November 2023: Rate Decision & Economy

The Reserve Bank of Australia (RBA) has today announced an increase to the official cash rate, taking it to 4.35%.

After an eventful month in September, the volatility continued in October with the continued change in sentiment around the likely direction of interest rates. Markets reacted accordingly; yields up on cash, values down on equity markets.

There are two economic camps right now; one with fear around the stability of macro economic conditions including burgeoning Government debts worldwide, others that see latent demand with cashed up investors looking for opportunities.

Economic Results & Sentiment

Parts of the economy remain really buoyant, with low unemployment, strong immigration and the strength of house prices driving the macro-economic outlook.

Australian Bureau of Statistics’ (ABS) data showed the annual inflation rate in the third quarter came in at 5.4%, lower than the 6% seen in the previous quarter but marginally higher than the 5.3% expected by analysts.

Despite some softness in consumer data, services inflation remains high and hard to shift.

IMF & Australia

The International Monetary Fund ("IMF") are not generally short of opinions. In their recent tour Down Under, they stated the need for Australia to be economically vigilant. "More is needed to bring inflation back to target and keep inflation expectations anchored". This is in the form of increased interest rates, and also (wisely in this writer's view) to reduce the government infrastructure projects in the pipeline. The latter has put much stress on the private sector availability of labour.

The Federal Government is listening to the latter, but there are too many current projects to unwind so it is hard to impact these pressures in the short to medium term. Monetary policy remains another lever as a result.

State Government Agendas

If we are looking to tame inflation, local State governments are not on the same page. Government Treasury shows they are collectively looking to add $160 billion in debt over the next four years. This means State Government net debt is projected to increase 66% over the next four years to $404 billion, which is forecast to be circa 40% of the $1.1 Trillion national debt at that time.

RBA Stance

With the hold at October's meeting, the RBA commentary was still robust on inflation and reiterating that they will continue to monitor events locally and internationally.

“The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.”

Shares & Markets

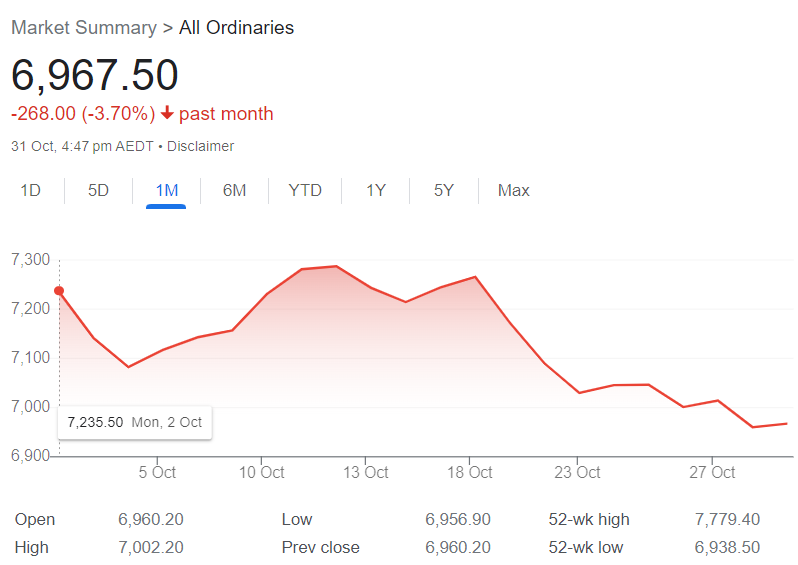

The market ended October, traditionally a tough month for equity markets, with a fall in the All Ordinaries, continuing the losses from last month.

The broader sentiment around expected sustained interest settings, after a steady run-up in bond yields, means that many are saying that this is the correction we had to have. The argument is whether there is more to come, both here and overseas. It seems equity markets are still hoping for a soft landing.

Across global markets, equity market performance in October showed similar trends. The fall in values closely correlated with the rise in long-dated bond yields. As we said last month, this trends of rising yields, despite inflation concerns, meant that something had to give and it was equity markets.

Direction for Local Interest Rates?

We often talk about the diverging views of "The Market" and "The Economists". The obvious divergence in behaviour is speed.

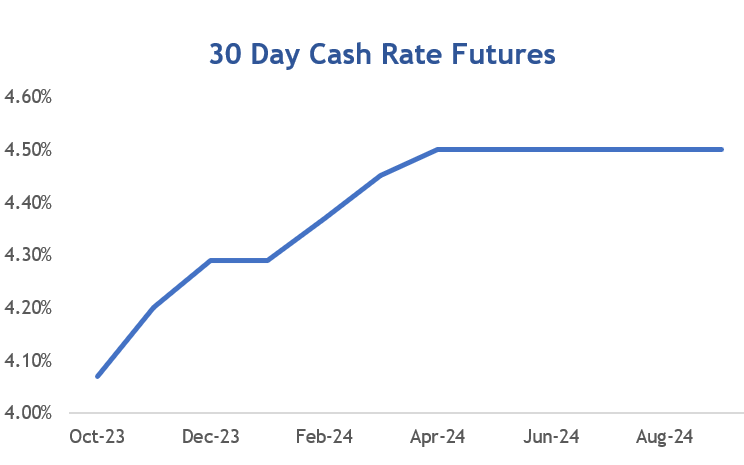

Another increase this month in the ASX Cash Rate Futures with a further 15 point increase in expectations. The market is no longer seeing interest rates being at the peak of the tightening cycle.

This is indicated by the ASX Cash Rate Futures as below.

Financial markets are now implying that the cash rate will trend and stay up until later in 2024. This reset catches up to many economists maintaining that more tightening of monetary policy was possible.

This will potentially limit the divergence in US and Australia cash rate settings.

Update for Interest Rates Worldwide

Not as much movement in rates, but lots of clarity in the tones of Central Banks worldwide.

New Zealand's central bank left the cash rate unchanged again at 5.50%; most pundits feel they are at the end of the tightening cycle. Their central bank is still cautious especially with annual inflation running at 6%. Still a good watch for Australia, lots to learn from this in the future.

The U.S. held the 5.50% rate again at their meeting last week; however the Fed officials are staying the course and do not want to end monetary tightening early. The overall mood is that rates may not be as high as they need to be, Chairman Powell said. “We haven’t made any decisions about future meetings.” Markets took this sentiment seriously.

In the UK, the Bank of England made a pause, keeping rates at 5.25%. Governor Bailey maintain a similar line as the US. “Higher interest rates are working and inflation is falling. But we need to see inflation continuing to fall all the way to our 2% target. We’ve held rates unchanged this month but we will be watching closely to see if further rate increases are needed.”

The central bank acknowledged that this may tip their economy into recession into 2024. A key insight to remind markets that the pain is worth the effort to counter inflation.

Canada, stayed at 5.00%, their annual inflation rate edged lower to 3.8% last quarter, but that is well above the similar 2% target.

Central Bank Cash Rates

Before posting any changes today we compare central bank cash rates and their longer term 10-year bond yields.

All the action this month is in the middle of the curve, and actually despite a lot of activity the "bookends" (short and long term cash rates) remains relatively unchanged. Australia remains "in the black".

|

Country |

Cash Rate | 10 Year Bond | Spread |

|

Australia

|

4.10% | 4.72% | 0.62% |

|

Canada

|

5.00% | 3.78% | -1.22% |

|

China

|

3.45% | 2.68% | -0.77% |

| Germany | 4.50% | 2.65% | -1.85% |

| India | 6.50% | 7.31% | 0.81% |

| Japan | 0.00% | 0.91% | 0.91% |

| New Zealand | 5.50% | 5.33% | -0.17% |

| Singapore | 3.66% | 3.24% | -0.42% |

| United Kingdom | 5.25% | 4.46% | -0.79% |

| United States | 5.50% | 4.58% | -0.92% |

Whilst the view of the market is that longer term rates are here to stay, expect the unexpected over the coming period.

Local Money Markets

Australian money markets followed the trend of last month, rising again despite a late dip. The 10-year rate spiked again as they caught up the world's view about interest rates.

| Month | Cash Rate | 180 Day | 10 Year |

|

Nov 22

|

2.85% |

3.61% |

3.74% |

|

Dec 22

|

3.10% |

3.48% |

3.48% |

|

Feb 23

|

3.35% |

3.67% |

3.50% |

|

Mar 23

|

3.60% |

3.94% |

3.85% |

|

Apr 23

|

3.60% |

3.81% |

3.30% |

|

May 23

|

3.85% |

3.82% |

3.34% |

|

June 23

|

4.10% |

4.21% |

3.65% |

|

July 23

|

4.10% |

4.67% |

4.03% |

|

Aug 23

|

4.10% |

4.70% |

4.06% |

|

Sep 23

|

4.10% |

4.37% |

4.02% |

|

Oct 23

|

4.10% |

4.41% |

4.48% |

|

Nov 23

|

4.35% |

4.73% |

4.72% |

We are moving into more "normal" monetary settings. Normal would include a higher 10 year to 180 day rate, so I'm watching the relationship between those two over the coming months.

Residential Property

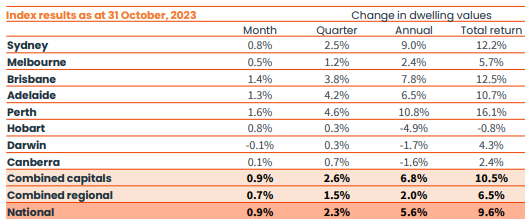

The latest residential monthly property results from CoreLogic showed a better than expected level of growth.

The increase is a eighth consecutive monthly rise with Adelaide, Perth and Brisbane again leading the charge. These cities continue to outperform the other capitals, and now have home values that are at new record highs.

Commercial & Industrial Property

A lot of divergent results continue. Much like the broader market, there are concerns in many segments but optimism in others. Some big projects getting momentum.

This includes Moorebank in Western Sydney, a $4.2 Billion project across a 243 hectare site that will deliver Australia’s largest intermodal logistics hub, is already getting strong tenant interest.

Other larger projects involving construction are still full of risk, and this cycle will take a long time to ride out.

Currency

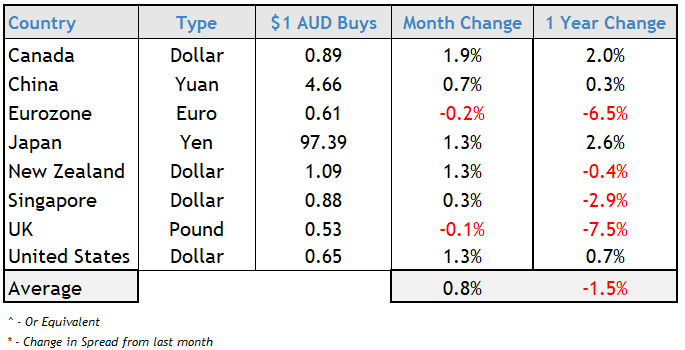

The Australian dollar went on a rollercoaster ride this month, especially against the USD. It touched 2023 lows before a bounce on the view of peaking US interest rates, and a local RBA that is hitting more tightening.

This was partly against a weaker USD, though with the AUD potentially oversold, combined with the prospect of rising local interest rates mean it was stronger against most currencies.

We hope that you back a winner at the track and in business.