March 2022: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") meet for March, leaving the official cash rate unchanged at 0.10%.

It might be a little challenging for policy makers over the coming period, with a trade-off between allowing inflation to grow, or alternatively putting the brakes on economic growth.

Events in the Ukraine have the potential to have a material impact on global markets too. With product availability being a challenge already, Russia and Ukraine are material suppliers of raw materials, food and energy – essential for many supply chains.

Employment Strong, Real Wages not so

Australia’s GDP and broader economic recovery has been one of the stronger ones in the world.

With these times, more textbook economic rules have been broken - we were taught that "full employment" is represented by an unemployment rate of around 4%. I can't remember it being ever touching that level. However, latest data shows that the unemployment rate could fall into the low 3's by the end of 2022. Extraordinary stuff.

So surprisingly, inflation and wage growth have not followed at the same pace.

This will be a key watch over the coming months. If inflation heads above the RBA’s target band, and wage growth ends up catching up, expect that to force the RBA's hand.

The International Monetary Fund ("IMF") gave us some comfort around inflation, their view is that it will gradually decrease as supply-demand imbalances improve throughout 2022, and (assuming) monetary policy is tightened.

The RBA we do know is very wary about the strength of real wages and the ability for those higher wages to support higher interest rates.

The Macro Position

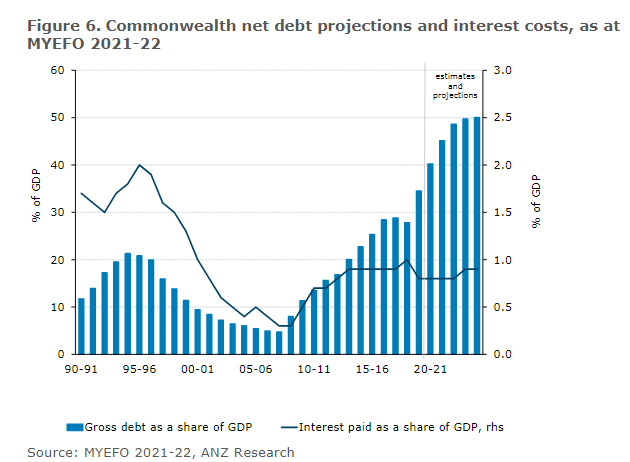

Not that we may think about it day to day, but with an election looming, the national financial position is an interesting one. As data from ANZ Research and MYEFO below shows, our balance sheet is in ok shape by world standards, but it is on the back of the low interest rate environment - see below.

So the national story in a way mirrors households. We have all borrowed a lot more, but we can afford to service the larger debt as interest rates are so low. Of course, this does leave us all exposed the other way if rates rise.

Repairing the Balance Sheet

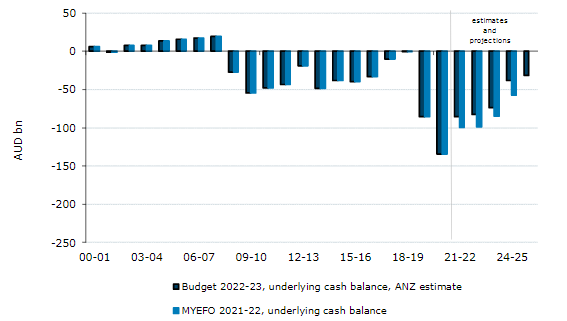

Our debt position can only improve through our "P&L and Cash Flow". More data from ANZ Research estimates our deficit in 2022-23 will be reduced by around AUD18bn, while the improvement through to 2026 is expected to be around AUD80bn.

Interest rate settings will be a big part of this recovery.

Shares & Markets

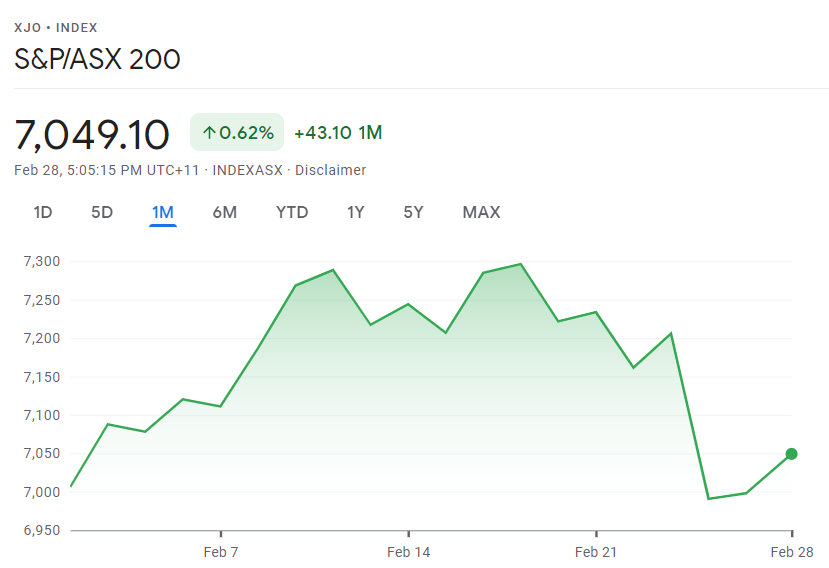

Over the month, the Australian share market was (overall) in positive territory as indicated below:

Equity markets had plenty of reasons to be pessimistic during the month. Factors including but not limited to inflation concerns, higher interest rates and the turmoil in Ukraine causing several jitters.

However, the big offset was a strong reporting season that was better than most expected. The results mean that Australian companies are in good shape to capitalise on opportunities in the post-COVID-19 economy.

Direction for Interest Rates?

No too much has changed over the past month, though we can now see the higher funding costs manifest themselves in terms of fixed interest rate pricing. The Australian bond market is still predicting four to five increases to the cash rate over the next 18 months.

Again, whilst it is unlikely there will be rate rise before the Federal election, the time lines have had to come forward.

New Zealand's central bank raised its official cash rate up to 1.0% - a third successive rise - to peg inflation concerns.

The Bank of England has lifted their cash rate for a second time in three months, to 0.5%, as it warned that inflation higher would climb around 7% by April. In the U.S. a first round of rate increases are expected imminently.

Money Markets

Another really busy month on money markets, with a high level of turnover.

| Month | Cash Rate | 180 Day Bill Rate | 10 Year Bond |

|

March 2021

|

0.10% | 0.04% | 1.69% |

|

April 2021

|

0.10% | 0.05% | 1.74% |

|

May 2021

|

0.10% | 0.04% | 1.65% |

|

June 2021

|

0.10% | 0.04% | 1.59% |

|

July 2021

|

0.10% | 0.07% | 1.48% |

|

August 2021

|

0.10% |

0.05% | 1.12% |

|

September 2021

|

0.10% |

0.04% | 1.18% |

|

October 2021

|

0.10% |

0.05% | 1.45% |

|

November 2021

|

0.10% |

0.20% | 2.09% |

|

December 2021

|

0.10% |

0.14% | 1.93% |

|

February 2022

|

0.10% |

0.26% | 1.98% |

|

March 2022

|

0.10% |

0.27% | 2.22% |

In terms of pricing, another rollercoaster ride for bond markets over the month with the uncertainty of events overseas.

The 10 year rate jumped around but ended up 30 points higher over the month, largely on inflation concerns and the likelihood of rising interest rises.

Property

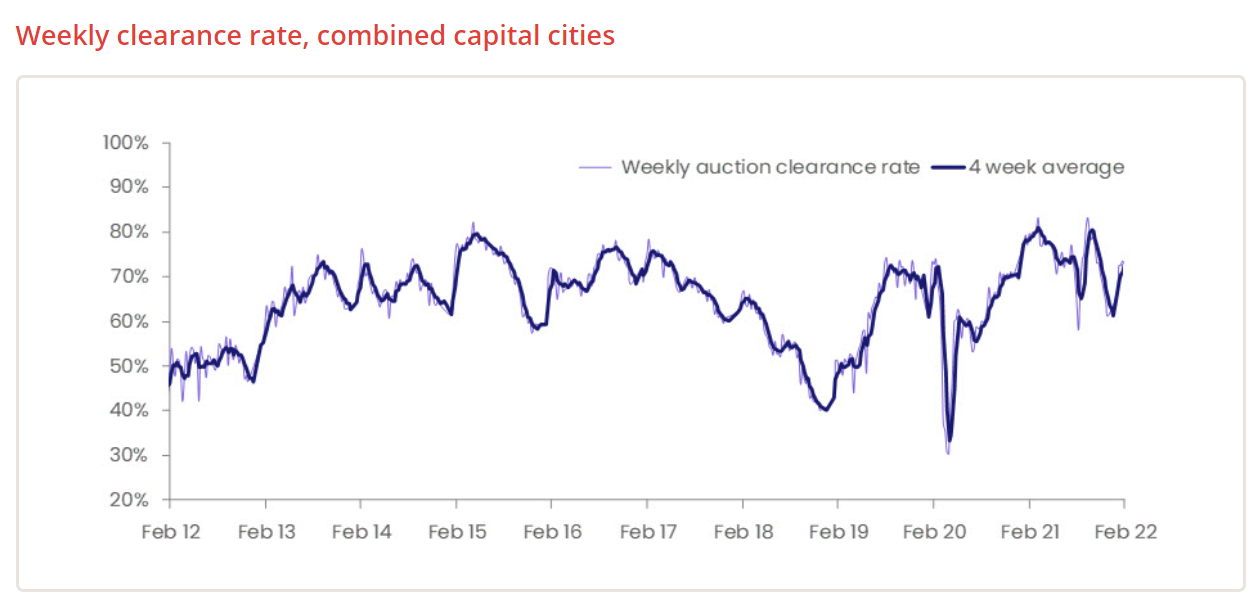

Australian housing values will be tested over the coming months, and there is more interest right now in lead indicators in this market.

This includes data from Melbourne Inner City Management, where vacancy rates in the Melbourne CBD and Southbank have dropped below 2% as students, retirees and young professionals return to the CBD.

There has been surge in new listings over February. CoreLogic data below shows us that on a historical basis, clearance rates are so far holding up ok.

Regional Australia maintains its strong recent growth and are still trending ahead of cities. Read our recent blog here.

Commercial Property

The Property Council of Australia’s latest office market report shined a very positive outlook for the category. Demand for space in CBD towers has risen in every capital city in Australia, building on the recent momentum that a balance will be found work-from-home trends. In turn, this is providing a much needed lift in confidence in central city real estate.

Tenant demand rose an average 1% across the CBDs, which for the first time in a while exceeded results in suburban locations.

Currency

The Australian dollar has bounced around during the course of the month, not surprising given the Russian invasion of Ukraine. With this uncertainty, markets typically rally to the US dollar as a safe currency.

In the context of that, our dollar is holding up reasonably well and will have support if it touches at or below 70 cents. Strong commodity prices have helped to maintain the base.

Until next time.