March 2024: Rate Decision & Economy

The Reserve Bank of Australia (RBA) held its second meeting of 2024, leaving the official cash rate at 4.35%.

Despite a bullish sharemarket, the movement and volatility in other economic indicators such as bond yields and exchange rates were as stable as we have seen in a long time. In my view this is a cautious case for celebration.

A "new normal" gives businesses and consumers a chance to adjust and make longer term decisions. Business sectors have responded that they have the optimism to make larger capital expenditure for example.

Economic growth is still sluggish with the latest data showing only a 1.5% year on year result. Australia's inflation rate was at an annualised 4.1%, down from 5.4% for the comparable annual period and below market expectations of 4.3%. This was the lowest figure since 2021.

Business confidence remains above the consumer; the ANZ-Roy Morgan Consumer Confidence was up 1.2 points to 82.2 this week. However the index has now spent a year below the benchmark neutral score of 85.

A Tough Rental Market

Housing is a big contributor to the inflation data. "Rent inflation" was at 7.8% last year as highlighted by Australian Bureau of Statistics data. Therefore, rent’s proportion of CPI growth has and will remain material.

The rate of rent increases is expected to remain high in an under-supplied housing market, exacerbated further by an increasing new arrivals to Australia seeking accommodation. Overall, the situation is a real challenge for policy makers.

RBA Stance Remains Vigilant

With a pause at February's meeting, the RBA commentary is holding the line on inflation and remains committed to getting inflation back to its target range. To quote:

"While there are encouraging signs, the economic outlook is uncertain and the Board remains highly attentive to inflation risks."

Shares & Markets - February to March

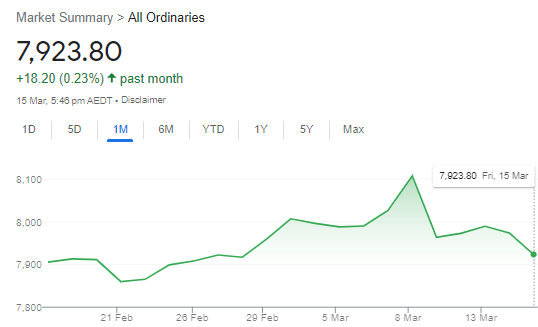

The market to March showed a small rise in the All Ordinaries, with much action in between.

Quite a yo-yo ride for Equity markets of late, touching record highs during March but then falling again due to ongoing sensitivity to inflation data and interest rate sentiments.

In 2023, Australian markets were up over 12% for the year, though most of that came in the last quarter. This result was still well below other global markets, with major indices growing at over 20% over the course of last year.

It has been quite a ride in sentiment for both equity markets and the economy generally. In reality, this is further evidence that with so much data available to us, perhaps there is a disconnect between sentiment and what is actually happening out there.

Direction for Local Interest Rates?

Bond yields have settled this month. The market is saying it overshot the view earlier in the year about sudden falls in interest rates.

Overseas, equity and bond markets have priced big falls in rates this year. Though both the US & UK 10-year yield increased, a small sign of this expectation being watered down.

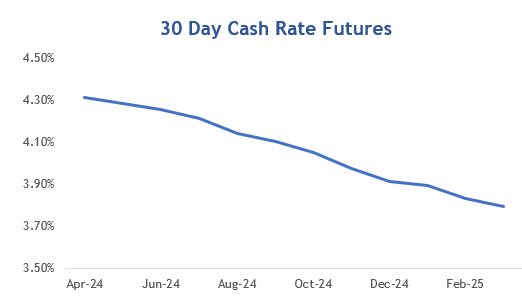

A downhill graph continues, but a correction of 10-20 basis points up with a rise this month in the ASX Cash Rate Futures, moderating the expectations for rate cuts. So a less dramatic fall as indicated by the ASX Cash Rate Futures below.

Whilst financial markets remain convinced that the cash rate has peaked, I think this period of stability is very positive. The RBA can afford to wait a little longer and to gauge what happens overseas.

Looking at Interest Rates Worldwide

Major central banks across Europe, the UK and Americas stated that the battle on inflation is unfinished. A period of stability should be a good thing for most.

New Zealand's cash rate unchanged again at 5.50%. Market pricing is set for lower rates from mid-2024 but the central bank remains focused on inflation. It has acknowledged the impact that subdued economic growth could have on the NZ economy. That might do the work for them.

The U.S. also remains at 5.50% with no change expected at their next meeting. Their message around monetary policy is consistent. Chairman Powell said the Fed was on a “good path” to achieve a soft economic landing. The ideal scenario is that inflation subsides while the economy grows and the unemployment rate remains low. Economic utopia. He is otherwise telling markets to be patient and stop second guessing.

In the UK, the Bank of England kept rates on hold at 5.25% for the fourth consecutive meeting. Annual inflation fell to 4% and bond markets are still pricing in cuts by end 2024. The central bank is strong that rates needed to stay high for inflation to return to 2% sustainability. An adjustment in long term rates sees their yield curve becoming less inverted.

Canada remains at 5.00%. Their central bank says it is too early to consider lowering interest rates as more time is needed to bring inflation toward the 2% target. Canada is a fascinating watch - like NZ they focus on local numbers, but their yield curve can't stay like this for ever.

Central Bank Cash Rates

Before posting any changes today we compare central bank cash rates and their longer term 10-year bond yields.

The majority of major economies have an inverted yield curve. This is defined as an interest rate environment in which long-term bonds have a lower yield than short-term ones.

|

Country |

Cash Rate | 10 Year Bond | Spread |

|

Australia

|

4.35% | 4.02% | -0.33% |

|

Canada

|

5.00% | 3.58% | -1.42% |

|

China

|

3.45% | 2.34% | -1.11% |

| Germany | 4.50% | 2.43% | -2.07% |

| India | 6.50% | 7.06% | 0.56% |

| Japan | -0.10% | 0.77% | 0.87% |

| New Zealand | 5.50% | 4.75% | -0.75% |

| Singapore | 3.49% | 3.11% | -0.38% |

| United Kingdom | 5.25% | 4.09% | -1.16% |

| United States | 5.50% | 4.30% | -1.20% |

Yield curves remain inverted, but there are signs of a settling market. Cash rates are showing a period of stability, allowing the long term 10-year money to settle in and find its place.

Long term rates in the US, UK, and Canada are good watches.

Local Money Markets - a 12 month Lens

Looking at the data over a longer period - Australian money markets are showing relative signs of stability.

| Month | Cash Rate | 180 Day | 10 Year |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

|

May 23

|

3.85% |

3.82% |

3.34% |

|

Jun 23

|

4.10% |

4.21% |

3.65% |

|

Jul 23

|

4.10% |

4.67% |

4.03% |

|

Aug 23

|

4.10% |

4.70% |

4.06% |

|

Sep 23

|

4.10% |

4.37% |

4.02% |

|

Oct 23

|

4.10% |

4.41% |

4.48% |

|

Nov 23

|

4.35% |

4.73% |

4.72% |

|

Dec 23

|

4.35% |

4.58% |

4.49% |

|

Feb 24

|

4.35% |

4.43% |

4.02% |

|

Mar 24

|

4.35% |

4.49% |

4.02% |

The market for 180-days was about as steady as it has been for a long time. That is a big statement after a long period of volatility. All the action is at the 10-years which is back where it started with sharp ups and downs in between.

Residential Property Performance

The latest residential monthly property results from CoreLogic (see table below) showed a 0.6% increase during February.

| Location | Month | Quarter | Annual |

|

Adelaide

|

1.1% |

3.6% |

11.8% |

|

Brisbane

|

0.9% |

2.9% |

15.6% |

|

Hobart

|

-0.3% |

-1.4% |

-0.6% |

|

Melbourne

|

0.1% |

-0.6% |

4.0% |

|

Sydney

|

0.5% |

0.6% |

10.6% |

|

Perth

|

1.8% |

5.2% |

18.3% |

|

All Capitals

|

0.6% |

1.2% |

10.0% |

|

All Regionals

|

0.6% |

1.3% |

5.5% |

The run in Perth, Adelaide and Brisbane values continued their rise to new record levels each month. No clear indicators on when that might settle down.

Despite higher interest rates, the shortfall of housing relative to demand means there is upward pressure on home values across most regions.

Commercial Property Trends

We are seeing structural changes, particularly in the office market. Vacancies remain uplifted, but there is a flight to quality and those properties with adverse locations or amenities are really struggling. There is a divergence in the performance in these segments and gives relevance for assessing the health of the commercial property market moving forward. At the lower end, the market is still an opportunistic one for owner occupiers and they are winning over investors at present.

That said the office sector had very low transaction activity last year, and the consensus on fair value between buyers and vendors remains wide. Can vendors continue to wait it out?

Currency Wrap-Up

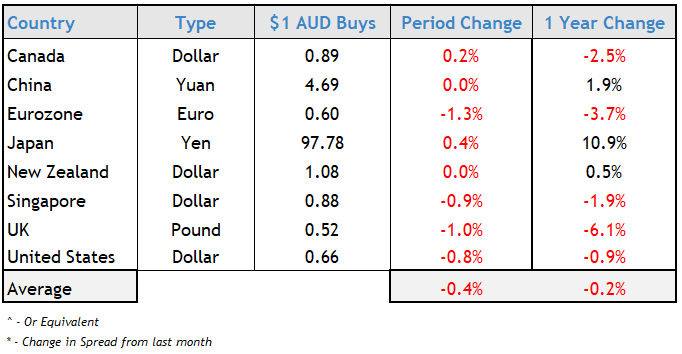

Like interest rates, it was a remarkable period of stability for the Australian dollar. Our year-long trend has now fully absorbed the AUD's past softness.

Many people see an upside in the Australian dollar going forward. We remain in a comparably favourable position on interest rates, so if the US & Europe rates fall quickly, the uplift could come sooner than expected.

2024 RBA Policy Announcements

A reminder that the schedule of RBA meetings has changed from 11 in a year to 8, held 5-7 weeks apart. Monetary Policy Announcements will be made at 2.30pm on the following days:

• 7 May

• 18 June

• 6 August

• 24 September

• 5 November

• 10 December

We hope you enjoyed our Economy & Property post. Follow us on Linked in for more insights.

.png)