February 2024: Rate Decision & Economy

The Reserve Bank of Australia (RBA) held its first meeting of 2024, leaving the official cash rate at 4.35%. (Please see new 2024 schedule for RBA Meetings at end).

First, what is ahead in 2024?

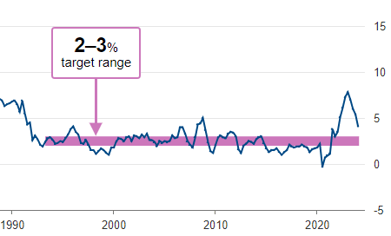

Largely, what's ahead feels uncertain, though it seems likely that economic growth will slow. So far, the highlight here is the CPI indicator, which rose (only) 0.6% in the December quarter, the smallest increase since March 2021. The annual rise of 4.1% was mildly below market expectations. The unemployment rate, despite some soft results to finish 2023, held steady at 3.9%. Retail data is soft.

The market hyped the drop in inflation here, though data is mixed.

Another upside is the U.S. economy which is performing much better than expected, with even The International Monetary Fund upgrading its forecast for global economic growth led by the resilience of their economy.

Outlook for 2024

The bottom line - conditions are still very unpredictable and we shouldn't be trusting markets completely to provide a guide.

Anecdotally at our end, business owners across many diverse industries are cautiously optimistic, recognising that macroeconomic trends are beyond their control. Many seem to realise they will need to maintain or accelerate change and/or innovation in 2024.

No doubt these businesses will need to plan for a continued low-growth environment with no quick return to low interest rates foreseeable in the near term. This could be offset with efficiencies (e.g. leveraging artificial intelligence or similar) or scale through acquisitions or other synergies.

Of course, this all sounds good in theory, tempered with the reality that the relentless pace of technological change and innovation will be a challenge for many.

RBA Stance

With a pause at December's meeting, the RBA commentary is still holding the line on inflation and how the current settings are impacting different segments of the economy. The general sentiment is that we are getting closer.

" In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market."

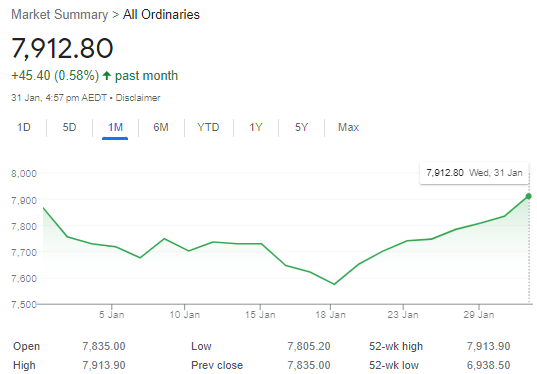

Shares & Markets

The market ended January with a rise in the All Ordinaries, following on from the strong gains at the end of 2023.

Equity markets reacted very positively to the inflation data, with interest rate sensitive stocks, including banks, being beneficiaries.

In 2023, Australian markets were up over 12% for the year, though most of that came in the last quarter. This result was still well below other global markets, with major indices growing at over 20% over the course of last year.

It has been quite a ride in sentiment for both equity markets and the economy generally. Really it is more evidence that with so much data available to us, perhaps there is a disconnect between sentiment and what is actually happening out there.

Direction for Local Interest Rates?

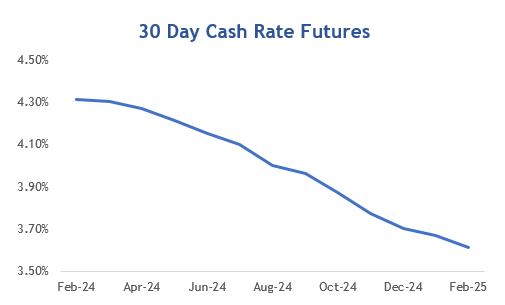

Bond yields have been steadily falling. Despite strong words from central banks world wide that inflation must be contained, markets believe that interest rates have peaked.

In the US, equity and bond markets have priced in more than 150 basis points of easing in 2024 year. The US 10-year yield fell by more than 1% in the quarter reflecting this which is dramatic.

A downhill graph with a fall this month in the ASX Cash Rate Futures seeing a massive decrease in expectations. Unchartered territory in this cycle as indicated by the ASX Cash Rate Futures below.

Financial markets are now implying that the cash rate has peaked and falls are being priced in towards middle 2024. There could be a perfect storm here for the RBA. With more focus overseas, they can adopt a wait and see approach, holding ground on interest rates while other countries start to ease off theirs. This would be a luxury and give some control on those important currency exchange settings.

Update for Interest Rates Worldwide

Major central banks across Europe, the UK and Americas haven't been shouting about plans to cut interest rates, markets have done that. For many, the battle on inflation is unfinished.

New Zealand's central bank left the cash rate unchanged again at 5.50%; market pricing is set for lower rates from mid-2024 with a cut to 5.25%. They went up quickly, so could also fall quickly.

The U.S. stays at 5.50% after their meeting last week. Their message around monetary policy remains consistent. Chairman Powell said they are waiting for the right level of comfort on inflation and jobs. Bond Markets were disappointed and seemed to ignore that message about higher for longer anyway.

In the UK, the Bank of England kept rates on hold at 5.25% this month for the third consecutive meeting. Annual inflation fell to 4% and bond markets are already pricing in big cuts by end 2024. The central bank is holding the line about the need for inflation to get back to target range (circa 2%) before there is any easing action. An inverted yield curve means banks locally are offering cheaper long-term mortgage deals.

Canada, remains at 5.00% and in perhaps a sobering message from the Bank of Canada; "the economy has stalled since the middle of 2023 and growth will likely remain close to zero through the first quarter of 2024". However, they followed up with, "persistence in underlying inflation and the Governing Council wants to see further and sustained easing in core inflation." Who will blink first?

Central Bank Cash Rates

Before posting any changes today we compare central bank cash rates and their longer term 10-year bond yields.

The majority of major economies have an inverted yield curve. This is defined as an interest rate environment in which long-term bonds have a lower yield than short-term ones.

|

Country |

Cash Rate | 10 Year Bond | Spread |

|

Australia

|

4.35% | 4.02% | -0.33% |

|

Canada

|

5.00% | 3.48% | -1.52% |

|

China

|

3.45% | 2.51% | -0.94% |

| Germany | 4.50% | 2.23% | -2.27% |

| India | 6.50% | 7.17% | 0.67% |

| Japan | -0.10% | 0.71% | 0.81% |

| New Zealand | 5.50% | 4.72% | -0.78% |

| Singapore | 3.55% | 2.97% | -0.58% |

| United Kingdom | 5.25% | 3.92% | -1.33% |

| United States | 5.50% | 4.08% | -1.42% |

Some yield curves are very inverted, so we have the scenario where the UK long-term rates are lower than Australia, despite their higher cash rate. This indicates that markets expect change and quickly.

Local Money Markets

Looking at the data over a longer period - Australian money markets continued the trend of late 2023.

| Month | Cash Rate | 180 Day | 10 Year |

|

Mar 23

|

3.60% |

3.94% |

3.85% |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

|

May 23

|

3.85% |

3.82% |

3.34% |

|

Jun 23

|

4.10% |

4.21% |

3.65% |

|

Jul 23

|

4.10% |

4.67% |

4.03% |

|

Aug 23

|

4.10% |

4.70% |

4.06% |

|

Sep 23

|

4.10% |

4.37% |

4.02% |

|

Oct 23

|

4.10% |

4.41% |

4.48% |

|

Nov 23

|

4.35% |

4.73% |

4.72% |

|

Dec 23

|

4.35% |

4.58% |

4.49% |

|

Feb 24

|

4.35% |

4.43% |

4.02% |

Who would wan to be a bond trader right now? The market for 180 days and 10 years is back where it was in September 2023, just with a yo-yo in between. For holders of debt, if these prices sustain, then banks will rollout fixed interest rate offers well below the current floating rates.

Residential Property

The latest residential monthly property results from CoreLogic (see table below) showed a 0.4% increase during January.

| Location | Month | Quarter | Annual |

|

Adelaide

|

1.1% |

3.7% |

10.3% |

|

Brisbane

|

1.0% |

3.2% |

14.8% |

|

Hobart

|

-0.7% |

-1.5% |

-0.4% |

|

Melbourne

|

-0.1% |

-0.9% |

3.9% |

|

Sydney

|

0.2% |

0.1% |

11.4% |

|

Perth

|

1.6% |

4.9% |

16.7% |

|

All Capitals

|

0.4% |

1.0% |

10.0% |

|

All Regionals

|

0.4% |

1.2% |

4.9% |

Melbourne and Hobart recorded a subtle decline over the month, while Sydney held up. Perth, Adelaide and Brisbane values continued their rise to new record levels.

The RBA will be wary of accelerating property prices with strong monetary policy action.

Commercial Property

The office market (especially at the larger end) remains the biggest issue currently. Losses continue to be booked recognising the lag in these long-term assets. In the SME world, vendors are holding on tight and this is reflective of lower than expected stock levels.

Data from the Property Council of Australia showed office vacancy rates have climbed to 14.8% nationally. This is around twice the average, with the main source of pain being for non-prime buildings. This is still below the US's circa 20% vacancy rate.

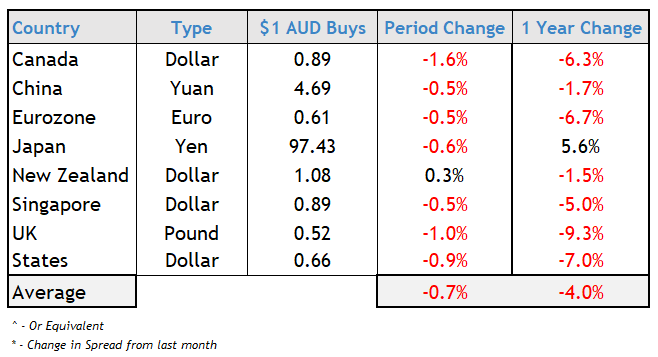

Currency

The Australian dollar went on a ride against the USD, though strengthened near the end of the month. There hasn't been a big ripple yet on the news of failed Chinese developer Evergrande, which will be broken up with debts of circa $450 Billion. Indirectly, there are fears about sustained demand for commodities.

Expect a volatile ride on currency markets this year. The Australian dollar remains sensitive to interest rates along with news from China as our biggest customer of commodities.

We hope you enjoyed our first Economy & Property post for 2024, and we wish you every success this year.

2024 RBA Policy Announcements

Please note that the schedule of RBA meetings has changed in 2024 from 11 in a year to 8, held 5-7 weeks apart. Monetary Policy Announcements will still be made at 2.30pm on the following days:

• 6 February

• 19 March

• 7 May

• 18 June

• 6 August

• 24 September

• 5 November

• 10 December

As always, we will continue to keep you informed.

.png)