THE REGIONAL PROPERTY STORY

Within weeks of Australia’s first confirmed COVID-19 case in late January 2020, millions of Australians were told to stay at home and work remotely. Our place of work became anywhere with a reliable internet connection. As time went on, there was a growing realisation that keeping a house close to the office wasn’t going to be critical.

So the movement began, from capital cities to regional areas, with an estimated 40,000 people relocating from Sydney alone since the start of the pandemic.

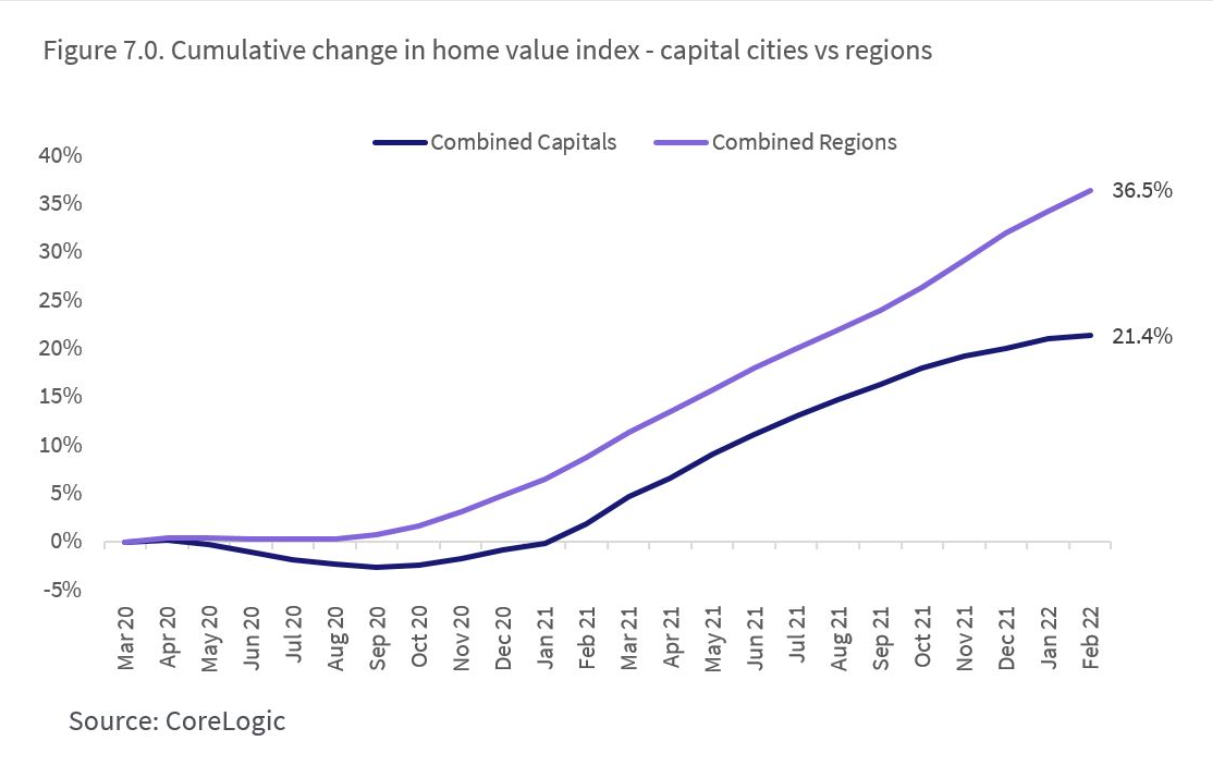

Whilst prices in major cities continued to grow, they were outstripped strongly in many key regional areas in Australia. The smaller Australian capital cities too, were indirectly part of this story, the beneficiary of Melbourne and Sydney people buying property in Adelaide and Brisbane as an example.

Overseas Migration (or lack thereof) is a significant factor too. ABS data showed that in Financial year 2021, net overseas migration created a loss of 89,000 to Australia's population. This was the lowest on record other than the period during World War 1. In a property demand sense, the movement of people moving internally in Australia, creates a separate demand factor compared with those coming in on a long term basis from overseas. The biggest gains from internal migration are usually in the Gold Coast, Sunshine Coast and coastal New South Wales for example.

Where are Regional Property Prices sitting today?

Data from Core Logic showed that between January 2021 and January 2022, regional Australia’s property values surged 26.1% overall. Amongst this, 24 of Australia’s largest non-capital city regions recorded double-digit growth in house prices, most of those well over 25%.

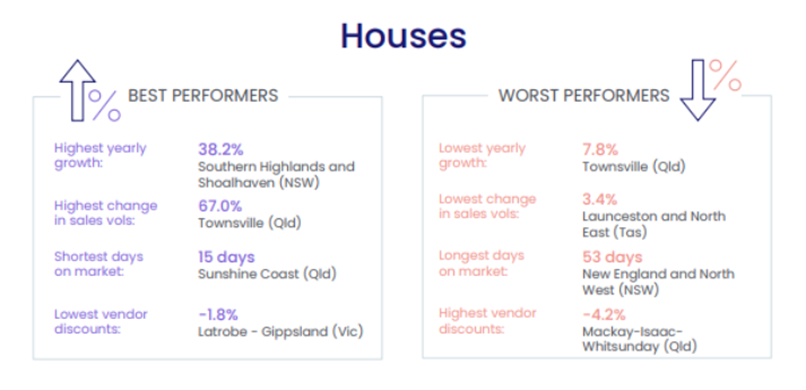

The data below showed that Southern Highlands Region (close to 40%) has the highest year on year growth. The Sunshine and Gold Coasts in Queensland were not far behind. Diving more closely into the figures, pockets of these regions (from our own data) shows annual increases of above 50% in many cases.

On Queensland’s Sunshine Coast alone, the median time of the market was just 15 days. Traditionally, regional markets had followed capital city price trends within three-to-six months, meaning prices should have started cooling in October 2021 at the latest. Another indication that the ‘rules’ are a little different this time around.

Economic factors affecting Regional Prices

Australians are borrowing more than $32 billion a month to spend on homes or investment properties, about double the amount of four years ago. Due to capped lifestyle spending and Government stimulus, the average homeowner is $130,000 ahead (on paper) compared with this time last year.

The so-called ‘Great Resignation', whereby workers choose careers based on work-life balance rather than salary, has had a positive impact on regional growth. Country towns have been able to provide the extra space, flexibility and affordability people seek in a post-pandemic reality.

For a variety of buyers, from first home buyers to sea changers, regional process has also looked “cheap” especially when pushed out of capital city markets.

This has led to a diversity of residential property price growth between city and country as CoreLogic shows us below:

However, with this growth surge, and after the early shifters have settled in, the new home buyers are now again finding it harder to find something that meets their needs.

Factors that might cool the Regional Property Market

With the RBA bonds-buying policy drawing to a close, consensus is that interest rates will start going up sometime during 2022. So at some point, home mortgages will become more costly for the average household.

Rising rates can be a blunt way of cooling demand, especially when around a million mortgage holders have not experienced an increase in rates, ever. This will impact many households, though it will differ by demography. It may be that it will impact the recent sea-changers less materially.

The Great Resignation could also be dampened if some employers demand that staff return, in part, to city offices.

A wildcard in the mix is immigration, which has been paused for the past two years. If those workers can work remotely, regional areas may be as attractive to them as cities have been in the past.

Perhaps so, but there are already some signs that leases in Melbourne and Sydney CBDs are rebounding off their low base. Most long term immigrants tend to start with renting, so this is a lead indicator for longer term demand. Their likelihood of buying property increases with time in Australia, so the watch will be whether they continue to be concentrated in urban Melbourne and Sydney areas for example.

Longer term too, as the population ages and populations increase, the challenge for regional areas is for the infrastructure to catch up to the needs of the population. Cities will still remain key in accessing medical services for example.

What History can Teach Us

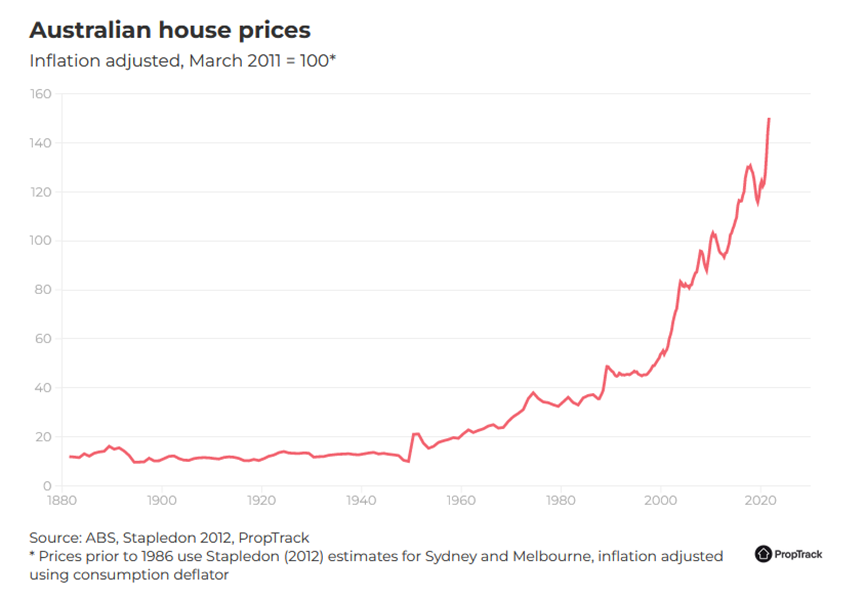

Australian house prices changed little from the late 1800s until the 1950s. Generally, inflation dictated how much home prices rose or fell. However, five years after the conclusion of World War Two, wartime price controls on home prices and rents were removed, and the average home price more than doubled - almost overnight.

The next spike in prices came at the end of the 1980s, with finance industry deregulation, competition from foreign banks and the floating of the Australian dollar being primary drivers. That led to an annual price hike in 1989 of 25%, or roughly what we see today. In both the 1950s and late 1980s, prices corrected immediately afterwards (though for different reasons).

Can we expect the same correction in values this time around?

There are competing factors that make it impossible to predict with any certainty.

While stock in capital cities is likely to increase as lockdowns and other COVID-19 measures ease, there is still a line-up of capable buyers willing to enter the market. Borrowing conditions will still be favourable even with the coming rises. If prices stabilise or even fall, those movements are likely to be moderate at worst if work practises sustain.

The story here is two-fold; property prices generally and the relative demand between regional and urban.

The sustainability of Regional prices will therefore be driven to their relative appeal to our cities. Time will tell the extent that this trend sticks.

More information?

Contact MCP:

E - mcpnews@mcpgroup.com.au

W -www.mcpfinancial.com.au

T - (03) 9620 2001

The team at MCP Financial Services has specialised expertise in supporting your property journey.