May 2022: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") met for May, moving the official cash rate to 0.35% - starting the path ahead for rate rises.

The RBA has been left with no choice but to act. The economic data was headlined by inflation which surged to its highest level since 2001. A stronger than expected 5.1% (depending on how you measure it). For a frame of reference, since 1990, annual inflation has averaged around 2.5%.

Even using the RBA’s preferred inflation measure, which went to 3.7%, this is well ahead of the RBA's preferred 2-3% target range.

Economic Momentum

The inflation numbers follows the trends of other markets worldwide. The United States (8.5%), United Kingdom, Canada and New Zealand are all raging around 7%.

There is still some uncertainty in the economy, but broadly there is some optimism of growth that is supported by increased consumption, though more significantly by the hope of increased business investment this time around.

Shares & Markets

Over the month, the Australian share market was in the red as indicated below:

The market seemed to absorb the reality of the raise in interest rate and higher inflation. There was also some weaker data in China, as lockdowns impact local production.

Of course, there are a number of other localised and macro factors that may deliver a slightly bumpy ride in the period ahead.

Direction for Interest Rates?

As we move away from emergency settings for monetary policy, interest rate increases were always inevitable.

We have seen a dramatic rise in short and long term market rates. Other economies - both large like the USA and local such as New Zealand, have acted swiftly and aggressively to thwart inflation and asset price growth.

How much the RBA jumps is not clear. It is either death by a thousand cuts or some bigger rises to catch up to the market expectations more quickly.

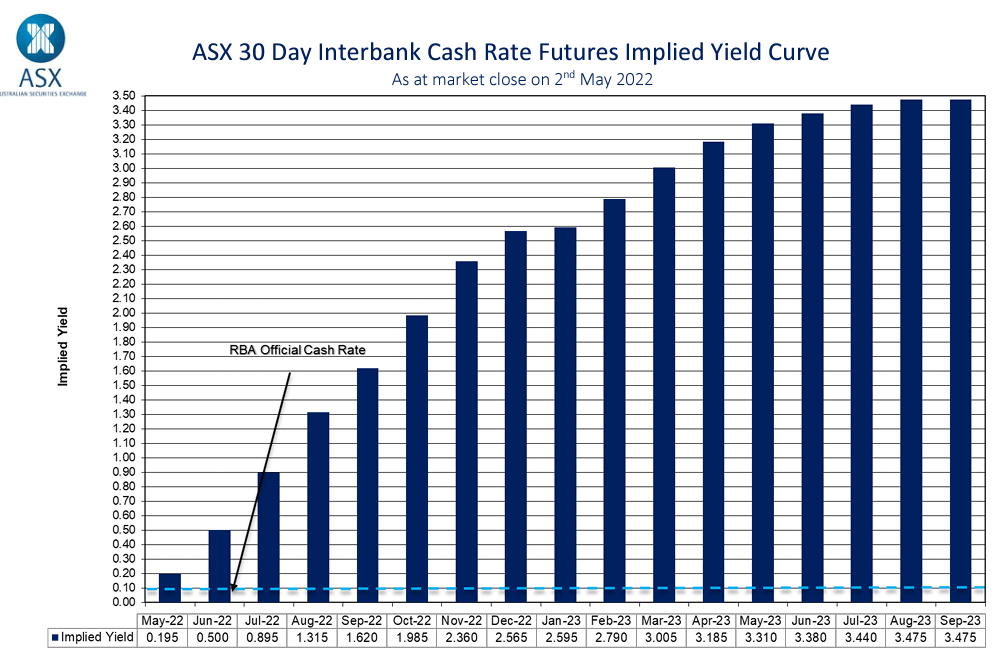

Looking at markets, they are pricing in a rate increase in the medium term of more than 2.5% (or 250+ basis points). These predictions include indicators like the ASX Cash Rate Futures as below:

Looking at RBA commentary, not sure they would agree with this level of rise, at least until there is sustained growth in wages. In their eyes it is a wait and see.

In terms of building expectations over the coming period, another option is to look at models as opposed to sentiment based indictors above.

As fixed mortgage interest rates increase, the gap between variable and fixed rates provides direction on where variable mortgage rates could end up. As an average, variable rates sit around 60 basis points lower than the prevailing 3 year fixed rate.

By this albeit crude measure, that means a total rise of around 150 basis points in this period.

In the short term, we expect financiers to pass on these rates swiftly.

Money Markets

Another busy month on money markets, with an increase in short term yields in particular.

Markets maty settle a little with the upward momentum in rates finally here.

| Month | Cash Rate | 180 Day Bill Rate | 10 Year Bond |

|

June 2021

|

0.10% | 0.04% | 1.59% |

|

July 2021

|

0.10% | 0.07% | 1.48% |

|

August 2021

|

0.10% |

0.05% | 1.12% |

|

September 2021

|

0.10% |

0.04% | 1.18% |

|

October 2021

|

0.10% |

0.05% | 1.45% |

|

November 2021

|

0.10% |

0.20% | 2.09% |

|

December 2021

|

0.10% |

0.14% | 1.93% |

|

February 2022

|

0.10% |

0.26% | 1.98% |

|

March 2022

|

0.10% |

0.27% | 2.22% |

|

April 2022

|

0.10% |

0.70% | 2.87% |

|

May 2022

|

0.35% |

1.40% | 3.12% |

The 180 day rate jumped up 70 points higher over the month, the highest since May 2019, based on the likelihood of rising interest rises. This flattened the yield curve a little as the 10 year bond climbed, but less aggressively.

In the US, the bond market reversed signs of the dreaded inverted yield. Their 10-year rate rose significantly and above that of the 2-year benchmark bond.

Property

Another steady month in residential property markets.

CoreLogic data below shows the continued slowing of growth as the National Growth dropped below 1%.

Sydney and Melbourne's softness dragged the overall growth rates down. Most experts' expectations are based around a flat rest of 2022, with some potential falls in 2023.

Regional Properties holds its recent growth and is trending ahead of cities.

Commercial & Industrial Property

It has been an amazing run for most property classes. The expectation over the coming period is some increase in rental income, this will lift yields as interest rates rise too.

Currency

Surprisingly, our dollar fell to its weakest level in three months. Largely on a stronger USD which is dominating markets currently.

The US dollar index, reached its highest level since December 2002. This is fuelled by their strong local interest rates.

Until next time.