August 2023: Rate Decision & Economy

The Reserve Bank of Australia (RBA) has today announced no change to the official cash rate, leaving it at 4.10%.

This month it is international markets dominating the news, led by a change in Japan's monetary policy stance (see below).

Economic Sentiment

Locally, Australian Bureau of Statistics’ (ABS) data showed inflation falling during the quarterly CPI result and slowly making progress to target range of 2-3% set by the RBA. Highlights:

- Quarterly inflation slowed from 1.4% in March to 0.8% in June

- CPI rose 0.8% over 3 months to June, making a 6% increase

- Annual rate of headline inflation is 6.0%, down from 7.8% in December

- The RBA's preferred measure of underlying inflation (excludes volatile price changes) was 0.9% for the quarter and 5.9% over the last year

Balance remains hard to find amid sagging business and consumer confidence and weak retail data (turnover fell 0.8% in June, according to ABS data). On one hand, there are signs that the runaway train of inflation is slowing here and overseas. The US, Eurozone and the UK have all seen a cooling, while the UK fell to its lowest level in more than a year. There are similar trends in other major economies.

However, the macro data tells a different story, including the unemployment rate which at 3.5% was better than expected. ABS data revealed that 32,600 people found work in June, against expectations of employment growth of around 15,000.

The gains helped the jobless rate hold steady at a downward revised rate of 3.5 per cent.

Business Sentiment Subdued

The NAB released its Quarterly SME Survey and shows that business confidence fell 1pt, down to -7 index points. Forward orders fell 5pts to -4 index points while capacity utilisation was also lower at 82.1%. Capex also fell, down 3pts to +3 index points.

Notably, actual forward orders for SMEs have also fallen significantly which is an obvious indicator of weaker conditions ahead. This is a tangible rather than sentiment based indicator.

Again, indexes in isolation don't mean much, but the trends are key and include the measures of small and big business.

RBA Stance

The inflation results here and globally would be welcomed by the RBA though strong employment data is still firmly in their sights. So despite the hold at July's meeting, the RBA position in this commentary is reminding us all that things are still moving around.

“The Board remains alert to the risk that expectations of ongoing high inflation will contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment. Accordingly, it will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms.”

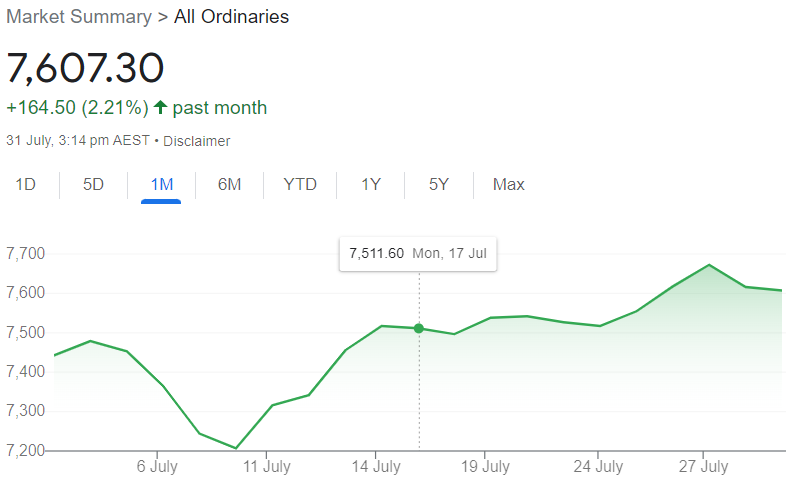

Shares & Markets

There are diverse views on what will happen with equity markets as we head into reporting season. Overall the market absorbed the ups and downs of interest rate sentiment and the Japan monetary policy shift and ended July with a gain in the All Ordinaries, continuing June's momentum.

Direction for Local Interest Rates?

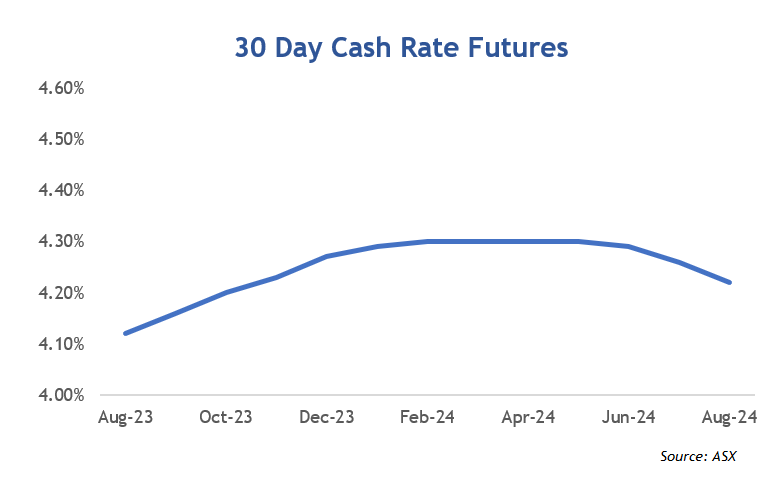

The pause in July meant that the "market" had a win last month against the economists.

Movement in the ASX Cash Rate Futures offers some insight. Last month, the shape of the curve changed, with a sharp 60 point increase in expectations. This month it has flattened out and the market still sees rates being closer to the end of cycle than many others do.

This is indicated by the ASX Cash Rate Futures as below.

Financial markets are now implying that the cash rate will remain relatively flat over the next 12 months and off a smaller peak. Many "Economists" don't agree and think there is more tightening of monetary policy ahead.

Financial markets are now implying that the cash rate will remain relatively flat over the next 12 months and off a smaller peak. Many "Economists" don't agree and think there is more tightening of monetary policy ahead.

Japan's Move and the Update for Interest Rates Worldwide

We got a reminder this month about the relevance of the Japanese economy.

Japan's Central Bank has finally altered its "yield curve control" program allowing “greater flexibility” in an attempt to be better tied to economic fundamentals (such as inflation and exchange rates) as the effects of their long monetary stimulus finally bites.

In simple terms, this means that their benchmark yield on 10-year government bonds can rise above the existing limit of 0.5% toward 1.0%.

For background, Japan has artificially held rates near zero for over 20 years. This has been in part due to comparatively lower inflation but also due it is burgeoning Government debt, which stands at circa $AUD 14 Trillion. Whilst this setting has lowered interest repayment commitments, the result is that their currency (Yen) has been hammered over this time. This is caused pricing pressures as Japan has many essential imports.

A change in policy is a clear sign that the Bank of Japan want to respond to the inflationary threats and that maybe that it can no longer suppress its bond market and a depreciating exchange rate.

The markets are digesting the action as bond markets were caught off guard and increased yields sharply. Watch this space if Japan also draws capital inflows from other countries.

New Zealand's central bank looks to be at the end of the tightening cycle. At its July meeting, the Reserve Bank of New Zealand (RBNZ) left the cash rate unchanged at 5.50%. This has followed 12 consecutive hikes since October 2021 with a total increase of 525 basis points.

In the UK, the Bank of England meets this week. Like NZ, the UK have had 13 successive increases since December 2021 and now set at 5.0%. Despite a slowing economy, most are expecting the next move to be a 25 point rise to 5.25%.

The U.S. lifted rates by 25 points to 5.50% after a pause last time. The Fed remains clear that inflation management is a priority. For context, their inflation is lower than Australia.

Canada surprised a little with another 25 points to 5.00%, despite their inflation slowing to within the range set by the central bank.

Eurozone increased rates again, signaling that inflation remains the enemy and more tightening may follow.

Central Bank Cash Rates

Before posting any changes today we compare central bank cash rates and their longer term 10-year bond yields.

The movement this month was mainly at the short end of the yield curve, with many increases in short-term money not matched by longer term. The spread in most countries remains inverted as we have discussed.

|

Country |

Cash Rate | 10 Year Bond | Spread |

|

Australia

|

4.10% | 4.06% | -0.04% |

|

Canada

|

5.00% | 3.55% | -1.45% |

|

China

|

3.55% | 2.69% | -0.86% |

| Germany | 4.25% | 2.47% | -1.78% |

| India | 6.50% | 7.16% | 0.66% |

| Japan | 0.00% | 0.56% | 0.56% |

| New Zealand | 5.50% | 4.79% | -0.82% |

| Singapore | 3.42% | 3.06% | -0.36% |

| United Kingdom | 5.00% | 4.33% | -0.67% |

| United States | 5.50% | 3.96% | -1.54% |

When there is discussion around the speed of rate rises, take a moment to compare it to other similar economies (Canada, UK, USA, NZ) where they are all at a significant premium.

Local Money Markets

Australian money markets were active and yields rose across all terms. The July hold result was in line with expectation and the short end of the curve remained largely unchanged.

| Month | Cash Rate | 180 Day | 10 Year |

|

Sep 22

|

2.35% |

3.04% |

3.65% |

|

Oct 22

|

2.60% |

3.55% |

3.90% |

|

Nov 22

|

2.85% |

3.61% |

3.74% |

|

Dec 22

|

3.10% |

3.48% |

3.48% |

|

Feb 23

|

3.35% |

3.67% |

3.50% |

|

Mar 23

|

3.60% |

3.94% |

3.85% |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

|

May 23

|

3.85% |

3.82% |

3.34% |

|

June 23

|

4.10% |

4.21% |

3.65% |

|

July 23

|

4.10% |

4.67% |

4.03% |

|

August 23

|

4.10% |

4.70% |

4.06% |

The 10-year rate softened during the month but spiked on the back of the Bank of Japan policy changes.

Residential Property

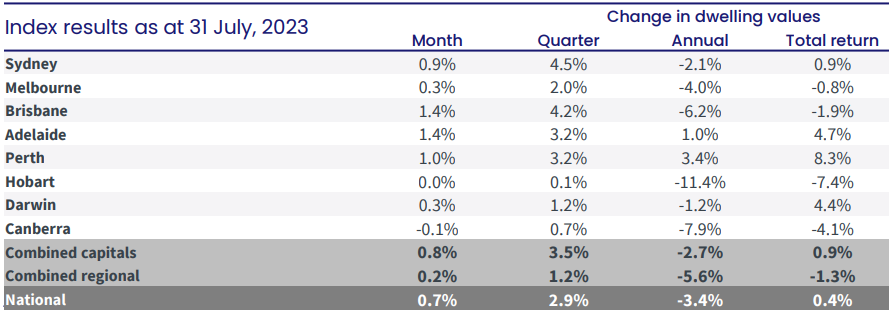

The latest residential monthly property results from CoreLogic showed a slower pace of growth.

More immediate indicators show vendors testing the market in greater numbers. In Sydney, listings increased by nearly 10% to 760 auctions with a preliminary clearance rate of 72%. In Melbourne, listings increased by almost 25%, with 846 homes listed and the preliminary clearance rate actually improving from a week earlier at close to 70%.

However with Victorian land tax changes, there are early signs that vendors are becoming concerned about the viability of holding their investment properties.

Other Property Markets

A good watch for the broader economy is the state of the commercial property market. The headline is that rents are softer with the Melbourne CBD leading the way here, so incentives are very strong.

The focus will turn to how this sector holds up into 2024 as rates rise and yields soften.

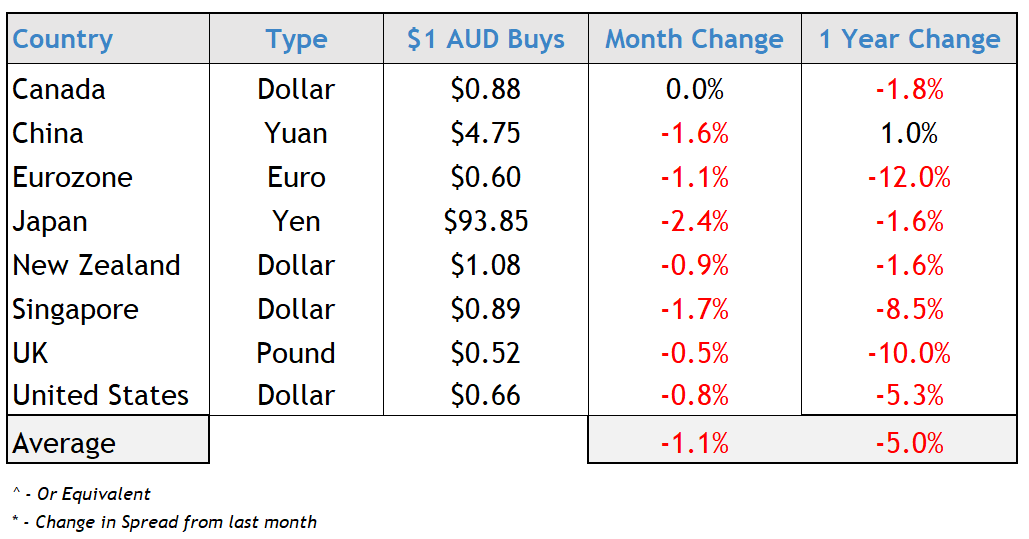

Currency

The Australian dollar lost ground against the Yen in particular (like most currencies) and was weaker against the majority of other currencies.

Our currency is fighting on a few fronts. There is less attraction for Australian cash with our comparatively low interest rates and concern over China’s slowing growth.

Our weaker currency is helping to fuel a balance of trade surplus which is now sustaining levels since before COVID-19. One negative is the reliance of commodities that have very volatile prices against imports that have more rigid demand and prices.

We wish you a prosperous August.