October 2022: Rate Decision & Economy

The Reserve Bank of Australia ("RBA") met today for October, raising the official cash rate by a further 0.25%.

Economic Sentiment

Markets are in a frenzy right now. There was a wild ride on bond markets in Europe for example, as they grapple with the need to keep economies flowing whilst controlling inflation.

The reality right now is that the economic landscape is being dominated by the US market. That has ripples for many things including currency, equity markets and interest rates. Markets are looking for direction and are super sensitive, so Fed chairman Jerome Powell didn't miss with his recent comments. He conceded that a recession may be possible, but the enemy is inflation so interest rates will keep going up as required.

Local Results

Australia recorded an annual inflation rate of 6.8% in August, down from 7% from the previous month, according to Australian Bureau of Statistics data.

With this slight improvement, there is some hope that Australia’s inflation rate is not growing. Many economists are highlighting the lag impact of rising prices and interest rates, the belief that it will slow domestic demand across the economy.

To complement this, there is some positive data from the RBA around supply drivers. This improvement comes with a slowing demand for goods, and a fall in shipping costs and delivery times.

The bottom line is that the RBA needs to control inflation quickly, but without sending the economy into recession. They are wary of people coming off cheaper fixed rate mortgages, though with August retail spending up again to record levels it highlights the tightrope which they walk on.

Shares & Markets

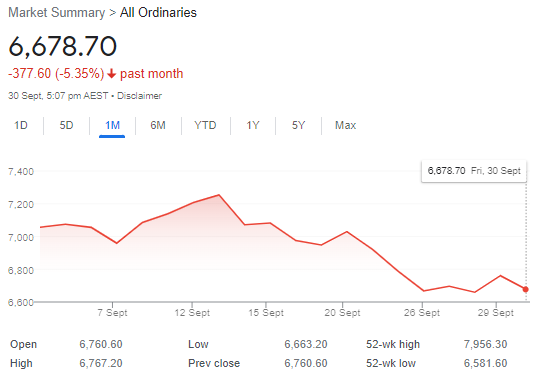

Over the month, the Australian share market had another really tough month, falling over 5%. Ironically, the market is now 15% off its peak, but still 15% above valuations from 5 years ago.

There are lots of smaller stories in these results, though this performance is based on the backdrop of rising rates and inflationary concerns.

In the US, falls have been more dramatic. Ironically, strong employment data (normally good news) is building expectations that the Fed will need to keep lifting interest rates to control inflation.

Buying the index, at least using a short or medium term window, looks a little brave and investors continue to look for pockets of value.

Direction for Local Interest Rates?

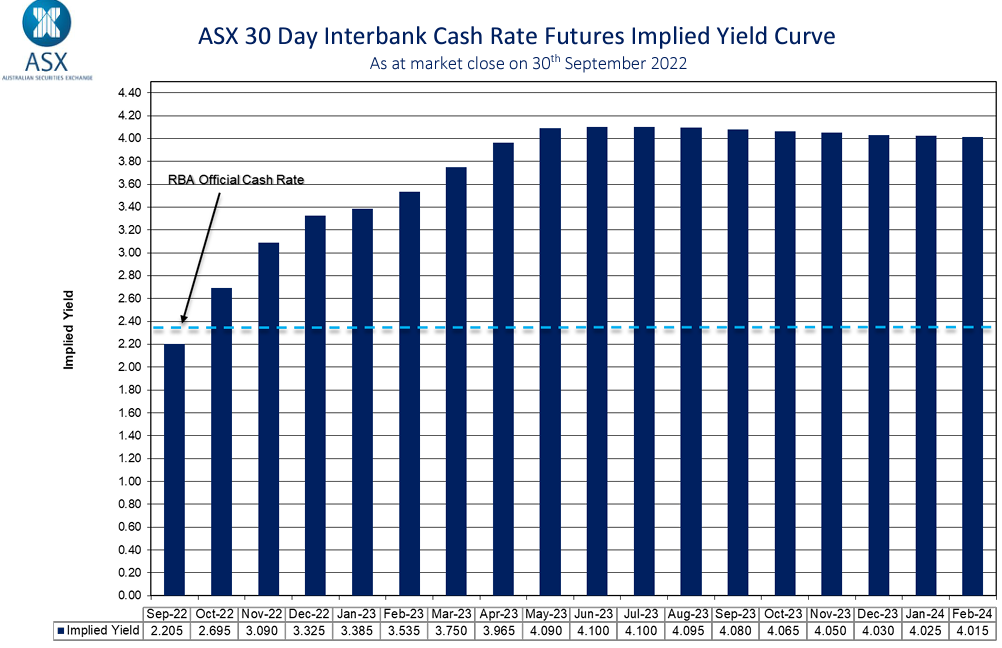

We are probably sick of this confusing graph every month from the ASX Cash Rate Futures, but it is a good one to gauge expectations in terms of a destination for the peak cash rate. This month, there is another 30 basis point (0.30%) increase from last month as indicated by the ASX Cash Rate Futures as below.

A little over 4.0% by early 2024, as shown below, still feels a little high.

World economic events are largely driving this outlook. The RBA's resolve will be tested if other key local indicators soften.

Update for Interest Rates Worldwide

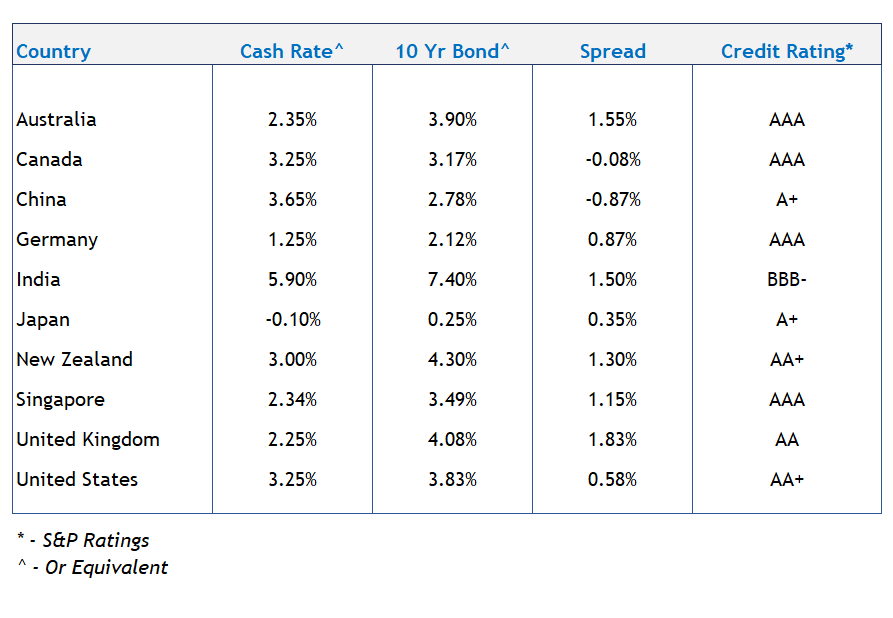

Central banks across the developed world are now increasing interest rates with relative consistency.

New Zealand's central bank meets again this week where it is expected they will raise interest rates by another 0.5% to 3.5%. This is the fifth successive time that the RBNZ has now raised rates by 50 basis points in its efforts to fight inflation. There are some concerns around how hard policy makers are going, the real concern is the high proportion of borrowers coming off low fixed rates and then transitioning into a rise of 4% in many cases. We keep saying it but NZ is a close watch as their economic measures have been more brutal than Australia's.

The UK has had a really tough month, with the Bank of England having to step in again for buying long term bonds. Government plans for large tax cuts and more borrowing brought panic to UK markets. A watch.

In the U.S, The Federal Reserve hasn't put a ceiling on rate increases, only that they will do what is required to bring down inflation to its 2% target. This is concerning markets across the world. Their next meeting is in November with a further 50 or 75 basis point rise expected. They also upgraded a forecasted peak cash rate of 4.60% in 2023, up from 3.8%

Japan with its policy rate unchanged at minus 0.10%, is starting to feel the pressure of its isolated monetary policy, with the Yen falling to a 24 year low against the US dollar. Despite this, no changes are expected in the short term.

For comparative purposes, and before posting the Australian change today, here is a listing of central bank cash rates and their longer term 10 year bond yields. For good measure we have included their credit ratings, which in the case of the UK, took a dive this month.

Money Markets

Money markets here and overseas all headed north, this movement was very consistent across both short term money and longer term bonds.

The market will still be tied to other markets around the world, in particular the US.

| Month | Cash Rate | 180 Day Bill Rate | 10 Year Bond |

|

October 2021

|

0.10% |

0.05% |

1.45% |

|

November 2021

|

0.10% |

0.20% |

2.09% |

|

December 2021

|

0.10% |

0.14% |

1.93% |

|

February 2022

|

0.10% |

0.26% |

1.98% |

|

March 2022

|

0.10% |

0.27% |

2.22% |

|

April 2022

|

0.10% |

0.70% |

2.87% |

|

May 2022

|

0.35% |

1.40% |

3.12% |

|

June 2022

|

0.85% |

1.94% |

3.48% |

|

July 2022

|

1.35% |

2.70% |

3.54% |

|

August 2022

|

1.85% |

2.78% |

2.96% |

|

September 2022

|

2.35% |

3.04% |

3.65% |

|

October 2022

|

2.60% |

3.55% |

3.90% |

The 180 day rate went up steadily over the month and reflective of the expectations around interest rate policy.

This shows a less "normal" but still not inverted yield curve. Of course, it is normal that the level of the yield curve flattens as the cash rate increases.

We talk a lot about "inverted yield curves", this refers to an economic cycle in which long-term bonds (say 10 year) have a lower yield than short-term ones. An inverted yield curve is often considered a predictor of economic recession. There are several countries, including the US, UK and Canada that have inverted yield curves especially when using a 2 year v 10 year comparison.

Though in the current volatile interest rate environment, this isn't so simple to apply textbook login and we really need to see how this develops when monetary policy tightening takes a breather.

Property

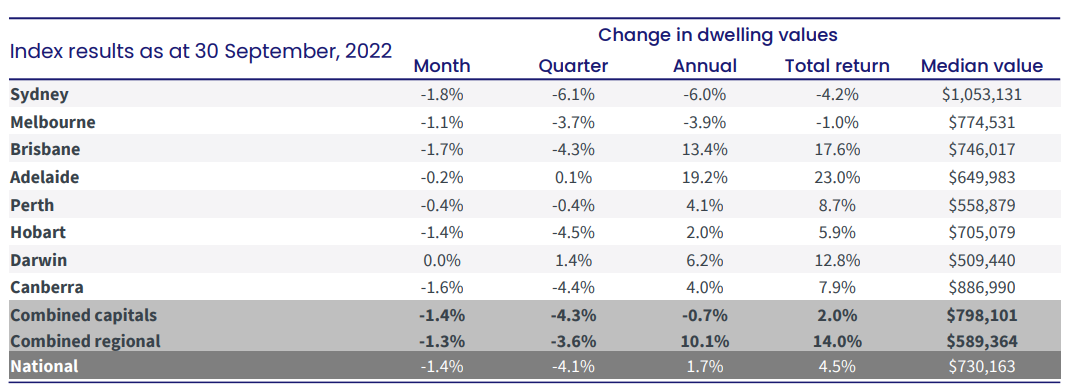

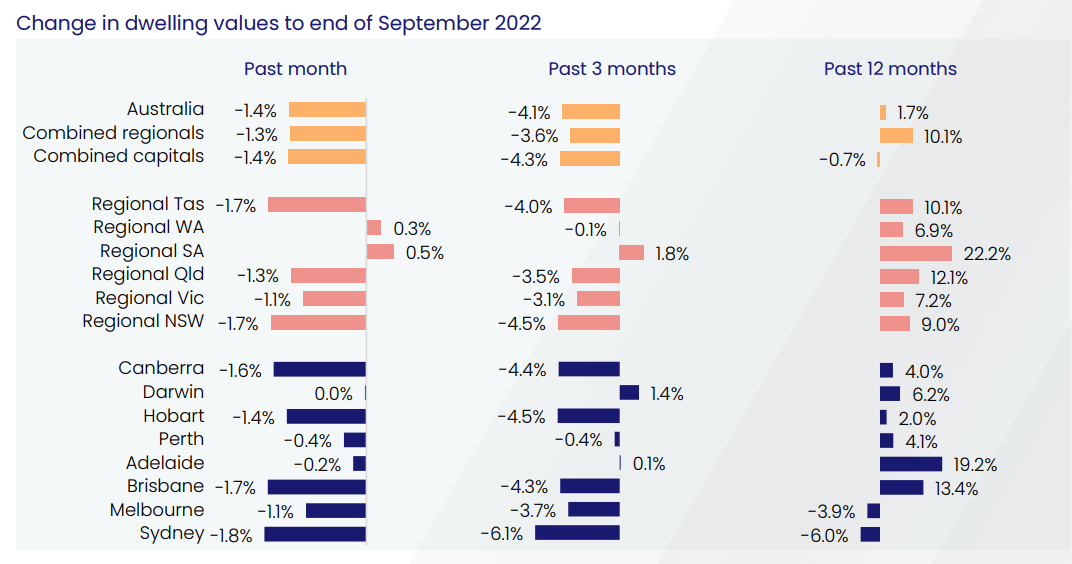

Residential Property continued its downward momentum over the month.

CoreLogic data below shows Sydney again had the largest fall, though we are now seeing the bullish markets of Brisbane and Hobart falling now too.

Anecdotally, whilst several economists are predicting a total cycle fall of about 15%, there are signs that buyers are coming back looking at opportunities. In that regard, looking at rental demand and yields is very relevant too.

Rentals & Yields

Anecdotally we have sensed it, and SQM Research showed that the residential vacancy rate fell to 0.9% nationally last month, which is the lowest level in more than 16 years. This was a combination of falling rental supply along with increased demand.

This means that yields, especially against falling valuations, will trend higher.

This is extending to other categories such as commercial/office stock, where there is appetite for tenants to pay more for better office space. This has lifted rents in stronger parts of Sydney & Melbourne despite higher vacancy rates, albeit not including the value of incentives.

Data from Knight Frank showed that average prime face rents rose by 4.6% to $681 per square metre and a 3.6% increase to $1,232 per square metre in Melbourne and Sydney respectively in the last year.

Currency

The Australian dollar fell significantly this month to around US64¢. Whilst it is the lowest level since 2020, to compare this in isolation is misleading. The world is turning to the "safer" US dollar amid fears of a world slowdown. The AUD actually improved against several other currencies that got smashed by a lot more, in fact on a trade weighted basis our currency is stronger over the year.

The strong USD is also adding to inflationary pressures for some countries, and increasing pressure on overseas borrowers that have issued debt in the US currency.

Japan's intervened in the foreign exchange market to buy yen for the first time since 1998, in an attempt to shore up their currency. The ultra-low interest rates are catching up with their economy, and with such a strong USD, their currency has depreciated nearly 20% this year already. Japan may have to choose between higher debt servicing costs on its 12 Trillion debt (USD) or a falling exchange rate.

In the UK, the pound reached its lowest level against the USD with all their economic troubles.

Back in Australia, there is optimism that if strong commodity exports and high commodity prices continue it should reverse the recent falls over the coming months.

Until next time.