Global Debt

Recent data collated from the International Monetary Fund ("IMF") showed that global debt has increased to $226 trillion.

What does it all mean?

Unpacking The Numbers

Similar to how a bank will look at an individual customer's capacity to service debt with income, a relatively blunt macro measure is to assess the level of debt as a percentage of a country's Gross Domestic Product ("GDP").

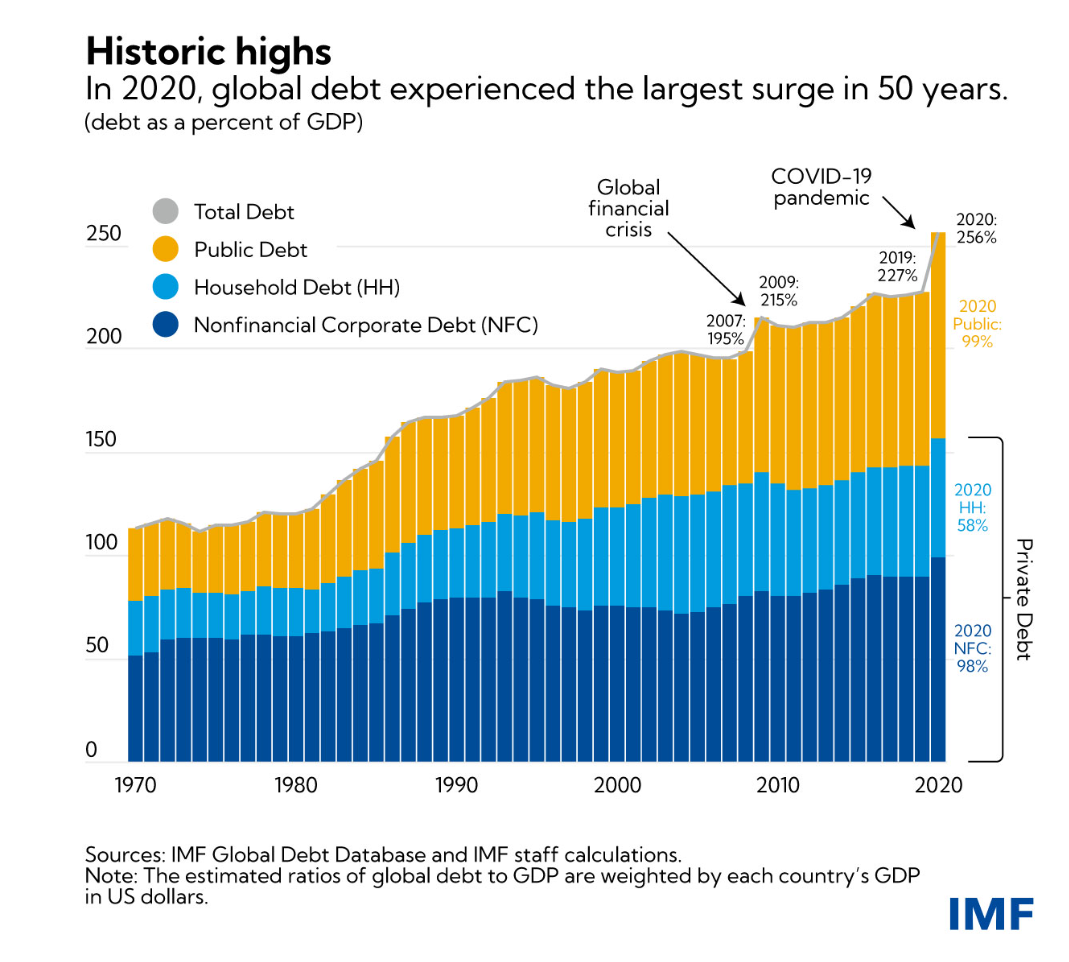

With the world hit by a health crisis in 2020, Governments pulled every lever to buffer economies. However, as the IMF data shows below, debt was already at very high levels prior to COVID-19. The warnings from central regulators like the IMF were already loud and clear that corrective action for both households and Governments would be needed in the future.

For some countries, Government debt is the primary concern, whilst for others (such as Australia) it is household gearing levels which are more material.

For example, Government or "Public" debt alone has now touched 100% of GDP, which is levels not seen in history.

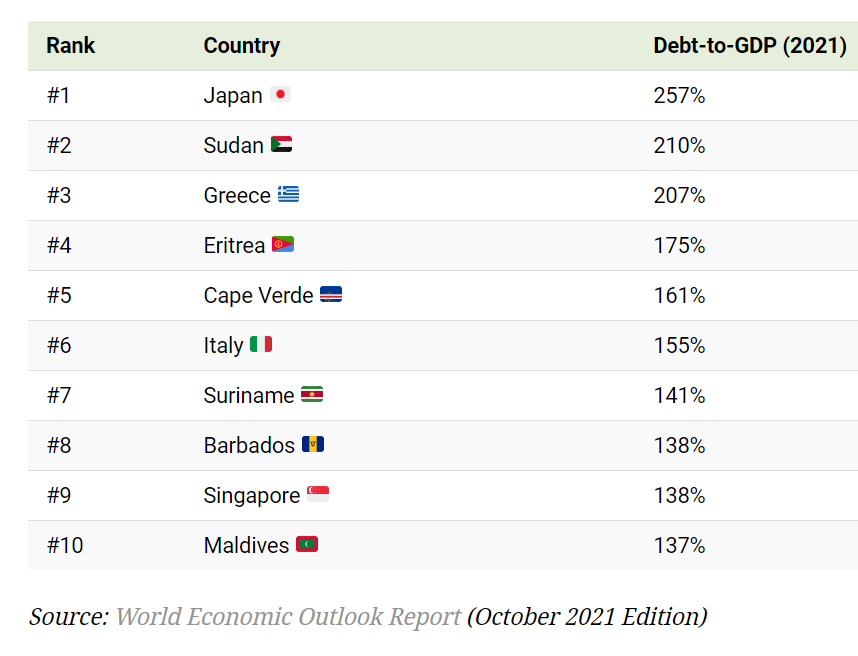

One challenge is that the Government and Private sectors will need to manage debt in an environment of rising interest rates. The World Economic Report published late last year, outlined a top list of countries with the highest Debt relative to GDP.

The list is diverse, with many on the list (think Greece) already suffering economic collapse in the recent past whilst others (Singapore, Japan) trade more heavily on the goodwill of their future economic prospects.

Case Study - Japan's Debt Troubles

Firstly, Japan is recognised as one of the most innovative countries and has the third largest GDP in the world. A good reputation. However, as the data above shows, Japan's public debt as a share of gross domestic product exceeds 250%, and fiscal stimulus and accommodative monetary policy has been a part of their landscape for the last 30 years.

For such an innovative country, Japan’s economy has had low growth levels, including no real wage increases and a stall in productivity. So they haven't got a lot to show for their borrowing and spending which is a concern as their population ages.

With public debt estimated to be approximately US$12.20 trillion, the cost of servicing this debt is estimated to use up half of the state's tax revenues.

On the other side of the balance sheet, they have the second largest store of foreign currency, behind China, but at just over US $1 Trillion it does dwarf in comparison to its debt.

It is therefore not surprising that they are motivated to buck economic trends and keep their domestic rates artificially low.

What is the relevance of Debt for Countries?

Well, largely it depends on your perspective and believe it or not there is a divergence of views of debt. Most Governments owe the money to their own people (Japan above is a prime example of this) rather than as foreign debt. In this context, the economic impacts can be less immediate. This is especially so in the historically low interest rate environment.

However as a general rule, when debt increases faster than GDP, that will eventually bring more pressure on an economy to increase taxes or cut spending.

When debt increases faster than GDP, there is more pressure on the economy to increase taxes or cut spending.

What is the relevance of Debt for Australia?

Our Government Debt, whilst spiking, still sits at a comparatively low 45% of GDP and just under $1 Trillion.

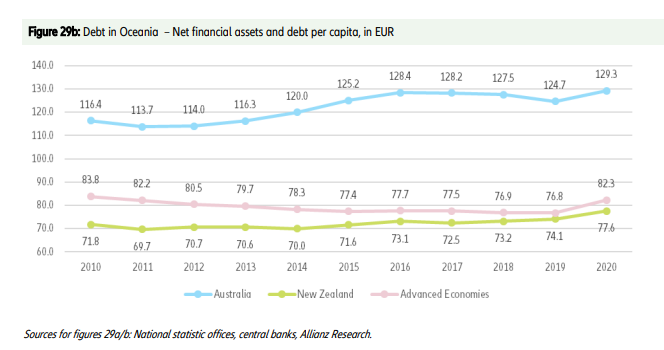

For households, this is where it gets more personal. For example, Australia’s debt to income ratio is the second highest worldwide, and reached a high of 129.3% in 2020 which is well above developed economies. See Table below.

Australians are wealthier on paper, as asset growth has outpaced liability growth, which are principally property mortgages. Our liability-to-asset ratio has improved significantly in the last decade, now under 40% from around 50% ten years ago.

Despite this "wealth" based growth, we haven't had the income growth to keep pace with asset growth. In an accounting sense, the balance sheet is stronger but the Profit & Loss is weak,

The risk of this is it opens up vulnerability to asset price changes or a rise in the cost of debt which we are seeing at present. Time will tell and we have been buffered by a lot of stimulus which has taken some air out of the tyres.

Final Thoughts

There is not a simple set of commentary that can identify clearly both what the quantum of the problem is and any corrective actions.

Without sounding like “motherhood” statements, perhaps some thoughts to consider:

- Economies need to balance the need for economic stimulus with an understanding of impact on long term economic growth, inflation and gearing levels.

- Economies need to stress test their ability to take on and service debt, if their traditional income sources are challenged in the longer term. Think climate change and commodities as an example.

- Consider building the financial literacy of the population; debt looks much more attractive to people without financial education - e.g. property schemes or similar that might encourage asset buying in peak markets.

Ultimately it may mean that we all need to water down our expectations of what we are entitled to, and work with what is sustainable in the long term.

More Information?

The team at MCP

W – www.mcpfinancial.com.au

E - enquiry@mcpgroup.com.au