May 2023: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") has today announced a 0.25% increase to the official cash rate, after no change in April.

After a quiet month on markets, there was strong reaction to the news that of another failing bank in the US, First Republic Bank, which is facing receivership and sale. It has scale, with over $US200 billion worth of assets and circa 7,000 staff.

Overall, the current view of the market is very mixed.

Economic Sentiment

Latest Inflation data shows a softening of goods led by inflationary pressures, though the price of services is still a cause for concern with ongoing pressure on labour costs and other inputs.

More broadly around the world, banking collapses aside, there are signs of above expected growth in China and other markets, with the US being a lot more robust than forecast. This is despite the US yield curve remaining inverted, which is the traditional sign of looming recessionary conditions.

There is much contrary data which is tough for policy makers.

Business Confidence

The business sector is starting to see fragmented reports of confidence. There is a lot of media attention on the rise of insolvencies, so the timing of surveys such as NAB’s Quarterly SME one is timely. This showed that business conditions are “still resilient”. So while remaining negative during the quarter, they are above the long-run average.

The survey found, not surprisingly that the drag was due to inflationary pressures, rising interest rates and the broad macro outlook.

RBA Stance Remains Clear

Although there was a pause in rate rises in April, RBA Governor Dr Lowe was quick to remind everyone last month that this may not be the end.

“The Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target,” Dr Lowe said.

“In assessing when and how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.”

In these situations, perspective is really important. Are these issues reflective of for example, lending defaults (macro impacts) or an example of poorly managed and structured institutions (contained impacts)? The new month will be crucial for confirming which is it and life could go back to "normal" pretty quickly if the latter is true.

Shares & Markets

The argument around economists and bond traders we have spoken about, can also be applied to share markets.

If we look at bond yields, the share market is expensive on several measures. The bears think the market is vulnerable to a substantial correction if (when) earnings fall and investors start taking a less optimistic view to earnings.

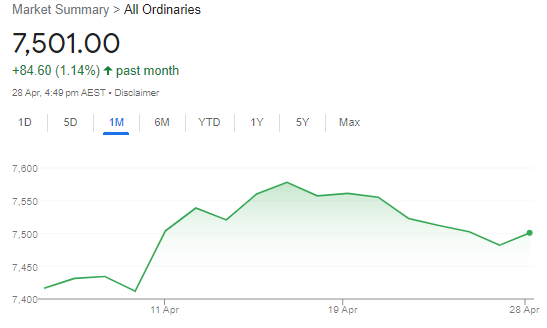

April was a roller coaster but overall a good month for the All Ordinaries and a rise of just over 1% contains a real divergence of sentiment.

Interestingly, investors seemingly ignored concerns over banking issues in the US, sensing our financial institutions are a much safer bet.

Direction for Local Interest Rates?

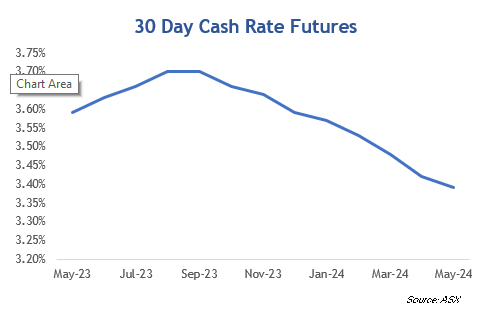

Again, some insights from the ASX Cash Rate Futures, gauging month to month expectations in terms of a destination for the peak cash rate. A small increase in expectations this month, though the market is still conditioned for more rate decreases earlier than economists expect.

This is indicated by the ASX Cash Rate Futures as below.

Financial markets continue to imply that the cash rate will now fall over the coming 12 months. So if this concept is confusing, just focus on the shape of the curve.

Again, like equity markets there is a lot to play out.

Update for Interest Rates Worldwide

The fun for Central banks continues trying to deal with inflation but not sending their economies backward either.

New Zealand's central bank kept going hard and above expectation with a further 50 point rise in their central rate to 5.25%. Their focus remains firmly on taming inflation and their stance is one of the most aggressive tightening cycles in the world. They have however softened their policy on mortgages, reversing some of their mortgage loan-to-value ratio restrictions from 2021. This acknowledges property prices had corrected.

In the UK, the Bank of England is expected to move with another 25 point increase to 4.50% at their May meeting. This will be the 12th consecutive rise though with some optimism that tightening could be coming to an end.

The U.S. yield curve is very heavily inverted with medium and long term rates falling. The Federal Reserve still raised interest rates by 0.25% last month as it continued its inflation fight. The commentary is important - saying there is no indication that financial stress was spreading. Markets weren't listening.

In Canada, after their eighth rate hike in this cycle, their central bank held steady at 4.50%. They are confident or optimistic that inflation is starting to ease.

In the Eurozone, there is still upward, albeit slowing momentum, with policy makers stating that inflation will remain the key in the direction of future interest rate decisions, and the current data shows more tightening will be needed.

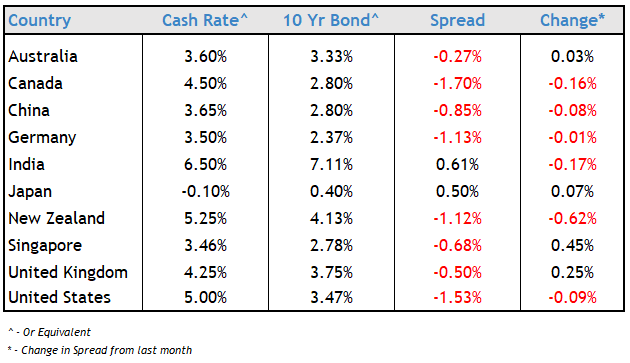

Before posting any changes today, we compare central bank cash rates and their longer term 10 year bond yields.

The change of the spread between short and long term money was significant this month. Again, with short term rates more settled, the change was driven by falling 10 year yields.

This means the market has lower rates expectations going forward and sees weak economic conditions in the future. Lots of red below, which may be either a good or bad thing, depends on your own situation.

Local Money Markets

Australian money markets were active, and yields fell across all terms.

| Month | Cash Rate | 180 Day | 10 Year |

|

Jun 22

|

0.85% |

1.94% |

3.48% |

|

Jul 22

|

1.35% |

2.70% |

3.54% |

|

Aug 22

|

1.85% |

2.78% |

2.96% |

|

Sep 22

|

2.35% |

3.04% |

3.65% |

|

Oct 22

|

2.60% |

3.55% |

3.90% |

|

Nov 22

|

2.85% |

3.61% |

3.74% |

|

Dec 22

|

3.10% |

3.48% |

3.48% |

|

Feb 23

|

3.35% |

3.67% |

3.50% |

|

Mar 23

|

3.60% |

3.94% |

3.85% |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

|

May 23

|

3.85% |

3.82% |

3.34% |

Everyone took a bit of a pause this month, and while parts of the curve went up and down over the month we pretty much ended where we started. The 180 day rate went up slightly perhaps based on hosed down expectations about falling interest rate rises.

It will be good to watch these forward rates to see if the market has overshot in its expectations of lower interest rates.

Some positive news that speaks to confidence in Australian's market and economy. The Australian Office of Financial Management ("AOFM") was asked by the Federal Government to raise $14 Billion through long term bond sales and this was heavily over subscribed. Perhaps also indicating that a return around the current cash rate is a good bet.

Residential Property

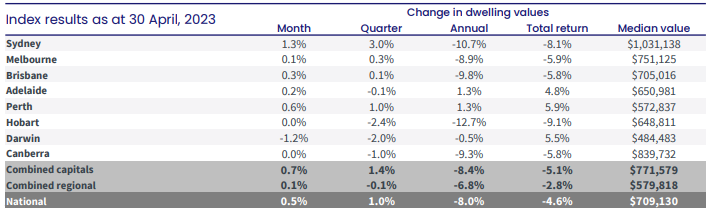

The latest residential monthly property results from CoreLogic showed home values up 0.5% nationally in April 2023, which continued last month's similar rise.

It is a very early statement, though the bond markets recent sentiments around the direction of interest rates could quickly lead to renewed interest in the property market.

The overall increase was led by Sydney and the subtle swing from regionals to capitals continues.

Build to Rent - Tax Breaks

The Federal Government is looking to deal with the scarcity of housing, specifically around boosting foreign investment in housing supply.

The strategy would involve halving the withholding rate imposed on foreign investors for built-to-rent projects to 15% and raising depreciation rates to 4% (from 2.5%) It is believed that this could create around 150,000 apartments in the build-to-rent sector over the next decade.

Currency

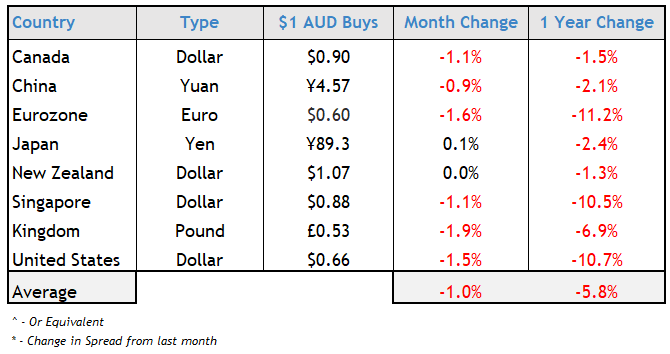

The Australian dollar remained at its lowest level for a while against the USD, at US66¢. The AUD was softer or at parity with all major currencies as the table below shows.

The long term historical trend is still a relatively weak one.

Some optimism in China’s growth prospects and a settling down in interest rate differentials may bring demand back for the AUD in the medium term.

We wish you a prosperous month ahead.