April 2023: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") met today, and for the first time in a while there was no change to the official cash rate.

The market's reaction to the Silicon Valley Bank's collapse and Credit Suisse rapid sale was powerful, effectively freezing the upward momentum in interest rates around the world in the short term.

Money and Bond markets reacted wildly, as our commentary below shows.

Economic Sentiment

Mixed and divergent. Latest Inflation data shows that the annual rate fell to 6.8% last month, which was slightly below expectations.

The unemployment rate dropped slightly back to historical lows of 3.5% last month, another sign of economic stability.

So in summarising the economic landscape; headline inflation is falling but still high, the labour market holding up, and business conditions are positive. There is plenty of evidence that if there are no more economic shocks, the need for holding the course on monetary policy remains.

Conversely, the bond market thinks that the cash rate increase cycle is finished and reversing, so who will be right? What we do know is markets are hypersensitive to any data right now, so I'm staying with the fundamentals (macro-economics) to give better medium term guides.

Unpacking SVB & Credit Suisse

The collapse of Silicon Valley Bank ("SVB") came suddenly and sent turmoil into markets. Shortly after, UBS agreed to buy a fading Credit Suisse for loose change.

It would be too sweeping here to provide any meaningful analysis, and no-one really knows if this is either systematic or will drive ripples to other institutions.

In these situations, perspective is really important. Are these issues reflective of for example, lending defaults (macro impacts) or an example of poorly managed and structured institutions (contained impacts)? The new month will be crucial for confirming this and life could go back to "normal" pretty quickly if the latter is true.

Shares & Markets

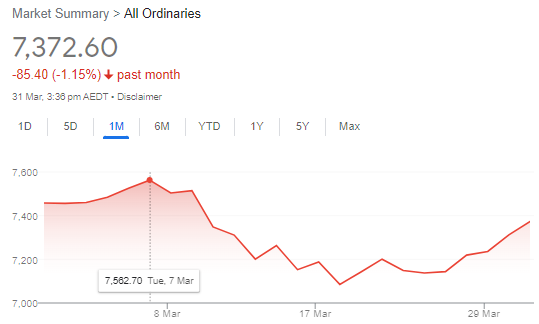

Not surprisingly, an active ride on equity markets as investors processed the rapid demise of Credit Suisse and fears of general instability of the banking industry. Though the market has absorbed the news more optimistically than expected.

While a negative month in March for the All Ordinaries, a fall of just over 1% contains a mix of different investor attitudes.

The roller coaster in Australian shares was reflective of worldwide trends, as investors seemingly ignored concerns over finance issues.

Direction for Local Interest Rates?

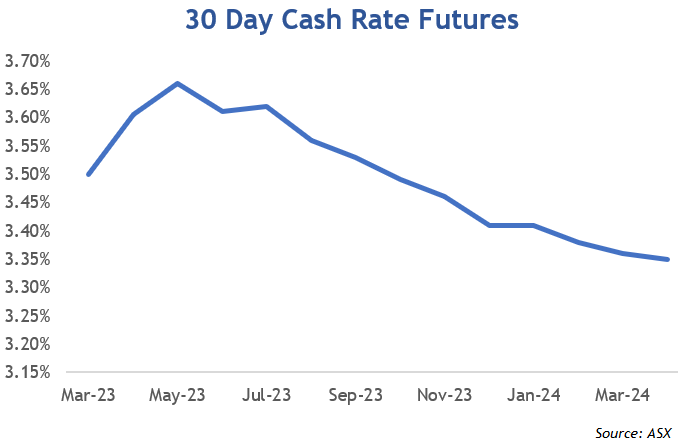

Again, some insights from the ASX Cash Rate Futures, gauging month to month expectations in terms of a destination for the peak cash rate. A sharp decrease in expectations this month, with the market now conditioned for more rate decreases earlier than expected.

This is indicated by the ASX Cash Rate Futures as below.

Financial markets are therefore implying that the cash rate will now fall materially over the coming 12 months, a wild change in sentiment.

This is the view of the market traders, though many economists don't agree and believe the war with inflation will continue to lead the monetary policy agenda.

Update for Interest Rates Worldwide

Central banks across the developed world are trying to absorb the turmoil in financial markets, while continuing to deal with inflation and their over-arching view that inflation is not coming down quickly enough.

New Zealand's central bank meets this week where a further 25 point rise is expected to 5.0%. Their focus remains firmly on taming inflation.

In the UK, the Bank of England moved with another 25 point increase to 4.25% at their March meeting. This was the 11th consecutive rise and follows very stubborn inflation data.

The U.S. yield curve is now very heavily inverted with medium and long term rates falling. The Federal Reserve still raised interest rates by 0.25% last month as it continued its inflation fight. The commentary is important - saying there is no indication that financial stress was spreading. Markets weren't listening.

In Canada, after their eighth rate hike in this cycle, their central bank held steady at 4.50%. They are confident or optimistic that inflation is starting to ease.

In the Eurozone, there is still upward, albeit slowing momentum, with policy makers stating that inflation will remain the key in the direction of future interest rate decisions, and the current data shows more tightening will be needed.

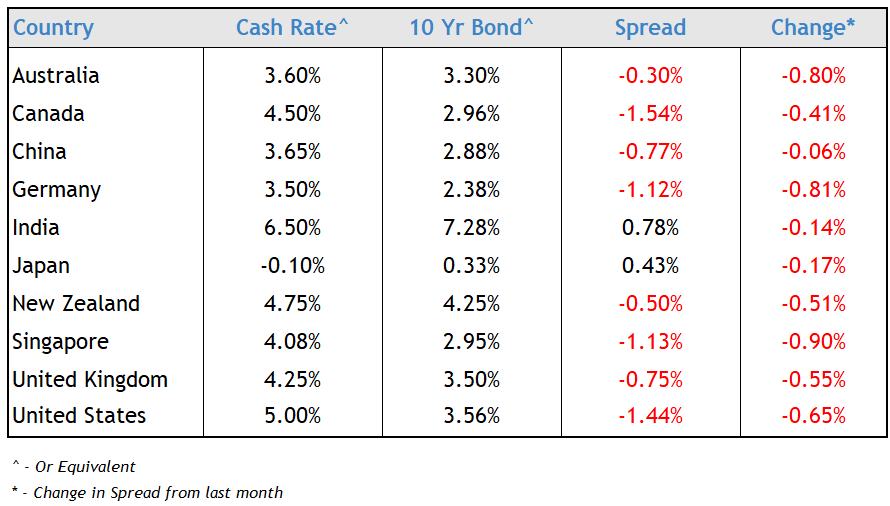

Before posting any changes today, we compare central bank cash rates and their longer term 10 year bond yields.

The change of the spread between short and long term money was significant this month. Again, with short term rates more settled, the change was driven by falling 10 year yields.

This means the market has lower rates expectations going forward and sees weak economic conditions in the future. Lots of red below, which may be either a good or bad thing, depends on your own situation.

Local Money Markets

Australian money markets were active, and yields fell across all terms.

| Month | Cash Rate | 180 Day | 10 Year |

|

May 22

|

0.35% |

1.40% |

3.12% |

|

Jun 22

|

0.85% |

1.94% |

3.48% |

|

Jul 22

|

1.35% |

2.70% |

3.54% |

|

Aug 22

|

1.85% |

2.78% |

2.96% |

|

Sep 22

|

2.35% |

3.04% |

3.65% |

|

Oct 22

|

2.60% |

3.55% |

3.90% |

|

Nov 22

|

2.85% |

3.61% |

3.74% |

|

Dec 22

|

3.10% |

3.48% |

3.48% |

|

Feb 23

|

3.35% |

3.67% |

3.50% |

|

Mar 23

|

3.60% |

3.94% |

3.85% |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

Markets are fickle, reversing its view of the severity of future interest rates from last month. The 180 day rate fell slightly in line with changing expectations about falling interest rate rises, though moved upward later in the month reversing a lot of the dip.

Yields for the 10 year rate followed markets worldwide as our yield curve is now inverted, but still more "normal" than other developed economies.

Anything could happen next, though Australia has some relative flexibility. The AUD currency position for example, means that the RBA still has room to continue to move up if they want to do so.

The focus will be on long term bonds for mine over the coming months.

Residential Property

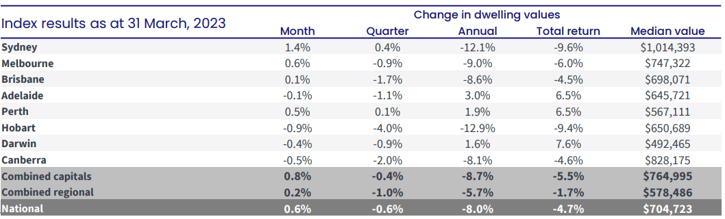

The latest residential monthly property results from CoreLogic showed home values up 0.6% in March 2023, which reversed a close to year run of consecutive falls.

There are conflicting pressures. On one hand, increasing interest rates and affordability stress is well documented. However, there is upward momentum from low supply, overseas migration and tight rental conditions.

The overall increase was led by Sydney, and the subtle swing from regionals to capitals continues.

Supply Pressures

Not a new story, but the scarcity of housing for either rent or buy is now a long term problem.

Data from the National Housing Finance and Investment Corporation predicts a shortfall of housing of over 100,000 by 2027. This is exacerbated by the expected 268,000 people that are likely to migrate to Australia between 2022 and 2024.

There is no easy solution in sight, we have noted here for a while that less than the average number of development projects have been on offer in recent years. With rising construction costs and supply pressures this creates unwanted fuel to the fire.

Currency

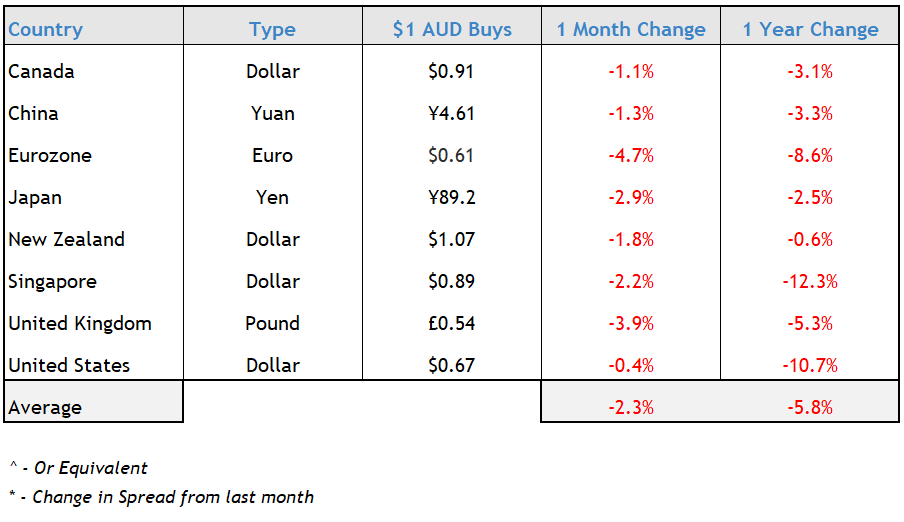

The Australian dollar remained at its lowest level this year against the USD, at US67¢. The AUD was softer than all major currencies as the table below shows.

Otherwise it was a fairly steady month.

The AUD is weak due to a number of factors. Concerns around the weakness in China’s growth prospects and our relative interest rate differential being key considerations.

We wish you a prosperous month ahead.