different profile to the expense in the Profit & Loss.

In our example, there is a reasonable operating surplus which includes the new credit being sought.

Capital or “second way out” is a comfort. Financiers want borrowers to solve their own problems in times of any distress, and a strong net asset position outside a business is a great mitigatory.

Finally, after this is all done, The ultimate test is whether or not you would provide the funding based on your knowledge of the customer.

For more information, newsletters and financial literacy updates see:

E - enquiry@mcpgroup.com.au

W - mcpfinancial.com.au