What is the Homebuyer Fund?

The State Government recently announced the $500m Homebuyer Fund. The scheme will provide as many as 3,000 purchasers with a contribution toward the purchase of a residential property.

The Fund has been introduced in response to affordability issues for Home Buyers. In 2021, the average house now sells for $954,000 (Apartments $616,000) and home ownership has deteriorated from 76% to 69%.

Therefore, the objective is to assist purchasers without a meaningful deposit to own residential property.

The catch – the Homebuyer Fund is a shared equity scheme. This means that the State’s financial contribution towards the property will be made in exchange for a proportional interest in the asset.

Is it worth it to sacrifice potential capital gains? How do it compare with the FHLDS?

The Facts

The State Government will contribute up to 25% of the purchase price of the property. For Indigenous and Torres Strait Islander homebuyers, this contribution is up to 35%. Along with the 5% deposit contributed by the homeowner (or 3.5% for Indigenous and Torres Strait Islander homebuyers), this will mean that the mortgage will be against 70% (or 61.5%) of the total purchase price.

Reducing the Loan-to-Value Ratio (‘LVR’) of the mortgage will also mean that the cost of the mortgage is more affordable, and purchasers can avoid the expensive Lender’s Mortgage Insurance (‘LMI’) premiums.

In exchange, the State will own the portion of the property it has paid for. Further, as the value of the property changes, so too will the value of their interest.

This stipulation also comes with annual reviews, limitations on what can be done to the property after it is purchased, and how the purchaser of the property can go about discharging their obligation to the Fund.

Lenders currently accepting this composition of funds are Bank Australia and Bendigo Bank.

Eligibility Requirements

To be eligible for the Homebuyer Fund you need to:

-

Be at least 18 years old, and be an Australian citizen or permanent resident;

-

Earn an income of $125k or less for individuals, or $200k for a joint income application;

-

Have saved the minimum required deposit of your property price;

-

Have no other interest in land at the time of purchase – however, you do not have to be a first home buyer;

-

Be a natural person;

-

Not be a trustee of a trust; and

-

Not be a shareholder in a corporation (other than a public company) that owns any land.

The eligibility requirements for the property are:

-

Needs to be situated in an eligible location;

-

Purchase price be $950,000 or less in metropolitan areas, or $600,000 in eligible regional locations;

-

The property needs to be occupied as the purchaser’s principal place of residence;

-

The property must be a standard residential property – house, townhouse, unit or apartment;

-

Vacant land or ‘off-the-plan’ property purchases are not eligible; and

-

The property cannot be purchased from a vendor who is a related person.

Eligibility for the Homebuyer fund does not preclude a purchaser from claiming other Government assistance, such as the First Home Loan Deposit Scheme, or stamp duty concessions for certain property.

Ongoing Obligations

Once the property is purchased, the purchaser is subject to a myriad of ongoing commitments to the State Government. One, to retain their eligibility for the Homebuyer Fund, and secondly, to reassure the Government that their interest in the asset is being maintained responsibly.

Annual Review – Providing documents to ensure ongoing eligibility for the Homebuyer Fund such as payslips and tax returns. Applicants are also expected to notify the State Revenue Office within 10 days if the circumstances of their income/expenses change.

Building Insurance – Applicants will be required to submit a certificate of currency of insurance each annual review period.

Maintaining the Property – Any renovations beyond $10 000 need to be approved. Applicants will also need to seek approval to refinance the property, sell the property, or make voluntary payments that result in early exit (within two years of purchase) of the Fund.

Repayments – Applicants are required to make payments for council rates, utilities, body corporate fees, stamp duty and home loan repayments on time.

Repaying the Homebuyer Fund

You will be required to make repayments on your loan when:

-

Your annual income exceeds the applicable threshold for two consecutive reviews;

-

You receive a windfall gain of more than $10,000; and

-

You are approved by your lender to increase your home loan.

Alternatively, you are able to make voluntary repayments under certain circumstances. For example, refinancing the mortgage, using existing savings, or using the proceeds from when the property is sold.

FHLDS v Homebuyer Fund

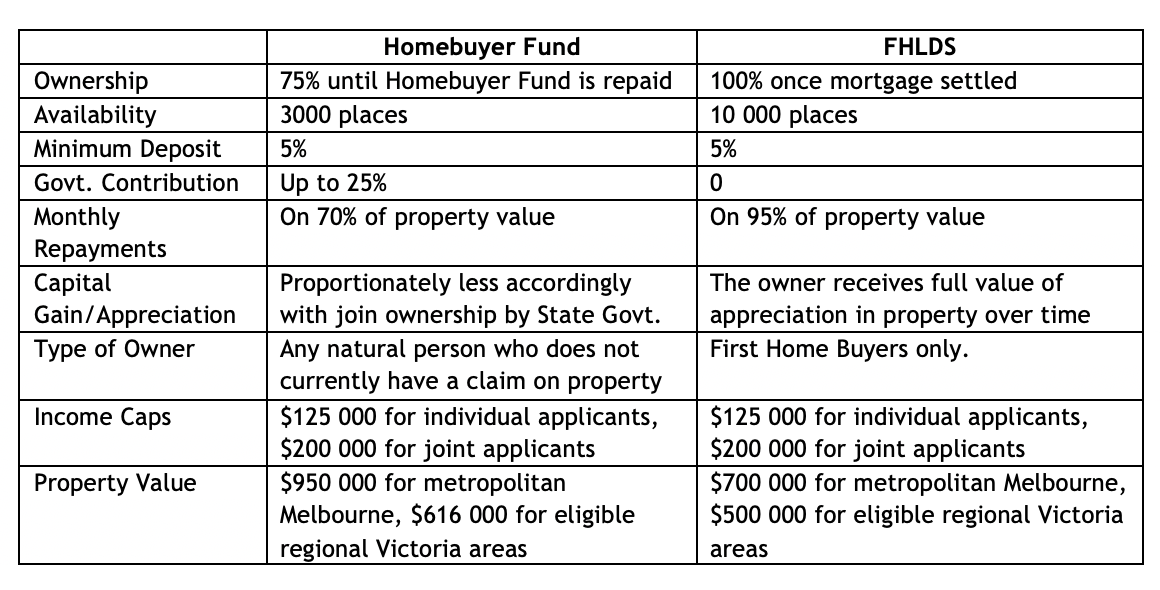

With these stipulations in mind, it is important to consider what is the best use of your current and future investment. The existing First Home Loan Deposit Scheme (‘FHLDS’) has historically provided viable options in terms of purchasing property – at the end of the day, an applicant must consider their individual circumstances. A comparison is below:

The FHLDS permits a prospective purchaser to purchase with a much smaller deposit of 5%, and the Government then covers the LMI. Whilst this means a mortgage is taken out against 95% of the property, thereby increasing monthly loan repayment obligations, the ownership of property is total. When the property is sold, any capital gain is greater.

Furthermore, FHLDS is only available to properties purchased for a value of $700k or less in metropolitan Melbourne, and $500k or less in regional Victoria.

This option is stable and rewarding for those homeowners who are confident in the stability of their income, and in their capacity to meet the ongoing obligations associated with their mortgage.

On the other hand, the Homebuyer Fund permits much smaller monthly repayments, as the mortgage is taken out against 70% of the purchase price, as opposed to 95%. The cost of borrowing is likely to be less substantial with a lower LVR.

The Homebuyer fund has higher caps for eligible property.

This option may be preferable to enter the market quickly, and are comfortable in temporarily foregoing a capital gain for the benefit of purchasing property quicker.

Drawbacks

Under this policy, the State Government is set to own part of up to 3,000 homes. As the Fund is repaid, monies will remain in the Fund, deeming it self-sustaining. Furthermore, the instrument is not expected to exacerbate any deficit on the current State budget, due to injections into the economy post property purchase.

Nonetheless, the initiative has been criticised as contributing to the housing affordability crisis, as increased demand will further inflate property prices. As the Fund will only be available to 3,000 home loans however, the extent of this is questionable.

The actions of the Government have also been scrutinised as ‘giving with one hand and taking away with the other’(David Davis, Shadow Treasurer for Victoria). This comes as the State Government have frugally increased premium land tax, stamp duty and windfall tax gains over the last year. Furthermore, the Fund is available to moderate- to high- income earners, potentially exacerbating the inequity in ownership across income brackets.

Summary

Purchasing a home is a big deal – what may appear as Government assistance may later come to look like an enduring obligation down the track.

The matter comes down to the type of obligation you are comfortable with owing, the trajectory of your income and expenses, and what lets you rest in your home at night.

For more information contact:

MCP Finance Team

W - www.mcpfinancial.com.au

P - (03) 9620 2001