Understanding why a business needs cash on hand.

The Cash Conundrum

Cash on hand is a balance sheet item that is widely misunderstood. Very few business owners can articulate how much money they actually need to operate day-to-day. Even established businesses can get caught short of cash and seek far from optimal emergency debt solutions. Unfortunately, this can become an unsustainable solution in the long term.

There are four main reasons why a business is short of money. Three of these relate to managing Working Capital (WC).

1. Lack of Opening or Permanent WC

2. Profit & Loss Performance

3. Growth

Definition of Working Capital

A technical definition is the capital of a business used in its day-to-day operations, calculated as Current Assets less Current Liabilities. Four key components are:

-

Accounts Receivables (Debtors)

-

Inventory (Stock)

- Cash or Cash Equivalents

- Accounts Payable (Credit)

Working capital is the lifeblood of business, but most business owners don’t know how much they need. Poor working capital management has caused many business failures, even when the financials show a profit.

There can be a tendency towards finding the subject of WC boring or unnecessary for SMEs. Often the owners will sacrifice salaries or dividends to manage the working capital cash shortfall, hoping that ‘things will turn around’.

Instead, one way to look at working capital is as a ‘lazy’ balance sheet. Think of WC management as an essential and empowering reporting requirement for a company’s monthly or quarterly business analysis regime.

Determining Permanent Working Capital

Most businesses require a minimum level of WC. Inventory (or services) must be purchased before being sold, and money needs to be collected after it is invoiced. All the while, the normal operating costs of the business (wages, rent, etc.) continue to accrue.

For example, a business might have terms of 30 days to pay suppliers but may take on average:

- 60 days to turn Inventory into Sales (Invoices)

- 45 days to collect Invoices

This cycle is known as Working Capital Days.

In this scenario, the Working Capital Days are:

Inventory 60 days + Debtors 45 days - Creditors 30 days = 75 Days.

If we translate this into numbers, it could be $150,000 + $250,000 - $100,000 = $300,000.

If this is a “normal” position based on the size of the business, then this amount of cash ($300,000) needs to stay permanently on hand. It may be that the cycle can be managed more efficiently (e.g. by reducing inventory levels), but a business should not seek to fund Permanent WC amount on a short-term basis.

Reason 1 - Why Businesses Need Cash is: “Lack of permanent WC left in the business”.

Profit, Working Capital and Cashflow

No amount of efficient WC can be a substitute for a good revenue model, sufficient gross profit and effective cost management. Your business model and profitability tracking are the foundation of Profit and Loss.

Say a business does not offer credit terms and collects cash at the point of sale. In addition, it receives favourable 60-day terms from its supplier.

If this cycle is constant, the Working Capital Days would be:

Inventory 60 days + Debtors 0 days - Creditors 60 days = 0 Days.

Translated into numbers, it could be $150,000 + $0 - $150,000 = $0.

In the absence of capital moments, this result implies that the business has poor profitability, not poor WC management - the hardest reason of all. Therefore, structural changes may be needed to improve profits and cash flow.

Reason 2 - Why Businesses Need Cash is: “Poor Profitability”.

Working Capital and Growth

When businesses grow, it is reflected by increased sales, more inventory purchases and larger debtor amounts to collect.

This may lead to increased profits but also a higher Permanent WC level. The best reason of all!

Using the previous example, the Working Capital Days may still be:

Inventory 60 days + Debtors 45 days - Creditors (30 days) = 75 Days.

However, if the business has grown, then the need for WC will increase too, e.g.:

$300,000 + $500,000 - $200,000 = $600,000.

The growth might mean the business is short of cash during this time of adjustment, and Accounts Payable terms can stretch. If the company isn’t prepared for the change, the pains may manifest in other ways.

Reason 3 - Why Businesses Need Cash is: “Growth”.

Remediating Working Capital

Once the WC profile of a business is understood, including what the “normal” amount needs to be, variances to normal are easily seen and reviewed.

A financial mistake is to throw in more debt or capital to an inefficient operation. Stop and take the time to understand what is causing the problem.

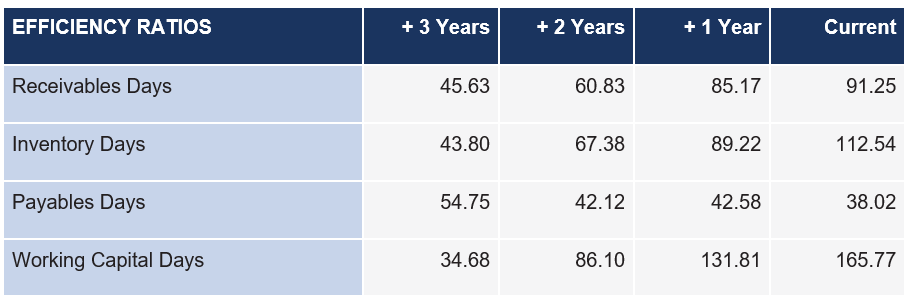

Take the following example. A review of both historical, current and projected performance revealed the following position:

The business had pursued a growth path, which resulted in increased customers, revenue and profit. However, it found itself short of cash after a couple of years.

Accounts Payable terms were very tight, and the business was constantly managing supplier requests for payment.

Growing businesses like this typically seek more capital contributions or a fast debt solution. This is where short-term funders have flourished in low-interest markets, but the resultant cost can be significant when interest rates are higher. Thankfully, in this scenario, the business owners paused to review the situation rather than rushing into debt.

The analysis determined that Net Working Capital had grown. The data was examined further as below:

The Review noted:

- Accounts Receivable Days had adversely increased by 45 days

- Inventory Days had adversely increased by 89 days

- Accounts Payable had actually reduced by 16 days

Working Capital Days (Debtor Days + Inventory Days - Accounts Payable Days) had increased significantly and was also exacerbated by revenue growth. This is a potent cocktail, where growth drives the amount of WC, and lack of effective management pushes it out further.

Example Remediation Steps

The business identified that it could improve its WC management rather than borrowing to manage working capital gaps.

The business implemented the following strategies:

- Refocused on its customer collections

- Exited a customer that had 120 average payment days and a below average gross margin

- Reviewed its slow-performing inventory lines, made some write-downs and decided to retire small-selling products

- Renegotiated supplier terms and then committed to meeting payments on time

- Reviewed its sales discounting policy to improve gross margins

These changes caused some short-term pain, including no distribution of profits. Within six months, the business was back on track and much stronger.

Take Control

Managing the finances of a business is challenging, and much is outside the owners’ control. WC need not be one of them. Perhaps there is scope to appoint a “head of working capital”.

A key to success is combining good WC management with a sound business model and a sustained gross margin. Understanding how the money in the business flows is one area that can be measured and sustained for meaningful results.

More Information?

E - enquiry@mcpfinancial.com.au

W - www.mcpfinancial.com.au