The dramatic rise in short and long term market rates has had sudden implications for households and businesses.

What can we expect in 2023, and how can you be prepared?

What will the Reserve Bank Do?

One thing we know about the RBA is that they have their own mind. They can surprise with their moves so nothing is certain. One guide is to look at markets, they are pricing in a rate increase in the medium term of around 0.5% (or 50 basis points).

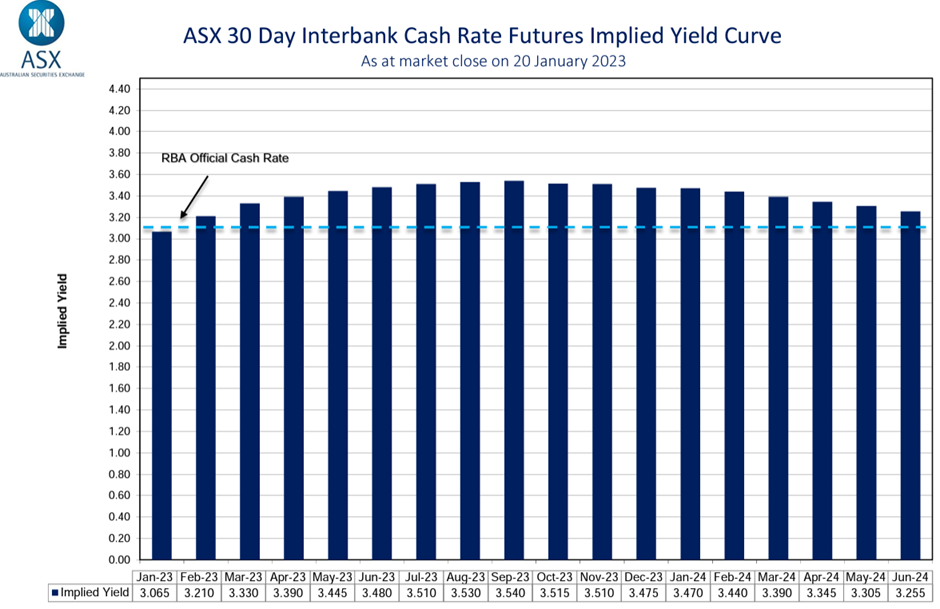

This is shown through indicators like the ASX Cash Rate Futures as below:

This would take the cash rate to circa 3.60% at its peak, and the market is expecting a relatively brisk ride up this year, before cuts in 2024. Using a sweeping 2.0% margin this would take an average mortgage to around 5.60%.

This all said, markets generally have a pretty average track record of predicting interest rate movements. There are so many variables that will drive this (inflation, exchange rates amongst) so predictions are tough.

The "experts" also have very divergent views on the destination of interest rates to their peak, with many saying the cash rate could hit 4.10% for example.

As fixed mortgage interest rates also increase, the gap between variable and fixed rates provides direction on where variable mortgage rates could end up. As an average, variable rates sit around 75 basis points lower than the prevailing 3 year fixed rate.

Fixed Interest Rates?

In Australia, you can generally fix for periods of up to 7 years with most credit providers. The most popular fixed terms are 1-5 years, with 1-3 year rates often the most competitively priced as is the case at present.

In terms of value, we wrote a little while ago that we felt that ship had sailed.

Presently, the average 3 year fixed mortgage is priced with a margin of just over 200 basis points over a benchmark 3 year swap rate, which is higher than normal, another sign that fixed rates aren’t great value at present. The statistics tell us that the borrower loses most of the time on fixing interest rates.

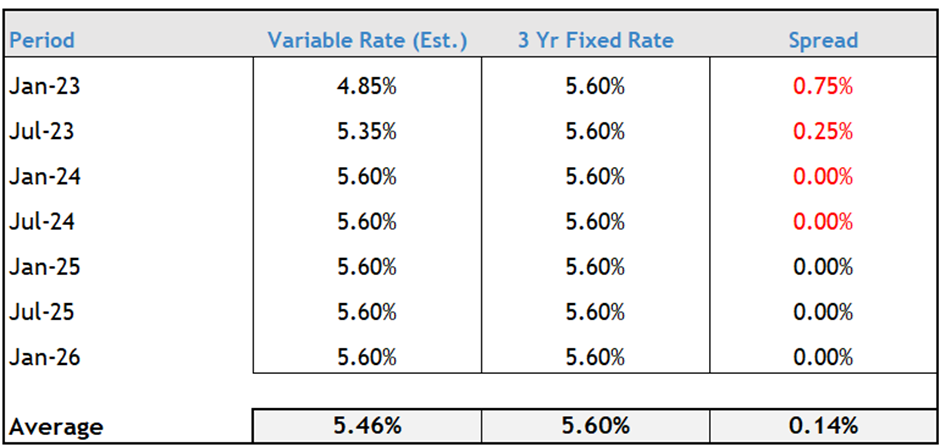

Some very rough maths below, but highlighting the opportunity cost of a 3 year Fixed Rate as proposed to Variable. We have modelled one scenario of three rate rises during 2023, with a pause to follow after that time.

Using average rates, it will take three 0.25% rate rises to be at parity. Before that time, taking the fixed rate will cost you more in interest.

So by fixing, you will need 4 or 5 rate 0.25% rate rises over the fixed term, to compensate for the deficit incurred.

Living with higher Interest Rates

We have now had a little while to adjust to the new paradigm. One obvious outcome is we can’t borrow what we could using the same level of income. In terms of the market, the ultimate litmus is loan arrears which haven’t responded adversely. That said, anecdotally the Covid-19 savings buffers have been eaten into and consumer spending is retreating. That data as it comes during the year will have weight with the RBA.

Households

The preparation should primarily focus on:

• Continue to sensitise all your borrowings at a buffer of 1% now. Assess the cashflow impact and plan.

• Consider restructuring or refinancing your borrowings to products which have lower interest rates.

• With higher rates, consider the opportunity cost of retiring debt, as opposed to the return of using money for other purposes or investments.

• Talk to your broker or lender about re-pricing your existing loans. This can be a lot easier than refinancing as this is not a “credit critical” activity for lenders.

Business

The preparation should primarily focus on:

• Continue to sensitise all your borrowings at a buffer of 1% now.

• Look at the overall cost of your banking, not just the headline interest rate, are their unused facilities that are incurring line fees for example?

• Consider reviewing your overall banking position, can you make savings to your transaction or trade banking costs for example?

More Information?

E - enquiry@mcpgroup.com.au

W - www.mcpfinancial.com.au

P - (03) 9620 2001

The team at MCP Financial Services has specialised expertise in supporting your business and personal finance requirements.

The information in this article is general information only. It is not intended to be a recommendation or constitutes advice.