February 2023: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") met today for the first time this year, raising the official cash rate by a further 0.25%. The momentum late in January around inflation, meant it had to act when otherwise a pause in monetary tightening would have been preferred.

Inflation Still the Story

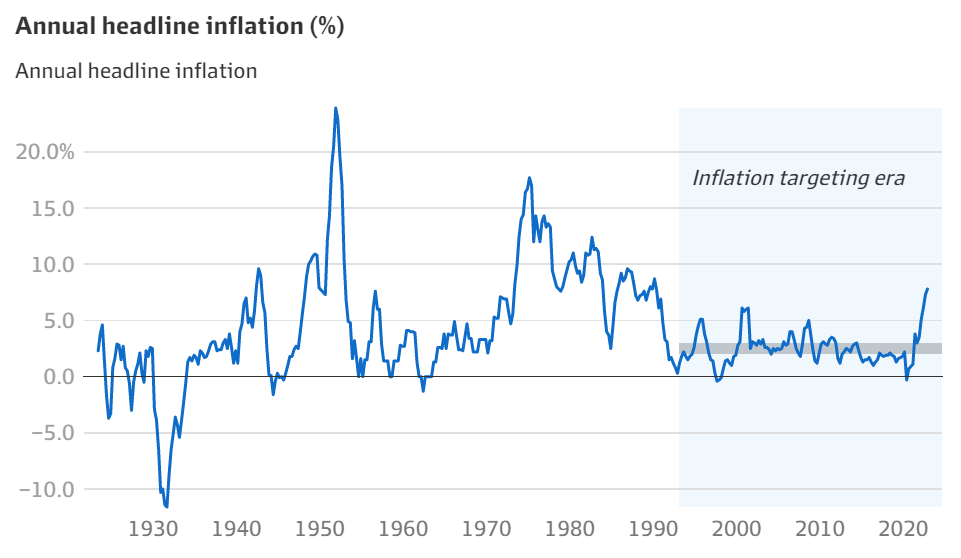

Annual inflation jumped to its highest level since 1990 with a 7.8% in the December quarter. These results included higher than expected spending on discretionary items which in part drove the result.

Despite the high number, the more recently soft December retail results gives some support to the view (perhaps a hope) that inflation could be reaching a peak.

The RBA, ABS data puts the current position in context, especially as we are generationally conditioned for a low inflation world. In the U.S. the Fed chairman Jerome Powell sees the peak of the cycle. “We can now say for the first time that the disinflationary process has started” and markets responded accordingly.

Other central banks around the world have made the same call while making their interest rate settings.

Other Economic Sentiment

Consumer Confidence at a macro level, not surprisingly, has deteriorated in Australia and along with other G-20 countries is currently trending below average.

Business Confidence is a little stronger, with Australia leading many other countries by trending around their average levels.

The latter is consistent with our anecdotal evidence with a better than expected resilience being shown by business.

Local Results

While there is some broad commentary about softer retail spending and expectations for heat coming out of the economy, others are not so sure.

Employment remains really strong; commodity prices are high and activity look more formidable with China opening up.

Shares & Markets

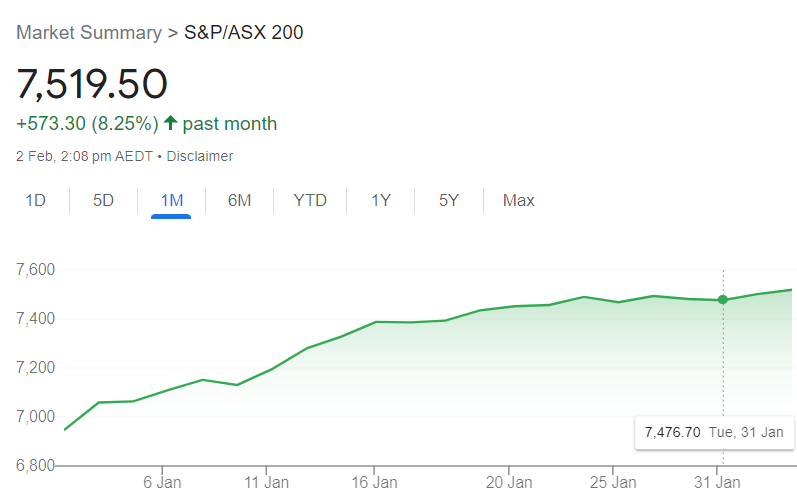

After a soft December, the Australian share market had a positive month, rising by over 8%. Markets are now approaching the post COVID-19 highs in August 2021, so if it is all doom and gloom out there, someone forgot to tell investors.

Wall Street’s S&P 500 Index continued its strong growth. The release of strong employment data gave momentum along with the early signs that inflation could be tapering off a little.

Direction for Local Interest Rates?

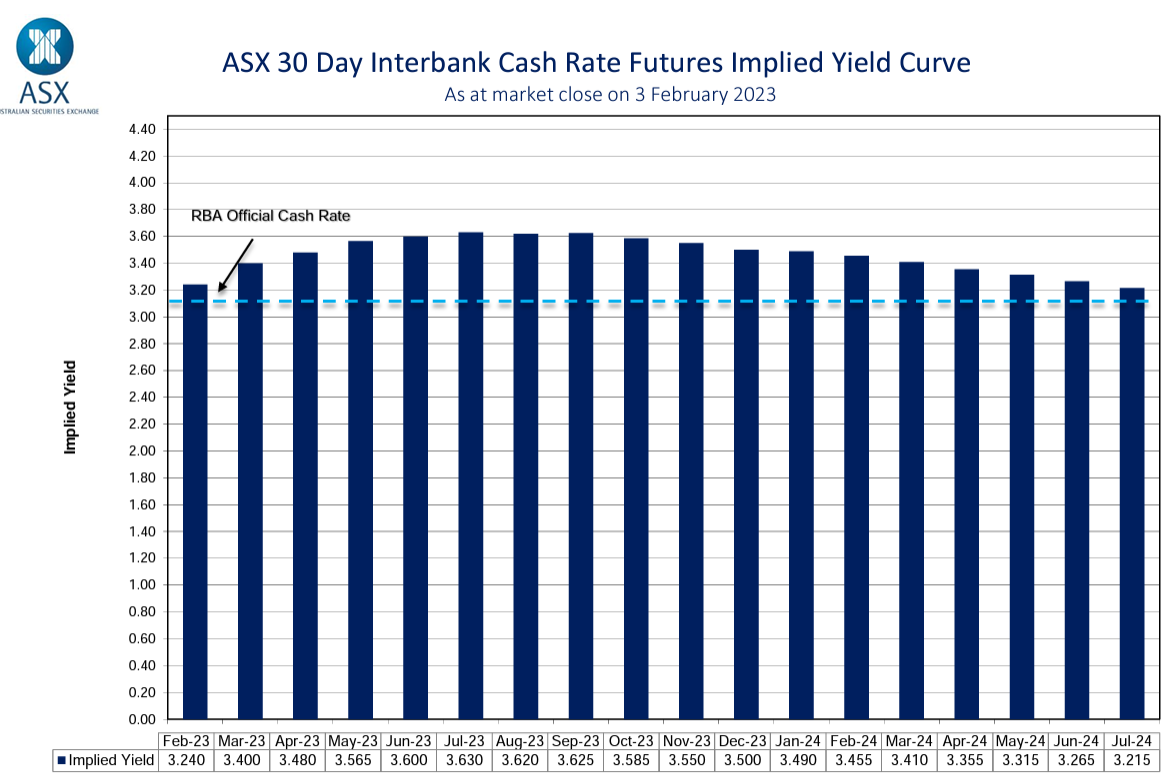

Again, some insights from the ASX Cash Rate Futures, gauging month to month expectations in terms of a destination for the peak cash rate. Another dip occurred late last year, though the peak and subsequent tail off is expected more quickly now.

The rate is expected to be a little over 3.60% by late 2023 as indicated by the ASX Cash Rate Futures as below.

As with bond rates, we expect fluctuations with this data in the coming months.

Update for Interest Rates Worldwide

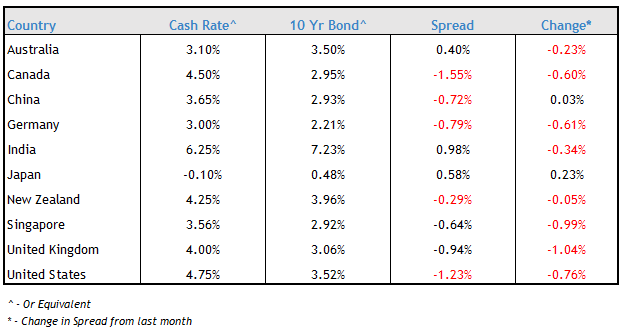

Central banks across the developed world are now managing their interest rate strategy with the short term in mind, specifically inflation.

New Zealand's central bank say inflation numbers weren’t quite as bad as feared, despite being very high and believe there are signs that inflation will ease. The expectations for the outcome at their next meeting in February are more tempered now, for the first time in a while.

In the UK, the Bank of England response to inflation has been swift, with another 50 point increase to 4.0% at their February meeting. While some additional rate rises are expected, the BoE have lowered their rhetoric around the need to keep increasing rates "forcefully" if needed. They hold the view that inflation is starting to peak.

The U.S. yield curve is heavily inverted but the strength of their economy, shown in the latest US employment data probably means that the central rate will exceed 5.0% during 2023.

In Canada, their central bank is expected to deliver another 25 point hike. This is the eighth rate hike over the past 12 months and they have the most heavily inverted yield of any major economy. The market expects inflation to come down quickly.

In the Eurozone, the ECB president Christine Lagarde hinted, like bond markets are also saying, that inflation may be coming under control by their next meeting, “We will then evaluate the subsequent path of our monetary policy”, said Lagarde.

Following on our data from previous months, and again before posting any changes today, we compare central bank cash rates and their longer term 10 year bond yields. The "spread" has continued to move as cash rates move up and against long term rates that are stabilising.

The market is saying that economies are either in for a rough landing, or it is expecting that rates will "normalise" once the inflation beast is tamed.

Money Markets

Australian money markets over the break, other than a spike for the inflation data, were fairly uneventful. Signs that long term money is starting to settle.

The yield curve is very flat right now, though more "normal" than other economies. The RBA still has room to move if need be.

| Month | Cash Rate | 180 Day | 10 Year |

|

Feb 2022

|

0.10% |

0.26% |

1.98% |

|

Mar 2022

|

0.10% |

0.27% |

2.22% |

|

Apr 2022

|

0.10% |

0.70% |

2.87% |

|

May 2022

|

0.35% |

1.40% |

3.12% |

|

Jun 2022

|

0.85% |

1.94% |

3.48% |

|

Jul 2022

|

1.35% |

2.70% |

3.54% |

|

Aug 2022

|

1.85% |

2.78% |

2.96% |

|

Sep 2022

|

2.35% |

3.04% |

3.65% |

|

Oct 2022

|

2.60% |

3.55% |

3.90% |

|

Nov 2022

|

2.85% |

3.61% |

3.74% |

|

Dec 2022

|

3.10% |

3.48% |

3.48% |

|

Feb 2023

|

3.35% |

3.67% |

3.50% |

The 180 day rate jumped on inflation data but otherwise stepped up as expected in line with future interest rate rise expectations.

The 10 year rate climbed up and down. The market looks confused about the impact of sustained inflation (upward) but falling on the future health of the economy.

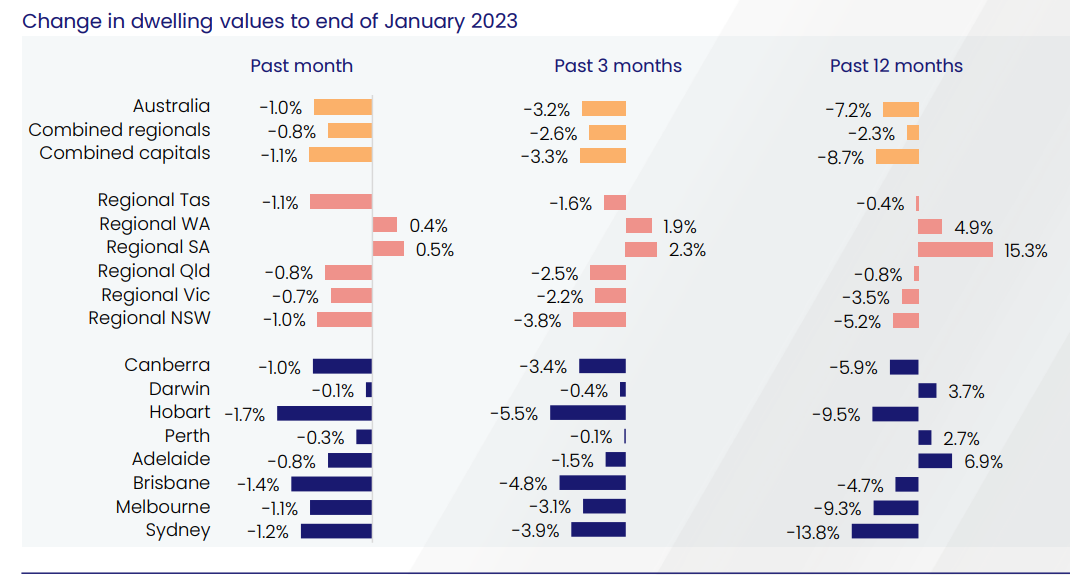

Residential Property

The latest residential monthly property results from CoreLogic show the consistent decline trend, in fact all capitals were in negative territory this month. Sydney median price fell below $1M!

The headline is that the current fall is the largest since modern data has been collated, the balance is that it is coming off such a significant Covid-19 upswing.

The number of listings remained down on the same time last year, this may be contributing to a slowdown in falls in both Sydney and Melbourne. The coming months will be interesting to watch.

Commercial Property

This property class is at an important stage. Most people are sitting on the side-lines waiting for real activity and to see where market prices are really at for now. More liquid property investments via listed property trusts have had valuations come off, but the private sector is showing resilience.

In this environment, developers and investors are finding it hard to attract fresh capital for new projects.

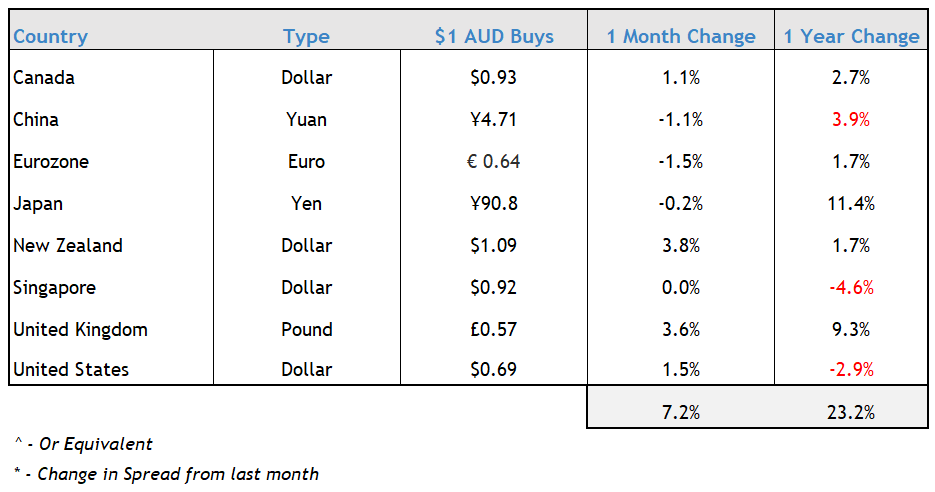

Currency

The Australian dollar remains strong against the USD at around US69¢.

The improvement against the USD reflects both softening US prospects and the prospect of strong sustained commodity prices, led by China's recovery.

The chart above shows, on the whole, how strongly the AUD has performed over a long period against other economies. On the back of a potential recovery in China, and a move away from the USD, many are bullish about the AUD's prospects this year.

We wish you a prosperous 2023.