Is it a brave new world?

It is an understatement to say that work has changed. In today's world, this change is not only about where people choose to work and how often, it is also reflected in the variety of ways income is earned. However, has the banking world changed at the same pace?

The mobility of providing services is sometimes called the "gig economy" and this means that many in the workforce do not fall into traditional employee arrangements.

Many workers act as independent contractors, invoicing for their services. They forego traditional employee entitlements and protections and can be more flexible in how they deliver services.

We all know someone in this economy either full time or as a side hustle, or considering entering it and leaving traditional employment behind. That someone might be you.

The Broad Income Types

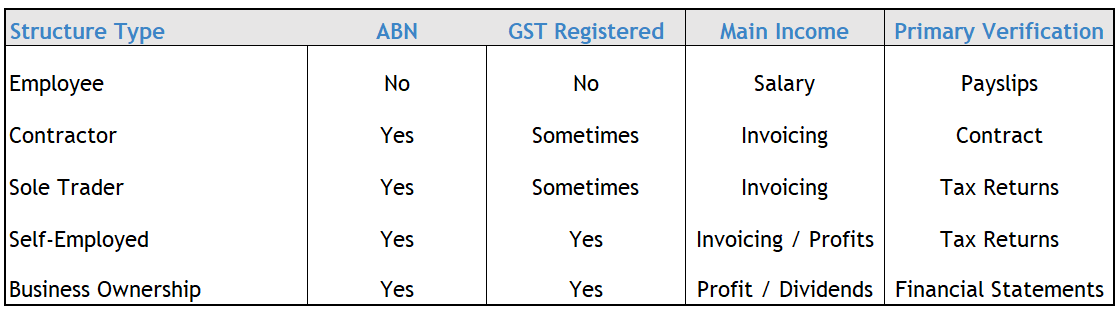

Planning ahead for finance is a wise move in today's world. Therefore, it is worth defining the different structures people operate under and the types of income they generate. Then we can add a layer to determine how financiers are looking to verify this income.

How do lenders view these new types of customers?

The good news is that lenders look upon non-traditional income structures or blends of structures more favourably than before. On the whole we have seen a progressive approach by lenders as they look beyond the traditional nature of work.

Delving into the five main income structures:

- Traditional Employee

Still the simplest model for people seeking consumer finance, mortgage finance or lending for investments. Traditional verification is based on income verified through payslips and PAYG Summaries.

The innovation in this category now includes a willingness to provide support to employees who have shorter tenures or are even under probation, by looking for non-traditional forms of income verification (salary credits to bank statements etc.). There is also a greater capacity to use bonus or commission income where it is sustained over a longer period. - Casual Employment

Lenders will now consider where there is a six month current history, or at least if there are multiple employers over that time in the same industry. The actual income used can vary, with one measure being totalling salary credits over a period and dividing by the expected pay periods to obtain the average net income amount. - Contractors

Lenders will generally consider independent contractors/ABN holders as self employed customers and a more onerous income verification processes will apply (see below). This category has in part created a new finance market for contractors that either don't have longevity (say more than 2 years) in their tenure or have inconsistent income flows. More on this another time. - Self-Employed

We have separated self-employed and business owners here; broadly defining self-employed where that person primarily supplies their own personal exertion to earn income. More recently, some lenders are simplifying income assessment by allowing the self-employed to use just the "salary" they pay themselves on a sustained basis. - Business Owner

Business Owners generally have more complicated structures. They may earn personal exertion income, but also have businesses or investments that generate income and hopefully profits too. Financiers generally need a two year history of financial statements and tax returns for verification of all entities in a group.

Many financiers find the self-employed/business owner too hard to assess, and in some cases can unduly assign a high risk grading when assessing for credit worthiness, resulting in either a higher interest rate or non-approval of the loan. Such thinking often ignores the fact that this category can have strong capital bases, diversity of income streams and experience in meeting commitments.

Plan ahead and plan well

How you operate and earn income can therefore have a bearing on how your prospective lender evaluates you for finance. It is worthwhile to bear this in mind if you are looking to borrow any material level of money. Lastly, what is good for the bank may not be good for asset protection or your tax position so make sure you always seek appropriate advice before applying for or committing to finance.

More Information?

E - enquiry@mcpgroup.com.au

W - www.mcpfinancial.com.au